Fintech, Finance, Technology, Banking Highlights – 22 October 2018

Visa Expands Tokenization Partnership With Netflix to Improve Digital Payments Experience Globally

Building on a pilot program that began in 2017, Visa announced an expansion of Netflix’s use of the Visa Token Service, with a key focus of improving card-not-present authorization rates and enabling a more seamless and secure merchant and customer experience globally.

Visa and Netflix are working together to realize the benefit of higher authorization rates resulting from global issuer lifecycle management of Visa tokens. With the Visa Token Service, card details can be replaced with a unique digital identifier used to process payments without exposing the cardholder’s sensitive account information. For those Visa tokens, issuers around the world can push dynamic updates on lost, stolen or expired credentials to enable a frictionless merchant and customer experience. As part of the effort to expand these benefits more broadly to issuers and card-not-present merchants generally, Visa is now working with Netflix and other token participants to measure these improvements and set milestones for industry performance.

“As the Visa Token Service and associated payment frameworks continue to scale, we believe low risk, trusted merchants, like Netflix, can realize authorization approval rates and a customer experience on par with the face-to-face environment. We look forward to our continued work with Visa to consolidate that potential under a broader digital merchant acceptance program and further improve the payment experience for Netflix members globally,” according to Vickie Gonzalez, global head of payments, Netflix.

“We believe tokenization, in association with other enhancements in digital payments, will create the framework for seamless processing and significantly higher authorization rates in eCommerce in the near term,” says TS Anil, global head of payment products and platforms, Visa. “By expanding our partnership with Netflix, Visa is further demonstrating its commitment to making digital commerce easier and more secure.”

Tinkoff Bank launches Tinkoff Junior mobile app for children and teenagers

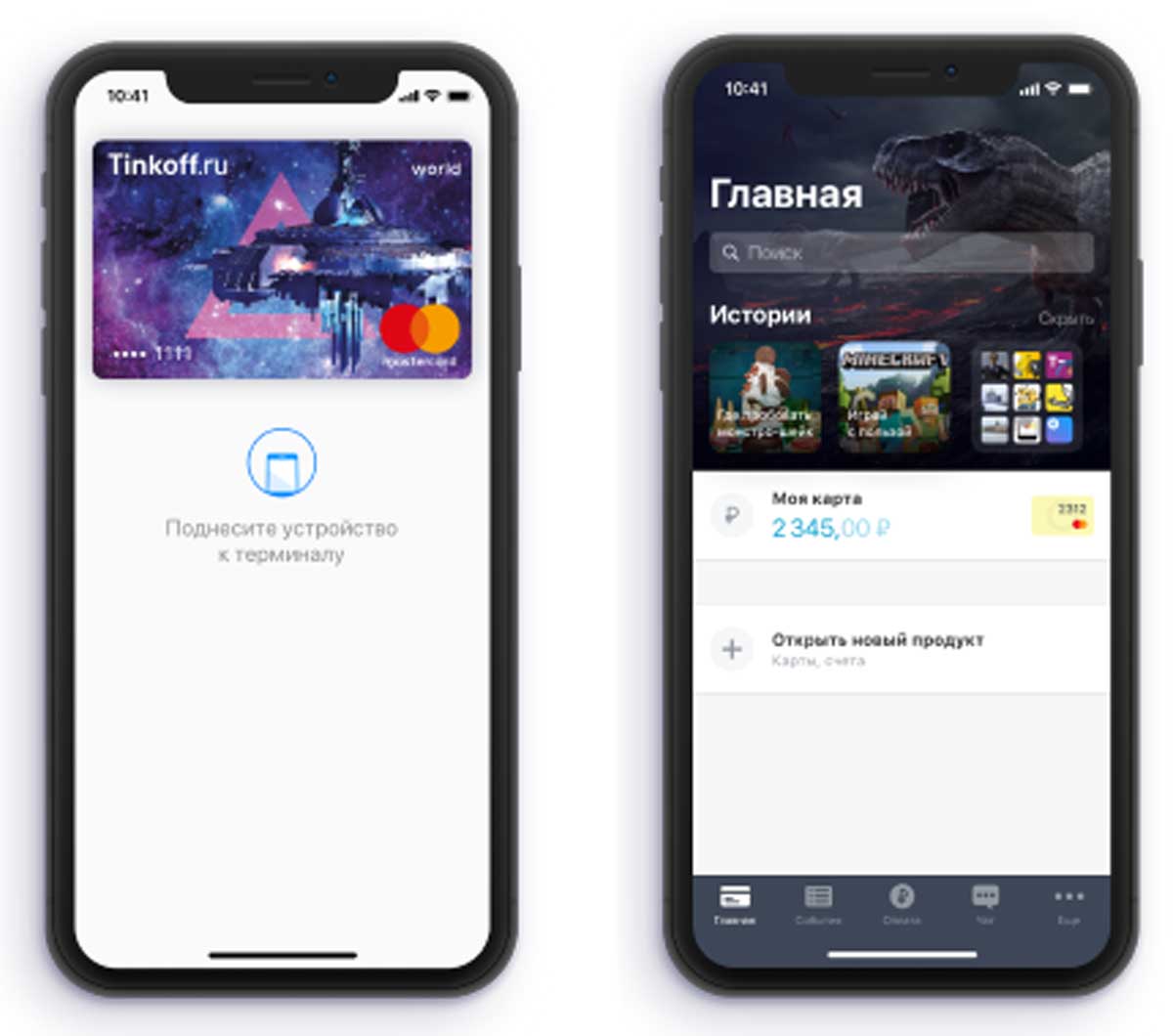

Tinkoff Bank is expanding its banking platform for children and teenagers with the launch of Tinkoff Junior, a mobile app that gives young clients an easy-to-use and robust tool to manage their personal finances.

