Fintech, Finance, Technology, Banking Highlights – 26 October 2018

Wealthify announces in-app integration with Yolt: a smart, simple way to view your investments

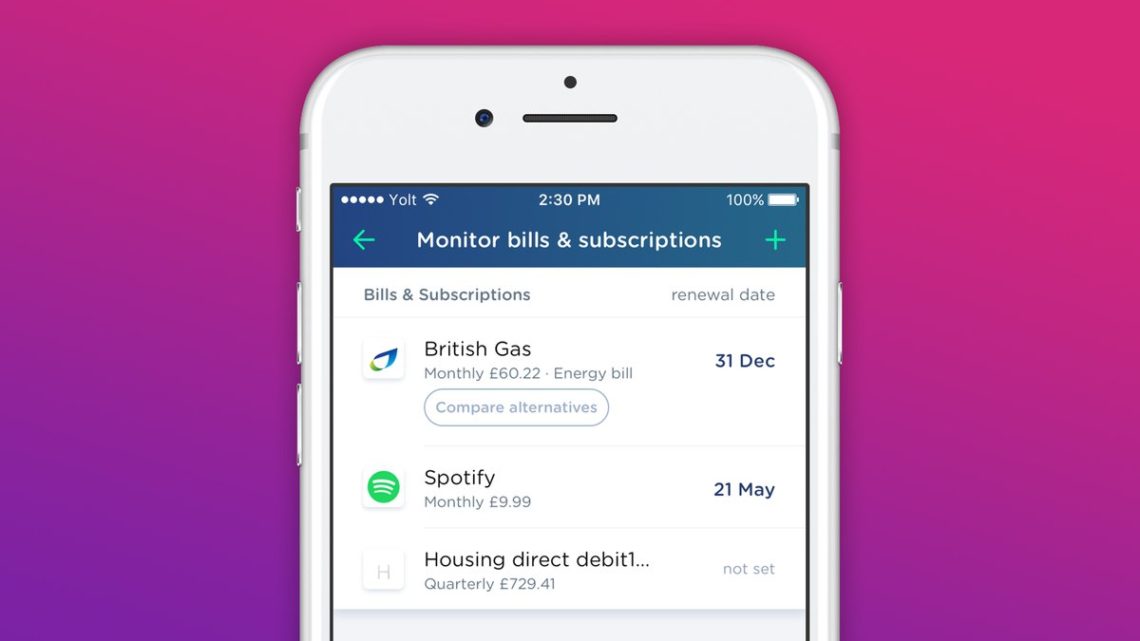

Yolt, the smart thinking money app, has announced it has connected with its first investment partner – Wealthify.

The joint in-app integration will enable Wealthify customers to view their investments within the Yolt money app, creating a new era of empowerment for consumers and enabling users to have one holistic overview of their money in one smart place. Yolt has become the first money app in the UK to show users’ live investments alongside other financial accounts including their bank account, credit card and savings accounts and even pensions.

Wealthify shares Yolt’s mission to empower users to take control of their finances. Both companies want to challenge the way people think about money and help users to make smarter financial decisions in a simple and straightforward way.

The announcement follows Yolt’s most recent news of reaching over 500,000 registered users as it furthers its vision to become the only money app users need. Building on the Open Banking ecosystem, Yolt wants to provide users with the ability to do more with their money across a variety of areas, including utilities & bills, financial products and leisure & experience. This latest announcement follows recent partnerships with pensions consolidation tool, PensionBee, home insurance platform, Homelyfe and life insurance adviser, Anorak.

Frank Jan Risseeuw, CEO, Yolt, comments: ” We’re delighted to announce our integration with Wealthify, offering our users an exciting option to view their investments alongside their other financial accounts and working towards our vision of becoming the only money app you need. We are excited to welcome our first investment partner to the app, providing users with seamless access to an investment tool and look forward to working closely with Wealthify and our other partners to encourage a greater number of people to unthink money and empower them to do more with it.”

