Fintech, Finance, Technology, Banking Highlights – 12 October 2018

IMF and World Bank unveil Fintech Agenda

The International Monetary Fund and the World Bank Group today launched the Bali Fintech Agenda, a set of 12 policy elements aimed at helping member countries to harness the benefits and opportunities of rapid advances in financial technology that are transforming the provision of banking services, while at the same time managing the inherent risks.

The Agenda proposes a framework of high-level issues that countries should consider in their own domestic policy discussions and aims to guide staff from the two institutions in their own work and dialogue with national authorities. The 12 elements (see table) were distilled from members’ own experiences and cover topics relating broadly to enabling fintech; ensuring financial sector resilience; addressing risks; and promoting international cooperation.

“There are an estimated 1.7 billion adults in the world without access to financial services,” said IMF Managing Director Christine Lagarde. “Fintech can have a major social and economic impact for them and across the membership in general. All countries are trying to reap these benefits, while also mitigating the risks. We need greater international cooperation to achieve that, and to make sure the fintech revolution benefits the many and not just the few. This Agenda provides a useful framework for countries to assess their policy options and adapt them to their own circumstances and priorities.

https://www.imf.org/~/media/Files/Publications/PP/2018/pp101118-bali-fintech-agenda.ashx

ING opens AI bond trading algorithm to the buy side

ING is continuing to improve decision-making in bond trading.

We announced today the launch of Katana Lens, an artificial intelligence (AI) tool that will help investors to easily find and compare interesting trade ideas.

Co-created with Dutch pension fund PGGM, Katana Lens is a web-based application that uses predictive analytics to help bond investors make faster and sharper decisions within minutes.

“What used to take forever, now only takes five minutes and a cup of coffee,” said Santiago Braje, global head of Credit Trading, who announced Katana Lens today at the Artificial Intelligence Summit.

Science over assumptions

Investors have millions of trading ideas to choose from. To narrow down their options, they often resort to making assumptions – a time-consuming activity that can lead to missed opportunities.

Based on a web application, Katana Lens uses an algorithm that learns from the history of hundreds of thousands of trades and identifies the most promising ones. By going through all the pairs of bonds and taking each ‘buy’ and ‘sell’ combination as a possible investment, it simplifies the selection process for investors, who are presented with a prediction or suggested decision.

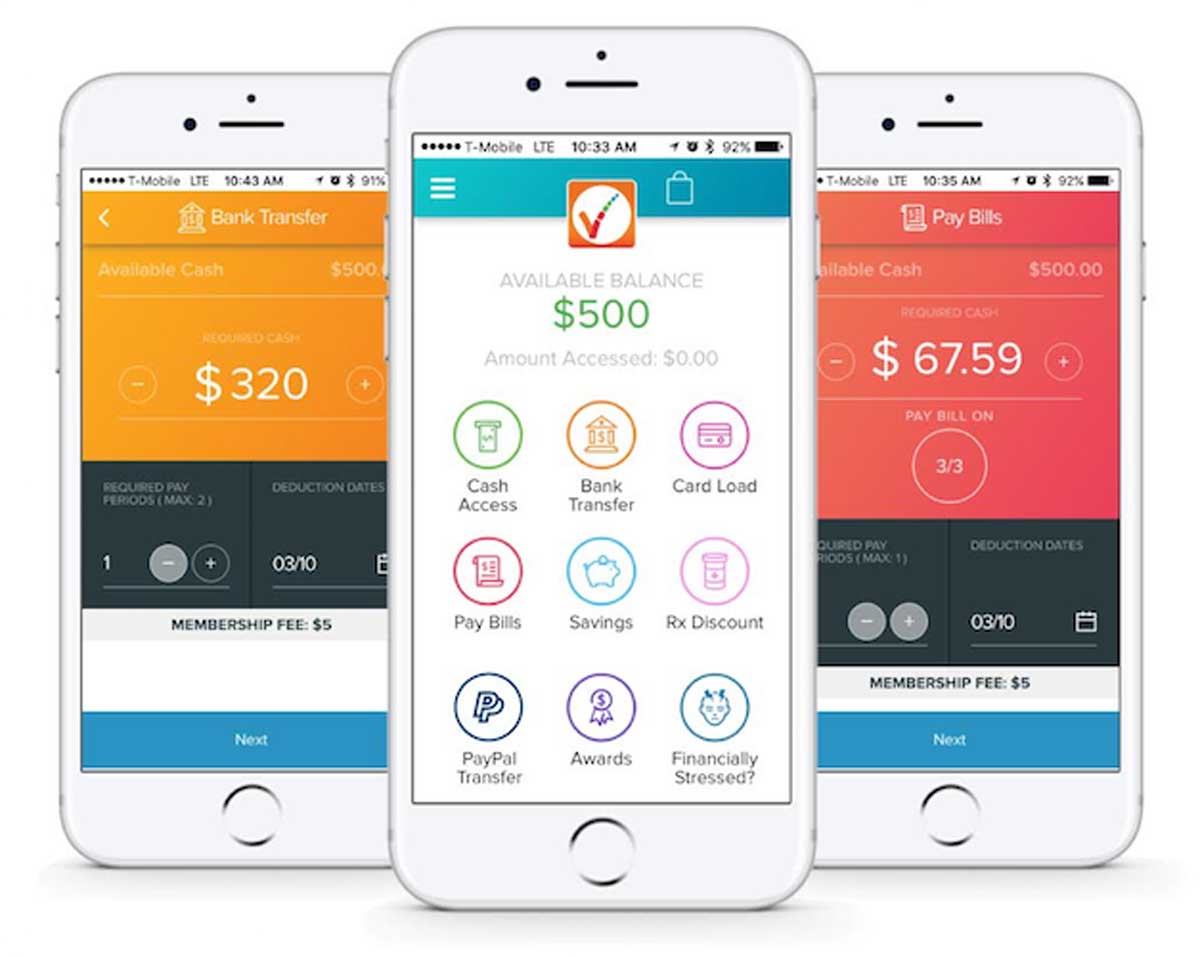

PayActiv raises $20 million

PayActiv, a provider of employment-based holistic financial wellness services, has raised $20 million from Generation Partners in a Series B financing round.

