Fintech, Finance, Technology, Banking Highlights – 27 March 2018

Money App Yolt Announces Collaboration With Challenger Bank Monzo

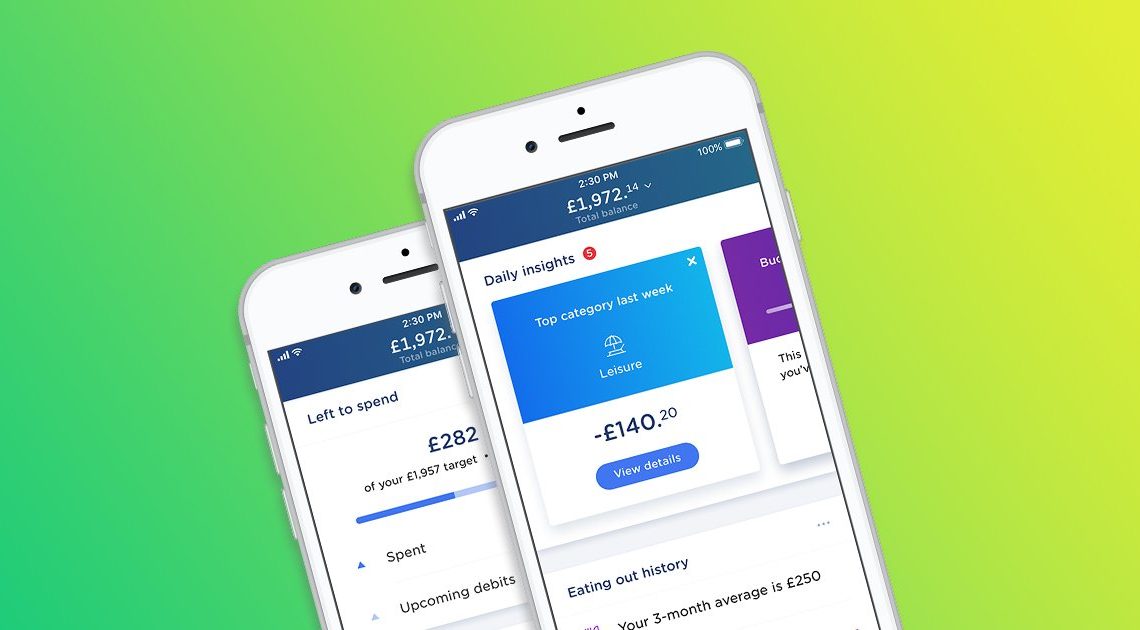

Yolt, the smart thinking money app owned by ING, has integrated with the UK’s biggest challenger bank, Monzo. Yolt users can now view their Monzo current account details and transactions alongside their other accounts and cards, all in one place.

Yolt continues to expand its integrations, following the official launch of Open Banking on 13th January 2018. This latest integration allows Monzo customers to track their spending across all their accounts in one, smart app. Users will be able to easily compare financial products and have more insight and control over their money.

Monzo launched in February 2015 and received its full banking licence in April 2017. To date, the popular digital bank has more than 500,000 customers, who have already spent over £1 billion with their Monzo cards.

With today’s announcement, Monzo becomes the 30th bank, and second mobile only bank, to connect with Yolt. This follows an integration with Starling Bank at the end of last year and partnerships with energy comparison platform, Runpath, and international money exchange FinTech, Moneytis.

Frank Jan Risseeuw, CEO, Yolt, said: “Both Yolt and Monzo communities have been very vocal in asking for this integration and with over 1500 requests, we are extremely excited to be able to announce the launch. This integration is a great example of how using the principles of Open Banking can give consumers more choice and freedom with their money. Through this integration with Monzo, we will help more people to unthink money, enabling them to enjoy life more.

Everledger nets $10.4 mln Series A

Everledger, the leader in real-world applications of emerging technology, today announced the successful closing of US$10.4 million in its Series A investment round.

Toronto-based investment banking firm GMP Securities co-ordinated the round with lead investor, the Canadian arm of Fidelity Investments. The round attracted broad participation including Singapore-based Vickers Ventures Partners as well as US-based Graphene Venture Capital, who will join existing investors including FPV, Fenbushi, Bloomberg Beta and Rakuten. Fidelity Investments and GMP Securities together raised US$8.3 million (approx. C$11 million) of equity, with GMP Securities given an option to purchase additional units in an amount equal to 6% of the investment (exercisable in whole or in part) secured at any time up to two years from the closing date.

Everledger’s legal counsel Proskauer (London) executed the round well after a deliberate selection of hybrid funding balanced with private equity as well as venture capital.

Everledger Founder & CEO Leanne Kemp said, “Everledger started with the purpose of building trust amongst stakeholders in global markets. Having this round of financing supported by strong and credible investors is testament to our success to date in achieving that purpose, taking us from a startup to a scaleup in just three years.”

“We are confident that having the support of such high calibre investors with a solid track record of accelerating growth, will enable further growth and success in our plans for entry to new markets where provenance matters.”

Equistone to acquire multi-channel cross-border payments provider Small World

Equistone Partners Europe (“Equistone”), one of Europe’s leading mid-market private equity investors, announces that it has signed an agreement to acquire a majority stake in Small World Financial Services (“Small World” or “the Company”), a leading international, UK-headquartered, multi-channel, cross-border payment service provider.

Small World’s investors, including FPE Capital and MMC Ventures, will sell their shareholdings in the Company as part of the transaction, with management reinvesting for a minority stake. The financial terms of the deal are undisclosed and, as Small World is regulated in multiple countries, completion of the transaction remains subject to regulatory approvals.

Small World’s technology-driven platform allows customers to make cross-border payments via its physical network of over 6,000 third-party send-side agents and 80 branches. Small World’s high-growth digital channels, through both app and web, provide choice and convenience to its three million active customers. Since being founded by CEO Nick Day in 2005, Small World has assembled an extensive proprietary international payments infrastructure, providing customers with access to cash collection through a worldwide banking network, fast direct-to-account payments, and loading of mobile wallets. The Company places strong emphasis upon regulatory compliance, relationships with partner banks, and innovative technology to provide a fast, reliable, and good value service to its customers. With millions of customers worldwide, Small World currently employs c.680 people across 16 countries and generates revenues in excess of £110m.