Albaraka Turk announced its 2024 Non-Consolidated Financial Results on the Public Disclosure Platform (KAP).

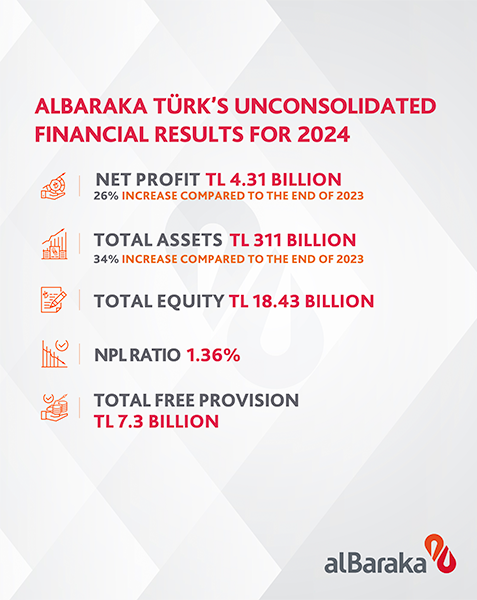

Turkey’s leading participation bank Albaraka Turk’s non-consolidated net profit in 2024 increased by 26% compared to the previous year and reached 4.3 billion TL.

Support to Real Economy Continues, Cash Loans Reached 148 Billion TL

Prioritizing high asset quality, Albaraka Turk’s asset size increased by 34% compared to the previous year and reached 311 billion TL in 2024. The Bank’s cash loans increased by 36% in the same period and reached 148.5 billion TL. The Bank’s non-performing receivables (NPL) ratio decreased to 1.36%, and the special provision ratio was realized as 88%, above the banking and participation banking sector.

By the end of 2024, the funds collected by the Bank through private current and participation accounts reached TL 205 billion, while the ratio of private current accounts to funds collected reached 50%, exceeding the average of the banking sector and the participation banking sector. Funds collected through participation funds account for 66% of the Bank’s total liabilities. Acting with the goal of sustainable profitability, Albaraka Turk maintained its balanced growth momentum and high asset quality in 2024 and continued to increase its profit generation capacity. In 2024, the Bank increased its free provisions by TL 2.1 billion to TL 7.3 billion. Albaraka Turk’s total shareholders’ equity increased by 38% year-on-year to TL 18.4 billion.

‘We will continue to operate successfully by maintaining the balance between growth and profitability.’

Commenting on the financial results, Malek Temsah, General Manager and Member of the Board of Directors of Albaraka Turk, emphasised that Albaraka Turk maintained its profitability growth above the sector average and increased its total profit by 26% to TL 4.3 billion, while its return on average equity was 27.1%. Temsah stated that Albaraka Turk continued its prudent provisioning policy by increasing its total free provisions to TL 7.3 billion, of which TL 2.1 billion will be set aside in 2024. Drawing attention to the balance between sustainable growth and profitability, Temsah emphasised that the Bank reduced its non-performing loan ratio from 1.65% at the end of 2023 to 1.36%, while keeping its provision ratio close to 90% and above the sector average. Emphasising the importance Albaraka Turk attaches to its capital, Temsah said, ‘We have strengthened our capital structure and increased our ability to allocate funds with the subordinated loan of USD 120 million we realised in 2024. In addition, as the bank that has allocated the highest level of free provisions compared to the sector, we see our free provisions as a capital buffer. In an environment where inflation accounting is no longer on the agenda and we have announced strong financial results despite the monetary tightening, we are evaluating alternatives to use the high levels of free reserves we have set aside to further increase our capital capacity and strengthen our support to the real sector.’

Malek Temsah said, ‘As the first participation bank in Turkey and the only one listed on Borsa Istanbul, Albaraka Turk acts with the vision of a sustainable future. In addition to compliance with international sustainability standards, we closely follow national legislation and make the necessary preparations. In this context, Albaraka Turk, within the framework of sustainable finance principles, determined the criteria for project financing in line with the United Nations Sustainable Development Goals (SDGs) and published the Sustainability Finance Framework Document.’