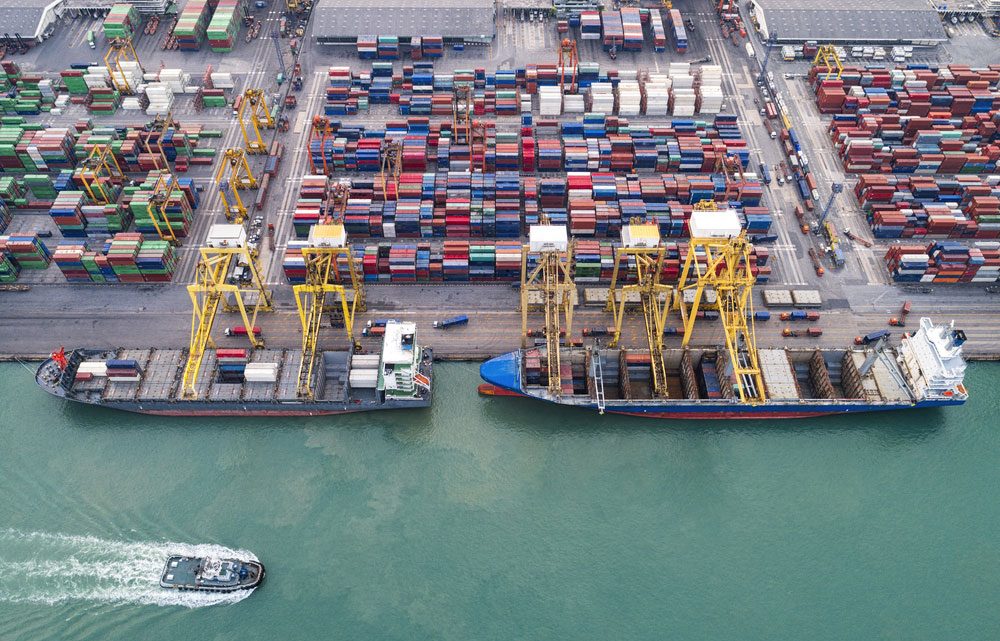

R3 and Bolero to partner on a new electronic Bill of Lading (eBL) service

R3, the enterprise software firm, is to partner with Bolero, the premier world trade finance digitisation solution-provider, to develop a new eBL service that opens up seamless connectivity across multiple trade networks.

The two companies have agreed a Memorandum of Understanding for collaboration on the joint project which will deliver a new, easy way of connecting supply chain participants, simplifying and further digitising world trade.

Bolero will extend the reach of its eBL Title Registry across the supply chain by developing an oracle on Corda, which will enable carriers to connect with corporates and other supply chain participants. Relevant parties will be able to endorse and verify an eBL’s title without needing to revert to paper.

BBVA passes 15 million mobile customers milestone

BBVA now has more than 15m mobile active customers across its global footprint, as its digital strategy continues to prove a success.

The number of customers using mobile as their favourite way to access the bank´s services has grown by more than 40% in the last 12-months alone. The levels of interaction with the bank via mobile are also accelerating as more and more services become available.

In Spain, for example, where 92% of products and services are already available via mobile, interaction rates have multiplied by almost two and a half times in a little over a year – from 23.8m interactions per month in May 2016 to more than 56m 12-months later. Meanwhile, during that time, visit to the website from non-mobile devices grew slightly by a little over 2.5m interactions a month.

The news comes just a couple of weeks after BBVA announced it now also has more than 20m digital customers and is exceeding 1m digital sales each month. The most used service by customers accessing the bank’s services from their app is unsurprisingly balance checking, with payments and balance transfers also prominent.

Utkarsh Small Finance Bank goes live with Intellect Digital Core

Intellect Design Arena Ltd, a digital technology product provider across Banking and Insurance, announced the successful roll-out of its complete end-to-end Digital Core Banking solution at Utkarsh Small Finance Bank Ltd, India.

Utkarsh is a premier micro- finance institution in India and received its license for setting up a Small Finance Bank last year. The idea was to leverage its expertise and create a customer centric bank to provide financial and non-financial support to the under privileged segments of society and impart self-employment skills to its members. The bank was formally inaugurated by Hon.

Citi nurtures Hong Kong’s next fintech generation

A group of 60 university students from Hong Kong visited Citi Ventures in San Francisco in September, as part of their week-long FinTech-focused entrepreneurship boot camp at Stanford Graduate School of Business in Silicon Valley under the Cyberport University Partnership Programme (CUPP).

The students learnt first-hand from veteran tech-bankers on how technology implementations and usage work in the banking world and were given a glimpse of some of the innovations that Citi is working on.

Ms. Angel Ng, Consumer Business Manager of Citibank Hong Kong said, “At Citi, we play a pivotal role in fostering the development of FinTech in Hong Kong, to build a digital ecosystem. We will continue to actively collaborate with different key stakeholders and close partners like Cyberport, to cultivate the next generation of FinTech talents in Hong Kong.