The Fidor chatbot uses conversational AI and natural language understanding to deliver personalised and efficient interactions with users in real-time.

Fintech pioneer Fidor, a leading digital banking group is announcing its new banking chatbot, designed in collaboration with Finn AI, the world’s leading AI-powered conversational banking technology provider.

This development distinguishes Fidor as one of the first digital banking service providers to embed a virtual assistant within its technology stack. Bank customers will benefit from a market-ready digital bank platform with pre-integrated conversational AI, including deep machine learning capabilities and natural language understanding.

The conversational bot is part of Fidor’s strategy to accelerate the adoption of AI, Machine Learning and Robotisation in banking when relevant to the customer. The company is renowned as an early adopter when it comes to innovation, new technologies developed in-house or through partnerships thanks to its API-based platform.

With conversational banking in place, bank partners will benefit from Fidor’s first hand experience and invaluable insights which can be applied to their environment. Organisations use the Fidor Operating System (fidorOS) to support digital transformation initiatives such as the creation of neobanks (digital-only banks). The fidorOS platform is sold as a solution stack to like-minded organisations such as banks, telecoms and retailers looking to launch neobanks. Fidor additionally provides Banking-as-a-Service capabilities for organisations across Europe – including technology, compliance, risk management, go-to-market strategy and customer service under its comprehensive banking license.

In 2018, Fidor was instrumental in the launch of 3 neobanks in North Africa, the Middle East and Europe, as well as the first pan-Asian sandbox and marketplace.

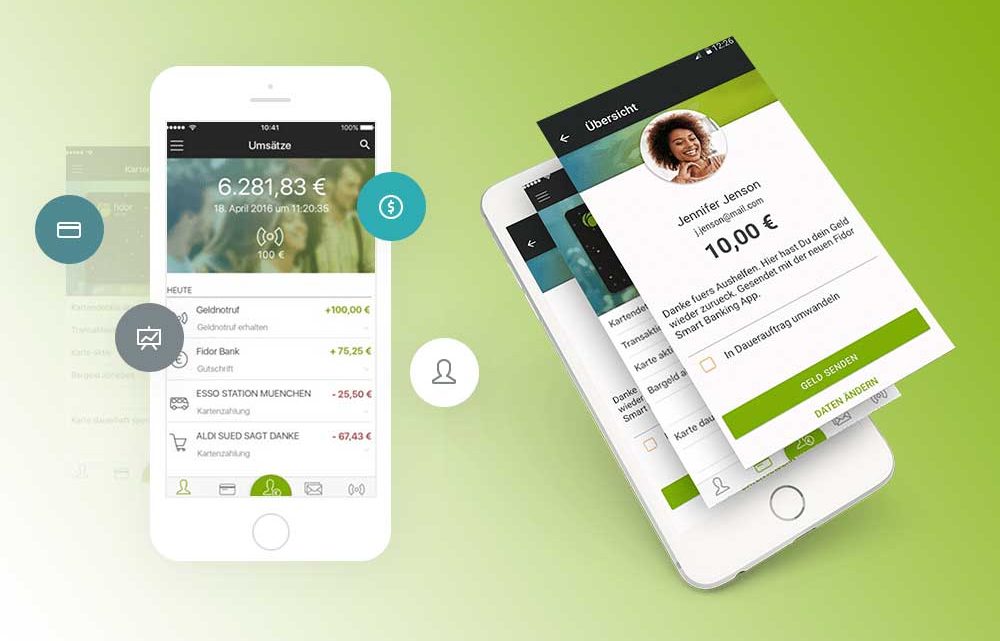

The Fidor chatbot will provide end users with access to instant, easy-to-action financial support for all of their banking needs, allowing them to perform tasks and interact with their bank using simple human conversations.

The chatbot is available on web and mobile banking platforms. It addresses general customer queries and the fast routing of complex conversations to the appropriate human for response, increasing customer satisfaction by reducing the time users spend looking for information. Next, the chatbot will assist with transactional services.

The chatbot has been designed to detect sophisticated language nuances with a comprehensive understanding of most user requests. It incorporates deep machine learning and natural language processing so it can continually optimise and refine its performance every time it interacts with a customer, providing a truly personalised experience.

Matthias Kröner, Founder & CEO of Fidor, commented: “Fidor was first to create deep customer engagement with consumers before they even become customers through our community! The expansion of our platform today reinforces our strong belief in chatbots as a new way to interact with customers. AI and machine learning are opening up a whole new world creating real bot/customer discussion that continuously improve. As customer expectations are constantly evolving, it’s crucial for banks to stay ahead of the digital curve and adopt technology processes that respond to customer needs. I am glad that banks that are powered by fidorOS will have a ready to use chatbot that also benefit from the learnings of our own bank. With today’s integration of AI and machine-learning services on the fidorOS platform, we’re building on our already cutting-edge technology infrastructure and improving user-experiences, for all of our customers.”

Jake Tyler, CEO of Finn AI, added: “Finn AI is proud to collaborate with Fidor Solutions and all banks that are powered by fidorOS. Our conversational AI platform is designed exclusively for banks. By working closely with financial institutions around the world, Finn AI has been able to build an impressive and proprietary platform that will perfectly serve Fidor Solutions customers. Our partnership with Fidor reflects our mutual commitment to continually innovate within the financial sector.”