Michelle Pearce-Burke, Co-Founder & CIO, Wealthify comments: “App-based, Open Banking architecture is one of the most significant and exciting developments in retail banking in the past 10 years and promises to bring transformational changes to the way people manage their finances day to day over the next decade.

Wahed Invest Raises Additional £6M as International Expansion Accelerates

Wahed Invest, the UK’s first halal online investment platform, has raised an additional £6m this year from existing investors to expand the reach of its global savings solution.

The online investment platform received the funding from existing investors, Boston based Cue Ball Capital, and BECO Capital, a Middle Eastern Venture Capital fund known for backing a variety of regional start-ups. This brings its total funding to nearly £12m since inception and has raised Wahed Invest’s valuation to over £75m.

Wahed, which first launched in the US in 2017 and expanded to the UK in August 2018, revolutionised the industry with the first-ever halal digital investment platform, allowing savers from all income brackets to invest in a globally diversified portfolio of ethically responsible stocks, Sukuk and gold with as little as £100 minimum investment.

Founder and CEO Junaid Wahedna, commented; “After gaining positive traction in the US and UK, we are excited to be able to carry this momentum into the rest of the world through our international expansion. Wahed aspires to provide a non-lending based savings solution to over 1.5 billion Muslims worldwide and to play a lead role in fostering innovation in the growing Islamic Finance sector.”

Wahed is also in the process of registering for the E-Money License with the FCA. The platform will offer a practical solution to the millions of Muslims who do not wish to deposit their money with traditional banks. Currently, existing Islamic banks still function as lending institutions by using Shariah compliant lending structures. Wahedna said, “Our survey results show that 84% of respondents do not trust existing Islamic Banks as being truly Islamic. We want to offer a pure investment-based savings solution with no lending components.”

Following a successful launch in the US and UK, Wahed plans on launching in the Gulf Corporation Council (GCC) and ASEAN markets, which have a young and rapidly growing demographic of Muslim consumers. According to Accenture, only 1 percent of the $50bn investment in Fintech since 2010 has been in the MENA region.

Tinkoff releases mobile mortgage app

Tinkoff Bank announces the launch of an Android-based Tinkoff Mortgage mobile application for its mortgage customers and partners.

Until now, Tinkoff Mortgage was only accessible via Tinkoff.ru. Now borrowers have the ability to use the mobile app installed on their smartphones to apply for a mortgage, while partners of the service (real estate agents, brokers and property developers) can submit a mortgage application on behalf of their customers and find the best mortgage options with the help of a mortgage calculator. Tinkoff Bank will reward Tinkoff Mortgage partners for each deal.

All mortgage-related processes have been made faster and more user-friendly. To log in, users (either customers or partners) can sign in with a fingerprint. Their passport and other documents can be photographed with a smartphone camera and uploaded to their user account – no details need to be entered manually. The mobile account is automatically synced with the Tinkoff Mortgage website.

To apply for a mortgage with the free-to-use Tinkoff Mortgage service, users (either borrowers or real estate agents) are required to complete a form on the website or in the Android-based mobile application. Then the system suggests which documents – a passport, an employment record or a 2-NDFL earnings certificate – should be uploaded.

Potential Tinkoff Mortgage customers (borrowers) can apply for or refinance a mortgage, track their application, upload documents, provide their real estate agent with access to their account or restrict access.

“Launching the Tinkoff Mortgage mobile application is the next logical step in the development of the Tinkoff Mortgage platform with about 1 million users and nearly 28,000 partners. Now, you can have your mortgage application approved not only when sitting at your computer, but virtually anywhere – even while commuting or waiting in line at the supermarket. All mortgage-related headaches can be completely sorted out by Tinkoff Bank and real estate agents, registered to use the mobile application. All documents are issued online, so that the customer must visit our partner bank just once to sign the contract and close the deal,” says Alexander Emeshev, Vice-President, New Products Development at Tinkoff Bank.