Fintech, Finance, Technology, Banking Highlights – 5 April 2018

ICICI Bank enables Non Resident Indians (NRIs) to send money through social media on its Money2India app

ICICI Bank, India’s largest private sector bank by consolidated assets, announced the launch of a service that enables Non Resident Indians (NRIs) to send money to a beneficiary in India using social media like WhatsApp and e-mail.

Christened ‘Social Pay’, this first-of-its-kind service by any Indian bank is available on Money2India (M2I), the bank’s app for remittances. This new facility will enable NRIs to send money conveniently to their friends and family, to whom they occasionally remit money, like on special occasions like festivals and birthdays.

To transfer money, users need to generate a secure link from the M2I app and share it with the beneficiary on their social media profile or email for adding his/her bank details. This link, which is valid for 24 hours is secured with a four digit code set by the sender, which he/she shares with the beneficiary. The beneficiary then validates the passcode before adding the bank details. The M2I user then re-verifies & confirms the payment details on the app to complete the transaction in a safe and secure manner.

ICICI Bank Limited is the first in India and among few globally to launch a service that allows cross-border remittances over social media.

Speaking on the initiative, Vijay Chandok, Executive Director, ICICI Bank said, “ICICI Bank is one of the leading players in the Indian remittance market. With increasing number of people connected on social media globally, ‘Social Pay’ embraces the medium as a way to simplify money transfers, adding to customer convenience. Users of our Money2India remittance app can now send money to their friends and family on special occasions like birthdays and festivals by leveraging social media, which they are regularly using. With this facility, ICICI Bank remains committed to extend its expertise in the cross border payments segment/business and the online money transfer.”

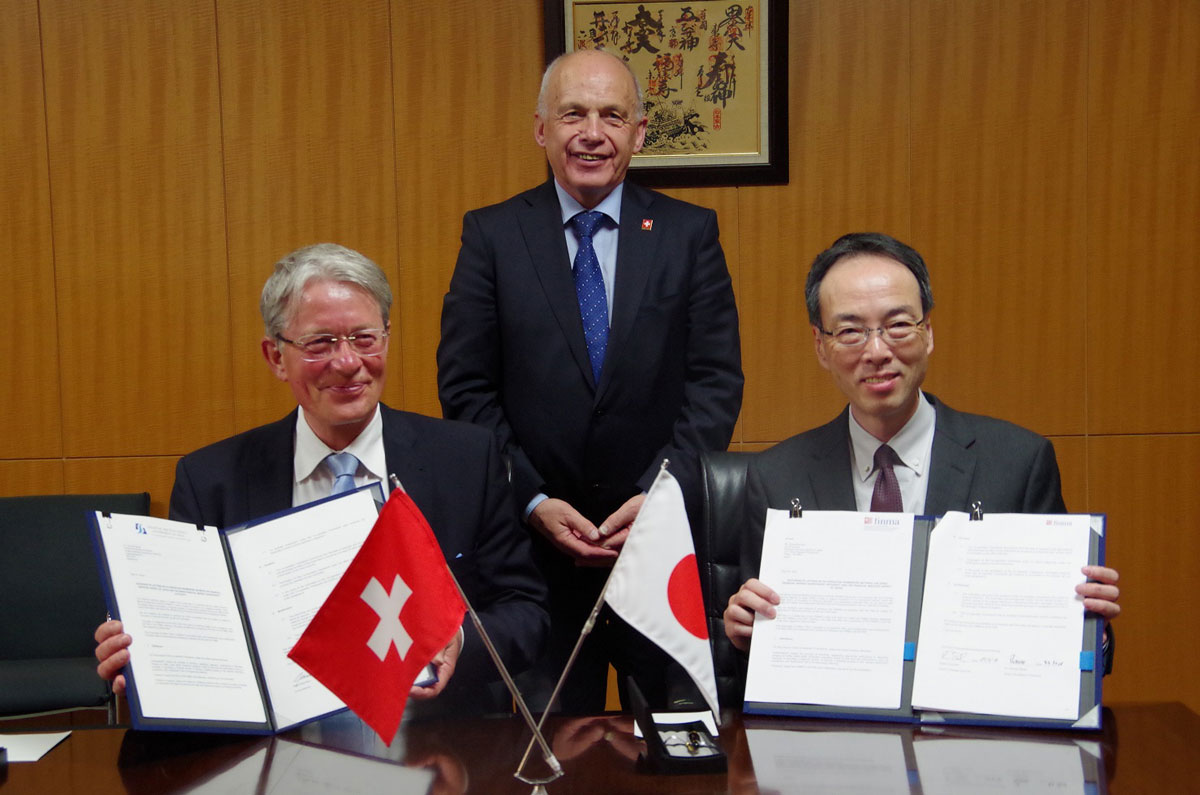

Exchange of Letters for Cooperation Framework on FinTech with the Swiss Financial Market Supervisory Authority (FINMA)

The Financial Services Agency (FSA) exchanged the Letters for Cooperation Framework on FinTech with the Swiss Financial Market Supervisory Authority (FINMA) on April 4, 2018.

This Cooperation Framework recognises the global nature of innovation in financial services and intends to enhance the relationship with FINMA on FinTech.

The contents of the Letters include, but are not limited to, the following:

The Authorities intend to refer Financial Innovators each other and to provide support to them.

The Authorities intend to share information on FinTech.

Wirecard and Crédit Agricole sign a digital payment partnership agreement

Crédit Agricole Payment Services (CAPS), a fully-owned subsidiary of Crédit Agricole, and Wirecard, one of the leading companies in digital financial technology, have signed a comprehensive contract to start their next generation digital partnership in payment services.

After first starting into initial negotiations in December 2017, the parties are now defining the next steps to achieve state-of-the-art multichannel solutions.

CAPS and Wirecard will provide new e-commerce payment acceptance and acquiring services, available at the beginning of 2019. This partnership will also reinforce the development of mobile Point-of-Sale (mPOS) and other Point-of-Sale (POS) solutions for fast and easy payments in line with new uses and consumer purchasing journeys. In addition to new customer acquisitions, CAPS will offer its existing clients the possibility to combine their existing POS solutions with online and mobile offerings, so that their consumers benefit from an integrated digitalized solution.

This partnership will also support the international development of large customers by providing a centralized platform for acceptance and acquiring processing capabilities in Europe.

Bertrand Chevallier, CEO of Crédit Agricole Payment Services, says: “We are delighted to announce the agreement with Wirecard, one of the most innovative providers of digital financial technology. This will bring our leadership in payment solutions to the next level. By capitalizing on the respective strengths of Crédit Agricole Payment Services and Wirecard, this partnership will enable both companies to grow in a rapidly changing market.”