Klarna, a global payment provider, announces a partnership with Canadian instant financing provider, PayBright.

Klarna and PayBright are joining forces to give Klarna’s 100,000 global retailers the ability to turn on a consumer finance solution for their Canadian shoppers quickly and easily.

“PayBright is a leading provider of e-commerce and in-store point-of-sale financing in Canada, working across multiple verticals from fashion and retail to travel and home,” said Michael Rouse, Chief Commercial Officer of Klarna. “By building a relationship with a like-minded company, we can offer a comprehensive range of alternative payment options in this critical market to our entire global merchant base. Through this partnership, Klarna is now the only company to offer pay later and consumer finance services throughout North America.”

Canada is the first country to be available as part of Klarna’s initiative to help retailers go live in new countries seamlessly and accelerate their international expansion. Via Klarna’s reverse integration platform, which enables partners and other issuers such as PayBright to connect directly to Klarna, retailers will benefit as their integration will instantly be supported in all available markets.

“This is another example of how Klarna wants to help retailers grow and be successful across multiple countries,” said Michael Rouse. “Retail is increasingly competitive and we want to give our clients every opportunity to meet their goals. Klarna now offers coverage for 12 countries via our single integration and that number will continue to grow over the next year.”

“Klarna and PayBright share a mission to make in-store and online merchants successful by creating a more flexible purchase experience for shoppers,” said Wayne Pommen, President and CEO of PayBright. “We are excited to work with Klarna to give consumers financial choice at checkout and make cross-border commerce an easy and hassle-free reality for our merchant partners.”

Klarna is Europe’s one of leading payments provider and a newly-licensed bank, which wants to revolutionize the payment experience for shoppers and merchants alike. Founded in Stockholm, Sweden, in 2005, the fintech unicorn gives online consumers the option to pay now, pay later or over time – offering a trusted, frictionless and smoooth checkout experience. Klarna now works with 100,000 merchants to offer payment solutions to users across Europe and North America. Klarna has 2,000 employees and is active in 14 countries.

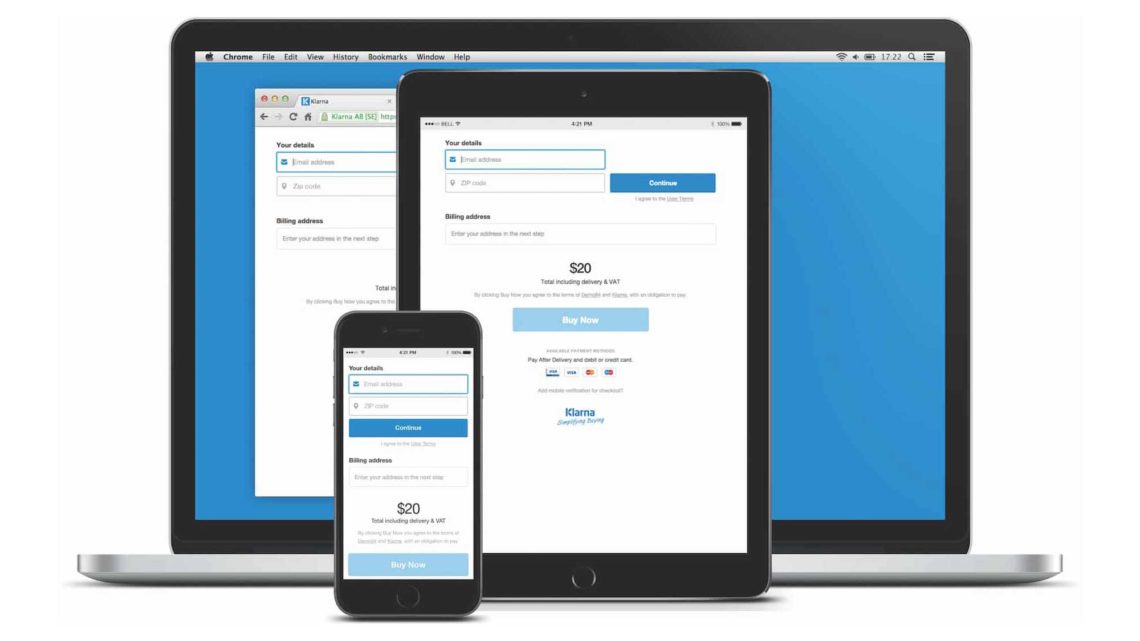

PayBright is a Canadian consumer lender and payments platform focused on instant point-of-sale financing for both e-commerce and in-store transactions. PayBright was the first company to launch instant financing for e-commerce purchases in Canada. Headquartered in Toronto, PayBright is partnered with over 4,000 merchants across all 10 provinces of Canada. Using PayBright’s platform, merchants can have their customers approved for affordable monthly payments on-location or online using desktop, tablet, or smartphone interfaces. PayBright has approved over $600 million in consumer credit since inception and is funded by leading Canadian investors and financial institutions.