Parents can open a current account for their child via the Tinkoff.ru website or Tinkoff mobile app, with a Tinkoff Junior debit card added by default. The card can also be added to a young client’s smartphone to allow them to make contactless payments via Apple Pay, Android Pay or Samsung Pay. Parents and their children can choose the card’s design.

Tinkoff Junior card holders will also join the Tinkoff Junior loyalty programme, which awards bonus points as follows: 2% of the purchase amount as bonus points for online shopping and 1% for other purchases, including movie tickets purchased via a mobile app. Bonus points may be spent on online shopping as well as items such as restaurants and fast food. The amount of bonus points spendable during the settlement period is capped at 2,000.

Children and teenagers can use the Tinkoff Junior mobile app to pay for a variety of services such as school meals, games and their mobile phone. They can also set spending limits, change their PIN and choose app themes such as space, wildlife, travels or dinosaurs. In addition, Tinkoff Junior’s young clients will be able to open a money box (savings account) and top it up, including via Card 2 Card transfers.

Young clients will be able to reach Tinkoff Bank’s managers via chat and have access to age-relevant content in Tinkoff Stories such as advice on using bank products, a What’s On guide and other lifestyle events.

Dynamics Inc., SoftBank Corp. and SoftBank Commerce & Service Corp. Agree to Comprehensive Collaboration in the Field of Battery-Powered Interactive Cards

Dynamics, SoftBank and SoftBank Commerce & Service agreed to consider a comprehensive collaboration for the deployment of Dynamics’ battery-powered interactive card in Japan.

Based on the agreement, SoftBank will support Dynamics Inc. on mobile connectivity and SoftBank C&S will support on service planning, marketing and sales expansion as strategic partners. The companies plan to start services from 2019.

“We are very pleased to be able to bring such an innovative payment experience with SoftBank and SoftBank C&S to the Japanese market. This is only the first step. Through this technology we will continue to provide more products of value to Japanese consumers,” said Jeffrey Mullen, CEO of Dynamics Inc. “We are extremely impressed with SoftBank’s achievements of capturing technological innovation and market trends, and we hope to have a great synergy between the three companies in the future. With this collaboration, we are convinced that we can drive change and growth in the market environment and business environment in Japan through Dynamics’ technology.”

“We are very happy that we can co-create with Dynamics, a company that has advanced technology and a completely different credit card embedded with communication functions as one of the IoT businesses that SoftBank is promoting. We believe that the development of IoT technology will improve quality of life and we will help accelerate this movement,” said Hidebumi Kitahara, Vice President, Head of Global Business Strategy Division, SoftBank Corp.

Card clash costing UK commuters £3.4 million a year

Double dipping is costing commuters over £3.4 million per year, according to the latest research from Commuter Club, the commuting subscription service.

The problem which is also known as card clash, occurs when travelers get charged on the wrong card when they tap in or out of the contactless ticket barrier. The most frequent cause is where commuters use their entire purse or wallet to tap in and out, a habit adopted by more than one in six commuters. This means the machine can often inadvertently read the wrong card if it’s contactless. There are currently 92 million contactless cards in use and almost all new debit and credit cards are contactless. Tapping a purse or wallet on the barrier is like playing contactless roulette.

As a result, commuters could be charged on one card tapping in and another tapping out and pay the maximum fare on both which could total £22.70[3]. According to the research, 21% of commuters that use contactless and Oyster know they have fallen victim to this since contactless was made available on London Underground in 2014. Whilst you can claim money back from Transport for London (TfL) for incorrect payments, more than half (61%) of those affected by card clash said they’d never got around to doing so. This means there could be around £2 million sat unclaimed each year. In fact, 31% of all surveyed have never checked to see if they had been overcharged, which could mean people are completely unaware it has happened.

If you know you’ve double dipped on your journey, simply register the cards you use to travel on the Transport for London website and you can check your travel payments online. If you don’t register, you can only check the last seven days.

Commuters don’t use protection

Commuters can prevent contactless devices from taking money from cards they don’t want them to by using protective RFID covers to block the contactless signals. Sadly more than one in ten commuters claimed to be unaware of this simple measure.

If you are a regular commuter – commuting four days a week or more, or 40+ weeks a year – season tickets or commuting subscriptions are better value for money. As an example, if you commute through Zones 1-6, you’ll save a massive £608 a year by using an annual ticket purchased through Commuter Club.