For the first time since its inception, the FCA has issued a license for the provision of a digital debt advice solution.

Tully is a fintech start-up created to improve financial capability, make it easier for people to manage their money and repay their debts faster.

The timing of the license couldn’t be more appropriate as the average adult now owes £30,965 with around 75% of all UK citizens facing some form of debt and 50% experiencing stress symptoms and the accompanying physical and mental health impacts as a direct result. Compounding this is a growing capacity issue in the current debt advice sector.

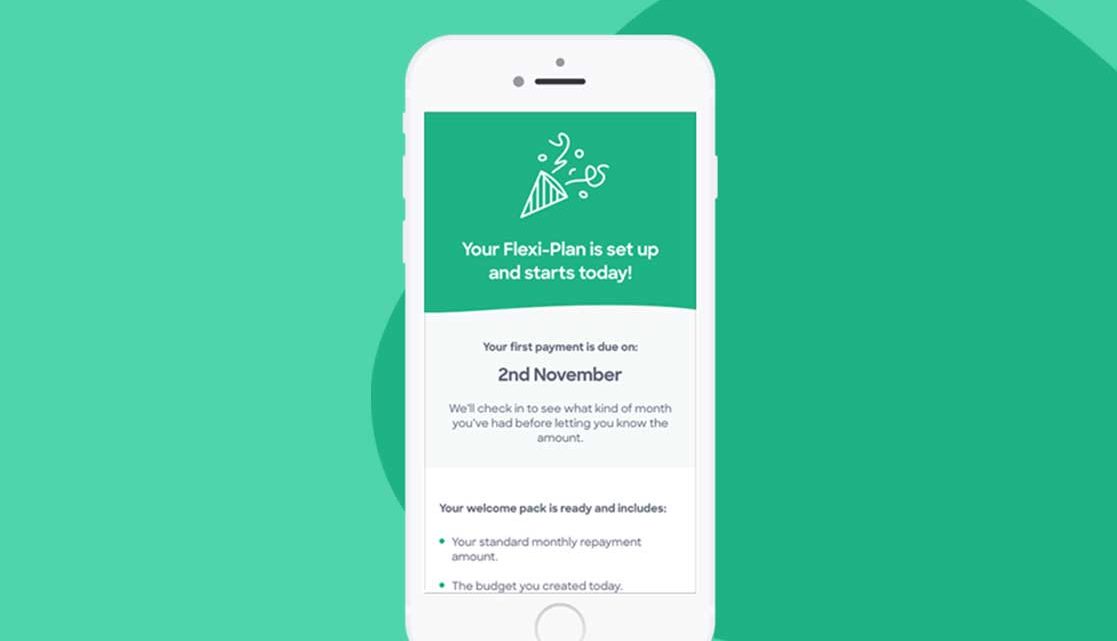

Tully’s mission is to improve financial capability and make financial support more accessible. Helping people gain a better understanding of their current financial situation, working with them to take control of their money and then building a plan to repay their debts. Built on an Open Banking platform provided by technology business OpenWrks, Tully is aiming to create an ecosystem that changes how people think about, understand and manage their money and debts.

Tully will increase capacity in the debt advice sector with its unique and free to consumer online service. Using new Open Banking technology Tully will give people a fast, accurate and realistic picture of their financial position in minutes. It means for the first time people will be able to build their own, personal view of their finances and then keep this updated every month.

Stuart Bungay, CEO & Co-founder of Tully, commented:

“Our focus at Tully is to help people regain control of their money and move towards a more stable financial future. Receiving our FCA license is a huge milestone in allowing us to make that a reality.

“Since day one the FCA have been overwhelmingly supportive of our vision and understand the desperate need for the type of technology-driven solution we’re creating with Tully. Demand for debt advice continues to grow and we believe digital channels have a key role to play in helping improve access to the debt advice and financial support millions of people need today.

“We already have a wide range of large corporate clients ready to start helping improve the financial lives of their own customers through Tully. Being granted our FCA license means we can start rolling out these partnerships in the coming months and begin delivering meaningful support to their millions of customers.”

The leadership team at Tully have over 100 years of combined experience working within the credit and debt industry and have come together with the shared view that current solutions to financial difficulty fall short of consumers’ requirements. The Tully team will begin rolling out services to users through a number of high-profile partners across banking, energy and local government throughout 2019.