Fintech, Finance, Technology, Banking Highlights – 6 July 2018

Azimo adds ten new countries to services for customers in Nordic countries

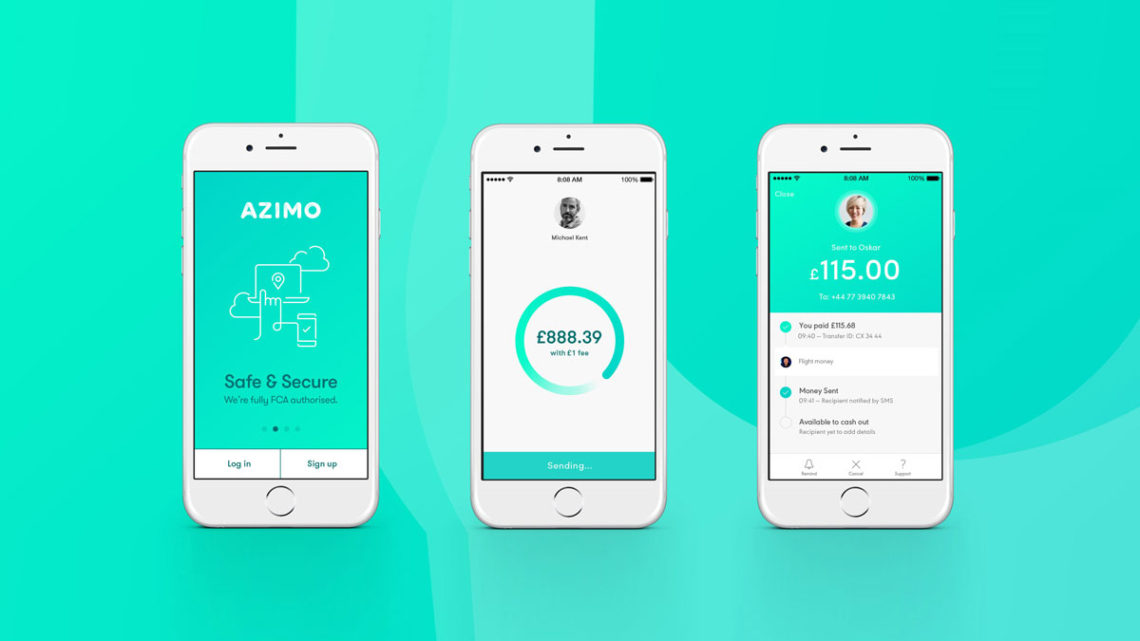

Digital money transfer company Azimo has added 10 new countries to its service for customers in Nordic countries. Customers in Denmark, Norway and Sweden are now able to send money to individual bank accounts in Thailand, Vietnam, Hong Kong, Singapore, Australia, New Zealand, Romania, Bulgaria, Croatia and Hungary.

The new service delivers transfers to recipients’ bank accounts in local currency. With low rates, fast delivery times, and 100% coverage for all bank accounts, Azimo’s service to these 10 new countries is now the best in the market.

Nearly 3.5 million foreigners and children of foreign parents live in Denmark, Norway and Sweden; they send more than $7 billion abroad each year.

Azimo’s number and volume of transfers from Denmark, Norway and Sweden have increased by more than 150% in the last twelve months. Other important countries have also recently been added to its service, including the Philippines, Nigeria and Poland.

The company completed a $20 million fundraising round, led by Rakuten Capital, in May, which is being used to support the rapid growth of Azimo’s business in the Nordic countries and across the rest of Europe.

Michael Kent, CEO of Azimo, commented: “We already serve customers in Denmark, Norway and Sweden. We’re now extending our service to more countries, allowing more customers to send money around the world at a much better rate.”

Sberbank implements payments through Google Pay

Sberbank and Google have provided online shops and their clients a new tool for paying for online purchases – Google Pay. Sberbank is the first bank in Russia to support online payment of goods and services through Google Pay on websites and in apps.

Google Pay makes the payment process significantly easier: to make a purchase, a user just needs to select their Google account, a card for payment out of the added ones, and approve the transaction. The service is available in the majority of popular browsers on both mobile devices and personal computers. It is a user-friendly payment method with a uniform interface wherever shoppers make purchases.

“Google Pay will help users of online shops save time when shopping and make this process more user-friendly. In the modern world, the speed and easiness of making purchases are the priority, and that’s why Sberbank is focused on introducing technology that helps to avoid performing additional actions and lets purchases be made in seconds,” said Director of Sberbank’s Acquiring and Bank Card Division Svetlana Kirsanova.

“Google Pay provides a unique service in the area of selling online goods and services. By using the single integration, sellers will receive access to many cards saved in the users’ Google accounts. That will make users’ lives easier and increase sellers’ conversion rates,” said Managing Director of Google Russia Dmitry Kuznetsov.

Edinburgh Napier University launches dedicated Fintech course

Prospective students will have the chance to combine digital skills with the finance world after Edinburgh Napier launched a new dedicated Masters degree in Fintech. The University’s Business School already has a wealth of courses on offer at both undergraduate and postgraduate level, and the addition of the brand new Masters in Financial Technology is set to expand its portfolio even further.

The new MSc Financial Technology is an exciting hybrid drawing its content from both the University’s Business School and the School of Computing, the latter of which has an internationally-recognised reputation for research in cybersecurity. It’s open to anybody with a degree in a relevant subject, such as maths, computing or finance, or people with sufficient professional work experience in the industry.

Students will have the opportunity to study subjects such as financial management, data wrangling and transnational financial crime as they equip themselves with the knowledge of banking, cybersecurity and more in order to develop their technical awareness in the financial sector. There will also be an opportunity to learn about the management of online identity issues such as fraud.

Through the course, students will develop a deep understanding of the complexity of how international financial markets, banking and money transfer systems are affected by innovations in Fintech, leading them to potential careers in banks, financial institutions, regulatory agencies and beyond. They will also have the ability to focus on either finance or technology for their dissertation.