Fintech, Finance, Technology, Banking Highlights – 18 September 2018

BofA Merrill introduces mobile wallets for business cardholders

Starting this month, BofA Merrill’s mobile wallets will begin to make their commercial clients’ lives easier through faster, more secure and more efficient business purchases, while providing the same convenience they have in their personal transactions.

The millions of Bank of America Merrill Lynch cardholders who use our corporate, commercial and purchasing cards in the United States are now able to use Apple Pay, Google Pay and Samsung Pay to make business purchases.

Bank of America has offered mobile payment services to customers, clients and merchants since 2014, but the addition of mobile wallets for commercial cardholders is new to the industry.

“We are very pleased to announce today a new, highly convenient mobile capability to our commercial clients,” said Hubert J.P. Jolly, head of Financing and Channels in Global Transaction Services at Bank of America Merrill Lynch. “Cardholders will no longer have to search for their physical wallet for every business purchase. The result should be faster transactions and greater peace of mind for the cardholder.”

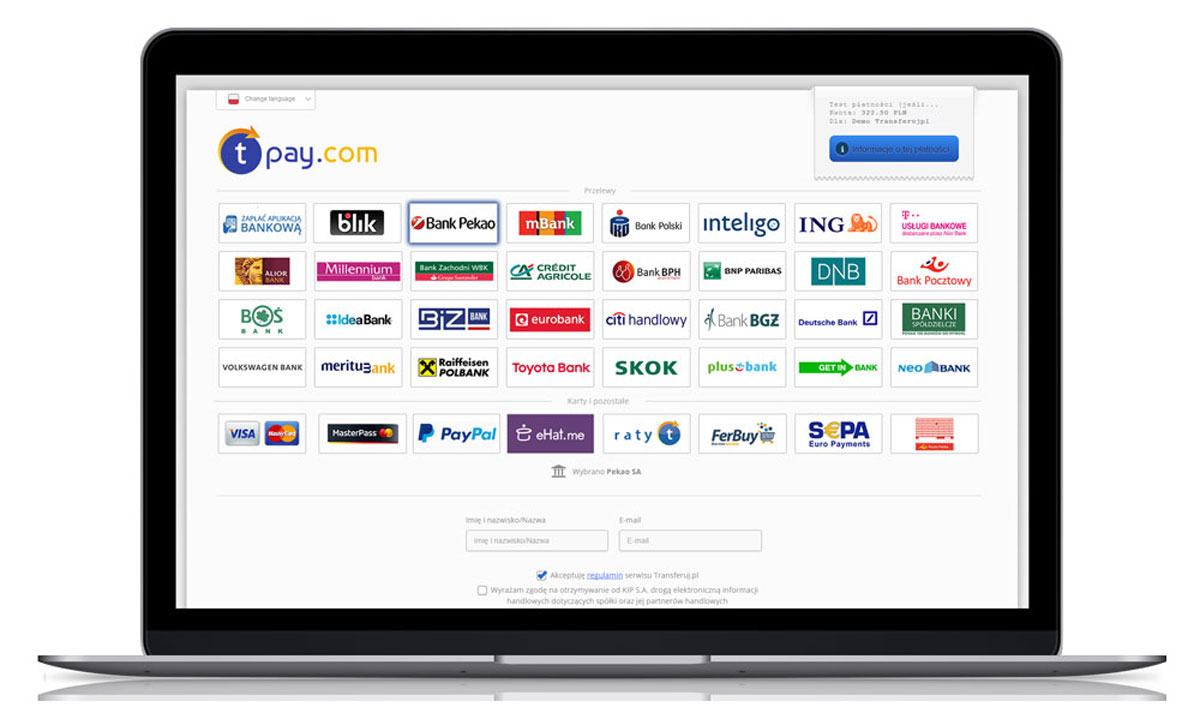

Helios buys majority stake in Tpay

Helios Investment Partners, the leading Africa-focused private investment firm, has announced the acquisition of a 76% stake in TPAY Mobile FZ-LLC, a fast growing direct carrier billing provider in the Middle East and North Africa region from A15, a leading tech investment fund based in Egypt.

