Fintech, Finance, Technology, Banking Highlights – 25 October 2018

Barclays sets up specialist AgriTech team

Barclays announced the launch of a dedicated agri-tech team, focused on supporting UK start-ups to connect with the farming community and boost innovation.

Last year was a record year for financing in agri-tech, with more than £1.5 billion invested in the sector according to PitchBook. The UK agri-tech industry contributes £14.3 billion to the British economy and employs 500,000 people.

Today’s appointments signal the bank’s intention to further support innovation in the UK’s farming sector and to ensure new technology, products and services boost growth.

Led by Craig Sigley, the new agri-tech team will be split regionally and will include regional relationship managers: Paul Hazzard (South Wales & South West), Dave Pruden (North), Lizzie Asplin (South East), George Sigley (Midlands and North Wales) and Karl Blagg (East).

Each relationship manager brings a wealth of expertise to their new role in understanding exactly what farmers look for from emerging players in the sector as well as supporting agri-tech companies with their business growth plans.

Barclays already has a strong roster of agri-tech clients, including Agrivi and Well Cow. Agrivi’s software helps farmers to manage and monitor crop production, while Well Cow has developed a device that can detect digestive problems in cattle and improve their welfare.

IraLogix raises $5 million

iraLogix, Inc. announces that it has completed a $5 million Series A financing led by Integrated Retirement Initiatives with participation from Riverfront Ventures and other strategic investors.

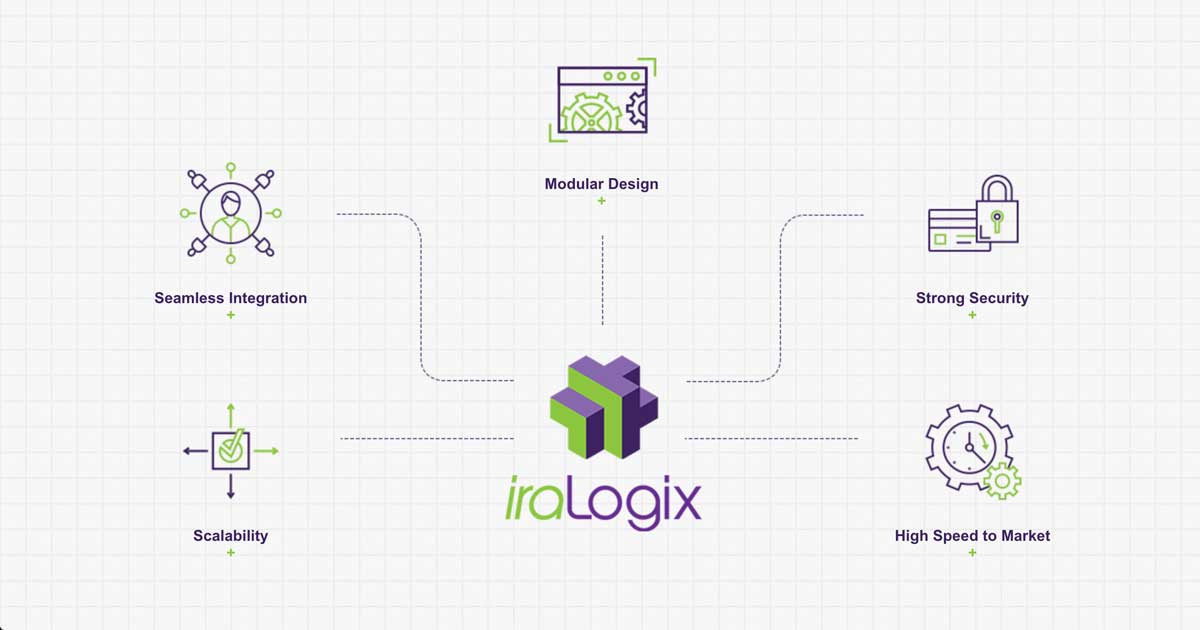

iraLogix is a unique, cloud native technology platform providing completely paperless, end to end white label IRA product capability to financial services firms interested in growing their IRA business quickly and profitably. iraLogix provides a wide range of institutionally priced investment choices and seamless access to professional advice, education and other financial services, all with no account minimums.

“This timely investment will help us accelerate as we expand our ability to provide advanced IRA technology solutions to our rapidly growing list of institutional IRA provider clients” said David Bernard, iraLogix’s CEO. “Integrated Retirement’s continued confidence and support has been instrumental as we increase the speed at which we secure new clients and add new services for existing clients. We are excited about the positive impact we’re able to make in helping our clients address this $3 trillion opportunity in the retirement market.”

Ondot Announces Investment from Citi Ventures to Power Enriched Transactions

Ondot Systems announced that it has secured a strategic funding investment from Citi Ventures.

Ondot works directly with financial institutions to give consumers increased control over and visibility into their personal payment transactions. With Ondot, consumers can manage functions such as fraud alerts, transaction limits and purchase location restrictions, all from the convenience of an app on their smartphone or desktop. This investment will further support Ondot’s efforts to grow its international presence and product offerings.

Today’s digitally connected consumers are looking for more ways to access detailed information about their digital lives — including personal payment transactions. Ondot’s platform addresses modern consumer preferences by offering a solution that can be built directly into the card processes of financial institutions, making mobile and on-demand solutions more accessible and visible than ever before. Ondot’s provides financial institutions with either a white label app or an API that can be integrated into pre-existing services available to its consumers.

“As we steadily march toward high-frequency, invisible and autonomous payments, consumers increasingly expect detailed information about their transactions,” said Vaduvur Bharghavan, Ondot Systems CEO. “Bringing together details such as real-time transaction authorizations, proximity controls, merchant specifications, and applying machine learning on historical data helps consumers have more control over their cards and delivers a premium cardholder experience.”