Fintech, Finance, Technology, Banking Highlights – 13 April 2018

EU financial regulators warn against risks for EU financial markets, Brexit, asset repricing and cyber-attacks key risks

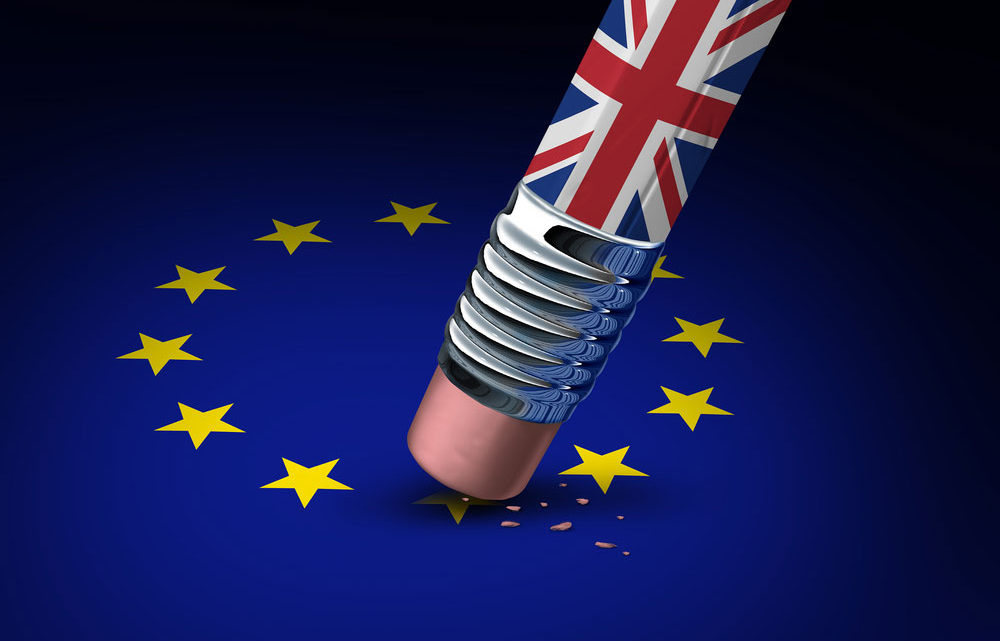

The securities, banking and insurance sectors in the European Union (EU) face multiple risks, the latest report on risks and vulnerabilities by the Joint Committee of the European Supervisory Authorities (ESAs) shows. The ESA report for the second half of 2017 outlines the following risks as potential sources of instability: sudden repricing of risk premia as witnessed by the recent spike in volatility and associated market corrections; uncertainties around the terms of the UK’s withdrawal from the EU; and

cyber-attacks.

The ESA report also reiterates their warning to retail investors investing in virtual currencies and raises awareness for risks related to climate change and the transition to a lower-carbon economy.

In light of the ongoing risks and uncertainties, especially those around Brexit, supervisory vigilance and cooperation across all sectors remains key. Therefore, the ESAs advise the following policy actions by European and national competent authorities as well as financial institutions:

Against the backdrop of the potential for sudden risk premia reversals, supervisory stress testing remains a crucial tool for the management of systemic risk – these tests are to ensure that systemically relevant sectors and players are safe to withstand market shocks, such as insurance and occupational pensions sectors, central counterparties (CCP), banks and in the future asset managers;

Brexit: the ESAs recommend EU financial institutions and their counterparties, as well as investors and retail consumers, to consider timely mitigation actions to prepare for the UK’s withdrawal from the EU – including possible relocations and actions to address contract continuity risks;

Cyber security: the ESAs encourage financial institutions to improve fragile IT systems, explore inherent risks to information security, connectivity, and outsourcing. To support this, the ESAs will continue addressing cyber risks for securities, banking and insurance markets and monitor firms’ use of cloud computing and potential build-up of cyber risks; and

Climate change: the ESAs recommend financial institutions to consider sustainability risk in their governance and risk management frameworks and to develop responsible, sustainable financial products – moreover, supervisors should enhance their analysis of potential risks related to climate change for the financial sector and financial stability.

Sberbank and SAP have completed the largest in Russia “cloud” project

Sberbank and SAP have announced the completion of a major HR digital transformation project that utilises the SAP Success Factors cloud solution.

The system is currently used by 230,000 of the bank’s employees in Russia. In the future it is planned to connect all of Sberbank’s subsidiaries. The project will cover a total audience of 270,000 employees. The transition to the new system was carried out by a joint team made up of SAP Consulting and Sberbank employees over a year and has been recognised as the fastest project to deploy a cloud-based HR system of a major SAP client globally.

The aim of the project was to ensure a new level of quality of personnel management processes at the bank in accordance with the ambitious 2020 transformation strategy. Key objectives of the project included increasing the quality of employee recruitment and training, achieving transparent career planning and development, creating a new model of competencies, and developing corporate culture.

Paysafe to acquire iPayment

Paysafe, a leading global payments provider, today announces that it has agreed to acquire iPayment Holdings, Inc. (“iPayment”), a U.S. based provider of payment and processing solutions for small and medium-sized businesses (SMB).

The acquisition forms part of Paysafe’s previously stated investment strategy to expand its presence in North America in response to significant growth opportunities, particularly in the fast-growing SMB sector.

This latest U.S. based investment builds on Paysafe’s acquisition last August of SMB payments provider, Merchant Choice Payment Solutions (“MCPS”), as well as its high-profile sponsorship of North America’s IndyCar series, and will establish Paysafe as a top 5 non-bank payment processor in the U.S.

With more than 137,000 merchant customers as well as annual processing volumes of over $28 billion in 2017, iPayment is an established leader in the U.S. based payment processing industry. The company operates both direct and indirect sales channels and is a well-respected provider and partner for hundreds of agents, sub-ISOs and software developers specialising in the SMB sector. iPayment employs over 450 employees across its four U.S. offices located in Boston, Massachusetts; Westlake Village and Camarillo, California; and Minden, Nevada.

Stash to Unveil New Banking Services, Powered by Green Dot Corporation

Stash, the financial services platform that’s revolutionizing saving and investing, today announced its partnership with Green Dot Corporation and its subsidiary bank, Green Dot Bank, Member FDIC, to launch mobile-first banking services to help millions of Americans reach their dreams of financial security and prosperity.

Green Dot services will include bank accounts with debit cards, no overdraft fees, and a large network of free ATMs nationwide. Additionally, Stash will provide personal guidance across every aspect of a client’s finances – from spending to saving, to retirement and investing. Stash powered technology will provide clients with actionable advice to help customers get the most out of their money.