Fintech, Finance, Technology, Banking Highlights – 15 December 2017

David Marcus, Head of Messenger at Facebook, Will Be Joining Coinbase’s Board

I’m pleased to announce that David Marcus, Vice President of Messaging Products at Facebook, will be joining Coinbase’s Board of Directors.

David brings first hand knowledge of building impactful, trusted mobile-first products at scale. His experience will add breadth and depth to the Coinbase board and will help the leadership team as the company focuses on becoming the most popular, and safest place to buy and sell digital currencies.

Prior to Messenger, David was President of PayPal, where he led the payments company’s global expansion and product strategy. Under his leadership, PayPal brought back its technology and product centric DNA, won back developers and small businesses, and acquired Braintree (parent company of the popular P2P payment app, Venmo) that further accelerated the overall growth of the company. David joined PayPal after the acquisition of his last startup, mobile payments company, Zong, and led Mobile products before ultimately taking the leadership role at the company.

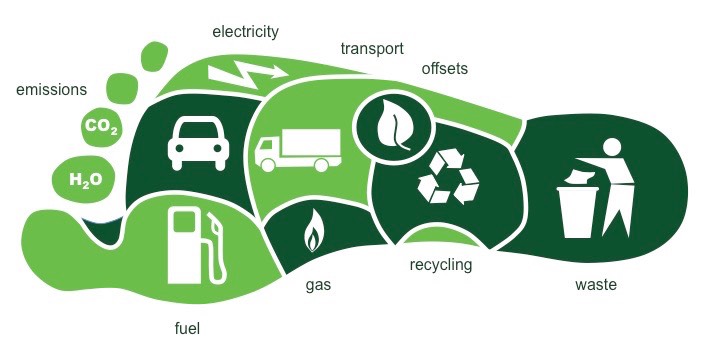

Financial institutions develop methodology to measure their carbon impact

Twelve Dutch banks, insurance companies, asset managers and pension providers have developed a methodology for measuring the carbon footprint of their investments and loans. This will enable them to set their own targets for helping to keep global warming within safe limits.

The final report (PDF 7 MB), including the methodology – the product of two years’ work – was published on 12 December 2017.

Influencing the carbon footprint

Financial institutions can influence the carbon footprint of business undertakings. They do this by taking account of the business’s carbon footprint when they make investment decisions. And by entering into a dialogue on the carbon footprint of business undertakings in which they invest or which they finance.

That information forms the basis of the Platform Carbon Accounting Financials (PCAF). This is one of the first initiatives in which financial institutions have worked together to reduce carbon emissions. The PCAF’s members consist of banks ABN AMRO, ASN Bank, Triodos Bank and De Volksbank, pension funds PMT and PME, asset managers ACTIAM, Achmea Investment Management, APG, MN and PGGM, and development bank FMO. At the Paris Climate Change Conference in Paris in 2015, they signed the Dutch Carbon Pledge, promising to join forces in the interests of the climate. Insurance company Achmea Investment Management joined the PCAF in 2017.

Discover Mobile App Users Now Can Log In with a Glance on Apple’s iPhone X

Discover announced today that cardmembers and Discover Bank customers who own an iPhone X can take advantage of Face ID to sign in to the Discover Mobile app.

The feature offers app users an intuitive and secure mobile log-in experience that requires no more than glancing at the device.

Latest in the line of mobile enhancements for Discover Mobile app users, Face ID on iPhone X revolutionizes authentication using the state-of-the-art TrueDepth camera system for a secure and private way to authenticate. A Discover Mobile app customer only needs to look at the device to open the app.

“The ease and security Face ID offers to our app users is an extension of our overall commitment to providing the best possible customer experience, whether that’s through our mobile app, by phone or on the web,” said Szabolcs Paldy, vice president of e-business for Discover. “Face ID provides Discover customers with an added security convenience at sign-in that requires no more than a quick glance at their iPhone X.”

Face ID support follows closely on the heels of other notable mobile enhancements for Discover including bank customers being able to perform wire transfers on the app and the recent Discover card announcement unveiling Cashback Bonus® via Apple Pay, which allows cardmembers to redeem their Cashback Bonus rewards for a statement credit through Apple Pay. Apple Pay is the easy, secure and private way to pay. Discover was the first major credit card issuer to offer the ability to redeem rewards after a purchase through Apple Pay.

Mambu selected by Argentinian lender Wenance to help expansion across Latin America

Mambu today announced that Argentinian fintech Wenance has selected their leading SaaS engine to help drive its Latin American expansion strategy. Wenance chose the solution for its flexibility and time to market, features critical to the company’s rapid growth plans.

Wenance started operation in 2014 and is Argentina’s largest digital consumer lender with over 80,000 active customers and a loan book of approximately 40 million US dollars. The company provides responsible lending by making credit decisions based on historical customer behaviour. It’s founder is entrepreneur Alejandro Muszak who established several successful lending businesses throughout Latin America including its main product, PrestoHoy.

“Over 40% of working people in Latin America lack access to credit and even more are unable to secure funds on fair and viable terms. We give applicants with thin credit files the ability to build and enhance their credit history and benefit from better terms on future products,” said Alejandro Muszak, CEO of Wenance.