Fintech, Finance, Technology, Banking Highlights – 10 January 2018

CIBC Innovation Banking launches to serve North American companies

CIBC introduced CIBC Innovation Banking, a full-service business that delivers strategic advice and funding to North American technology and innovation clients at each stage of their business cycle, from start up to IPO and beyond.

CIBC Innovation Banking brings extensive experience and a strong, collaborative team that extends across commercial banking and capital markets in Canada and the U.S.

“Developing, growing and implementing new technology is critical to driving the innovation economy. At CIBC, we are embracing the opportunity to help early and mid-stage technology companies compete and accelerate growth in this fast-evolving and growing sector,” said Roman Dubczak, Managing Director and Head, Global Investment Banking, CIBC. “We’re committed to becoming one of North America’s leading client-focused banks in the innovation ecosystem.”

In addition to tailored advisory expertise and financing solutions, CIBC Innovation Banking clients benefit from cash management, deposit, personal wealth and capital markets services to help grow their business and succeed in the North American innovation economy.

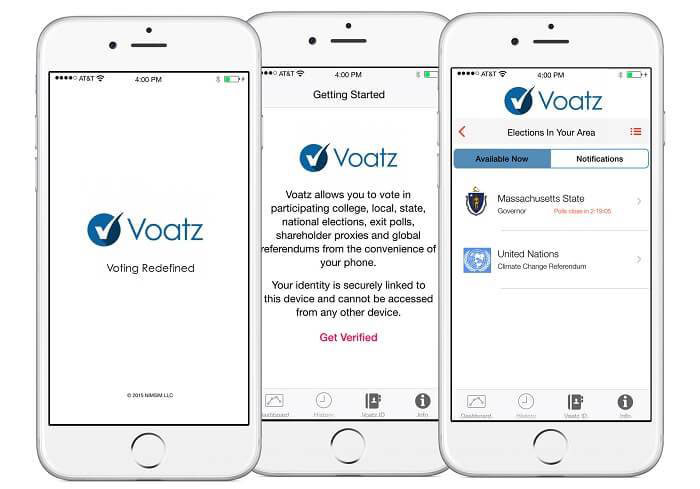

Overstock leads $2.2 million funding round in blockchcain voting platform Voatz

Voatz, a mobile focused election voting and citizen engagement platform, announced that it has raised over $2.2 million in seed round funding led by Medici Ventures with participation from the Urban Innovation Fund and Oakhouse Partners.

Other notable investors in the round include Walt Winshall, Michael Dornbrook, Joe Caruso and members of the Walnut Ventures angels group. The company plans to use the capital to build out its business development team, expand its reach across the United States and accelerate the development of several exciting new product features.

Voatz enables citizens to vote in many types of elections and voting events via a secured smartphone or tablet. Past attempts at Internet based voting have failed to gain traction due to fundamental concerns around security, auditability, and voter anonymity. The Voatz platform is able to tackle all these challenges by using biometrics for security and blockchain technology to ensure tamper-proof recordkeeping, identity verification and auditing.

“Voatz is a great addition to the Medici Ventures portfolio. The Voatz team has developed a leading solution to usher in an era of greater efficiency and transparency in voting,” said Medici Ventures President Jonathan Johnson. “Democracy will benefit greatly from critical improvements blockchain technology can bring to voting systems. For example, providing secure, immutable record keeping will bring greater confidence in accurate results, and ease of use will lower the barrier to entry for citizens to participate in elections. We look forward to partnering with the Voatz team to improve this critical function of society.”

BSO acquires Apsara Networks

Global network provider BSO has acquired Apsara Networks, a supplier of wireless connectivity to financial markets. By integrating Apsara’s wireless microwave technology into its fibre-optic global network, BSO solidifies its position as a top provider of electronic trading connectivity to exchanges and market makers.

Apsara’s wireless microwave network connects some of the world’s most important liquidity venues, including its New Jersey route spanning Nasdaq, NYSE and BATS.

To help fund the transaction and support future growth, BSO has opened up its capital to Boston-based private equity fund Abry Partners. Abry has taken a minority investment in BSO to provide capital for the Apsara acquisition, and to facilitate further investment to enhance customer service and support systems.

Commenting on the deal, Michael Ourabah, Founder and CEO of BSO said: “The acquisition of Apsara Networks enables us to offer unrivalled low-latency access, network resiliency and enhanced managed services to clients across established and emerging markets. Being able to deliver the next generation of trading infrastructure through this acquisition truly cements our market-leading position. Abry’s proven experience and additional capital has been pivotal to making this deal happen, and to providing us with the resources needed to accelerate our future expansion plans.”