Generation Partners has joined early round investors Ziegler Link•Age Fund II and affiliate funds of Softbank Capital in helping PayActiv end predatory fees and debt cycle for millions of workers.

This latest funding round comes at a time when PayActiv is promoting its mobile and global holistic financial wellness tools, including bill pay, budgeting & savings tools, discounts, financial counseling & education, and multiple instant funds availability options for immediate access to earned wages.

“Working with numerous companies across the country, we have seen that employers who offer timely access to earned wages through PayActiv not only help their employees reduce financial stress with security, dignity and savings, but also realize concrete benefits to their bottom line,” said Safwan Shah, founder and CEO of PayActiv. A landmark research paper released by Todd Baker at the Harvard Kennedy School found that the PayActiv approach to financial wellness could save US businesses hundreds of millions of dollars each year through enhanced employee retention. Deployment of PayActiv can also bring additional savings from increased productivity as well as more subjective ROIs in strong recruitment and employee morale.

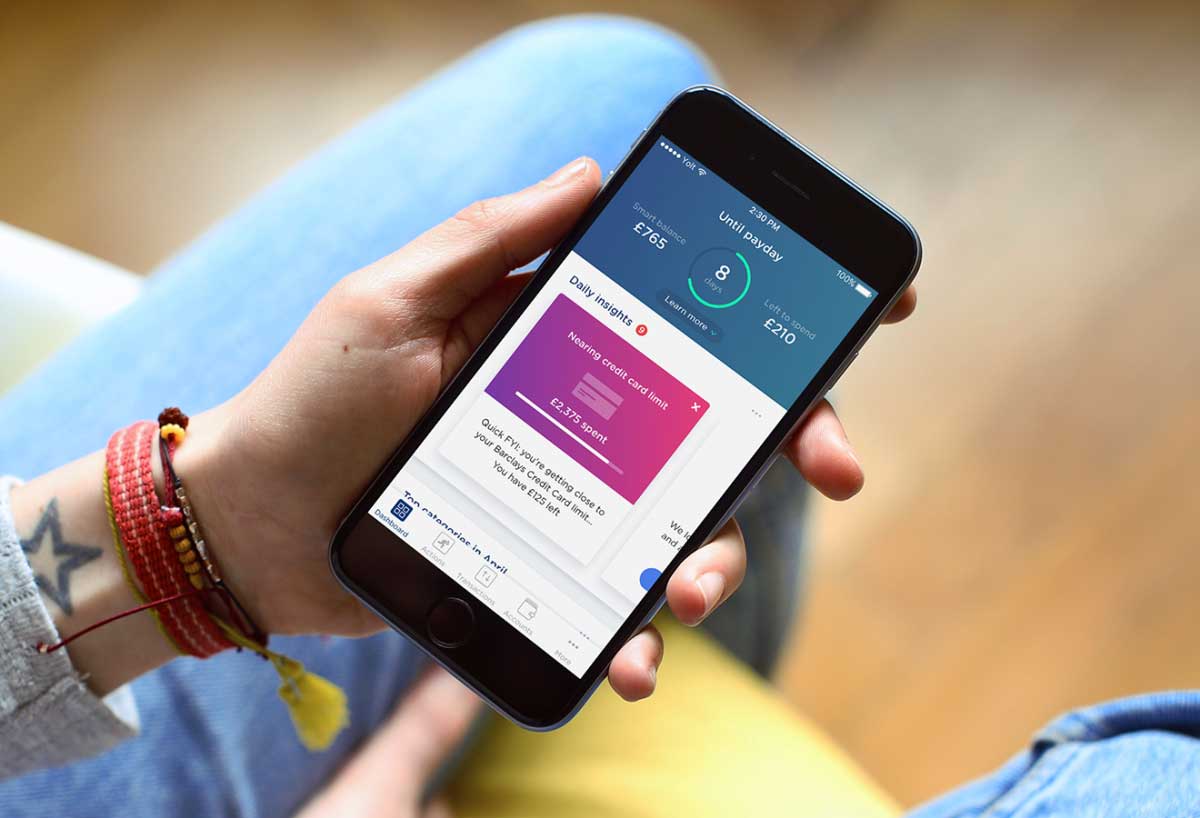

Yolt passes 500,000 user landmark

Yolt, the smart thinking money app, has announced it has reached 500,000 registered users since launching in June 2017.

Yolt empowers people to take control of their finances by enabling them to view their accounts, credit cards and pensions together in one place. From the beginning, Yolt has been on a mission to change the way people think about money through easy budgeting, spending categorisation and deal finding.

This half-million milestone comes during a huge period of growth for Yolt, both for the app and the company as a whole. With the announcement of two new markets, Italy and the imminent launch into France, Yolt has made its first steps to becoming a pan-European platform empowering more consumers to be smart with their money. In the UK, Yolt remains at the forefront of Open Banking becoming the first third-party provider (TTP) to successfully complete Application Programming Interface (API) connections with nine of the biggest high street banks in the UK (CMA9). As a result, Open Banking APIs enable users to view their bank accounts and credit cards in a fast, seamless and secure way.