Terms of the transaction were not disclosed. A15 and senior management will remain minority shareholders.

With offices in Cairo and the U.A.E, TPAY currently operates across 16 countries with almost half of its total transaction volume coming from African markets such as Egypt, Tunisia, Algeria and Morocco.

TPAY provides a much-needed mobile payment solution in markets with low banking penetration and high mobile adoption. Leveraging the mobile network operator billing relationship and collection network, it enables consumers to purchase digital goods using their pre-paid airtime balance or post-paid phone bills. TPAY’s business model supports financial inclusion and facilitates digital payments, both of which are top priority government initiatives in TPAY’s markets.

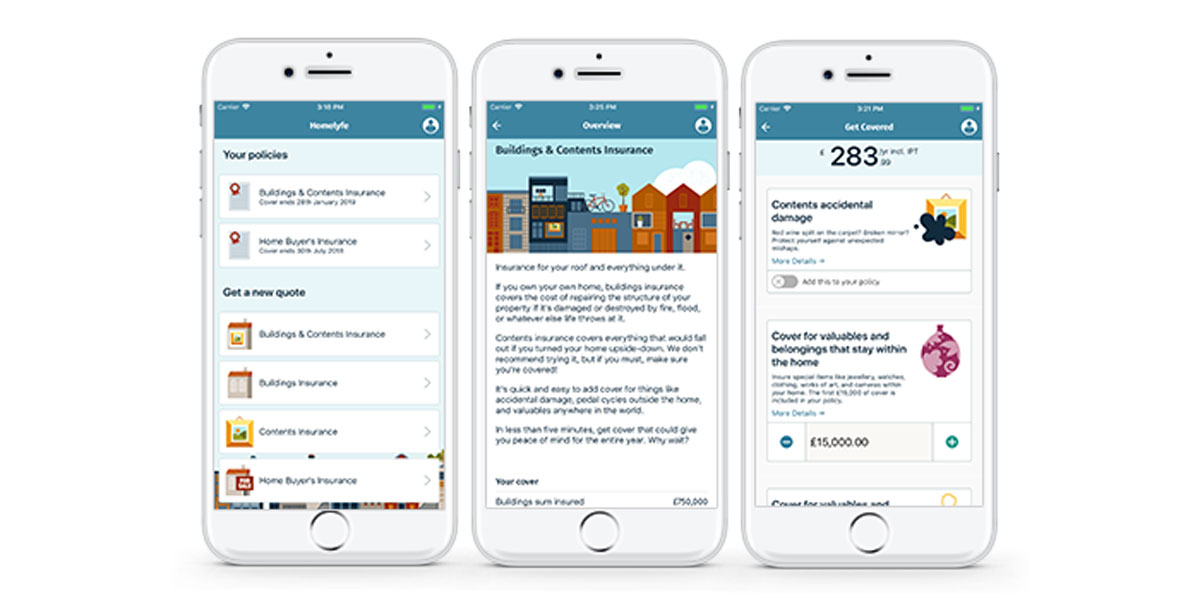

Homelyfe launches digital insurance platform

Insurtech start-up Homelyfe, which announced a partnership with ING’s smart money app Yolt last week, has launched a new digital insurance platform.

The Aventus platform allows challenger and retail banks to integrate with any insurer and create a seamless buying experience for any insurance line, in any digital environment, at start-up speed.

Homelyfe was founded in 2015, with a mission to make insurance simple and customer-centric by streamlining the quote process. It was built on the Aventus platform to showcase the technology and demonstrate the power of its data-driven approach.

The team is now collaborating with banks to enable them to integrate seamlessly with trusted insurance brands through the Aventus platform. As an insurer-agnostic platform, Aventus connects the digital marketplace, empowering banks to integrate with any insurer and pass first-party data securely and compliantly. The platform also leverages third-party data to augment question sets and ensure that banks can offer any insurance line in the most frictionless way possible.