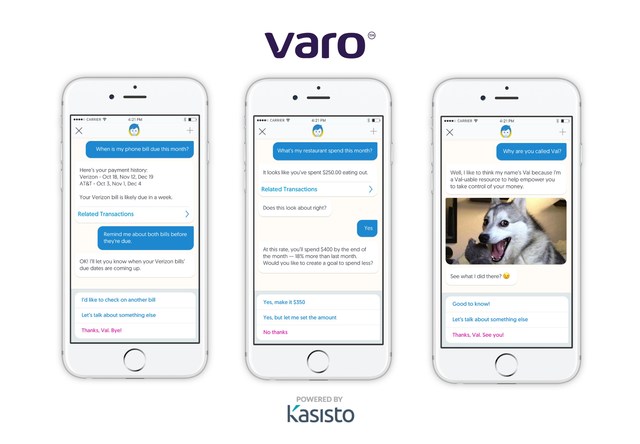

Kasisto, a company that aims to transform consumer banking with conversational AI, and Varo Money, Inc. (“Varo”), a mobile-only banking start-up that will help consumers gain greater control of their financial lives, today announced a partnership whereby Kasisto’s KAI Banking platform will power “Val,” the new smart bot inside Varo’s mobile app. The Varo Money app and smart bot, Val, are currently in beta and will launch in early 2017.

Varo is an intelligent mobile banking app providing an integrated deposit account with a debit card, savings and lending products. The startup is dedicated to improving consumers’ financial health by encouraging positive spending, savings and borrowing habits. By integrating KAI Banking from Kasisto, Varo will give its customers personalized insights and recommendations via a 24/7 digital money coach in the form of a conversational smart bot named Val.

According to a report from Greylock Partners, 85 million millennials are coming of age as the largest generation, 67 percent of which rely on mobile banking and check their phones 45 times per day. Varo’s mobile banking platform is meeting those consumers where they already spend so much time, and its bot Val is aimed squarely at improving customers’ financial health. Fortune reports that 63 percent of Americans may not have enough money in savings to cover an unexpected expense of approximately $1,000, and two-thirds of Americans cannot pass a basic financial literacy test. Traditional banking practices do not offer customers financial education, whereas Val will provide 24/7 expert guidance in the privacy and convenience of a mobile app.

Kasisto’s conversational AI platform enables Val to engage in ways that are contextual, predictive and personal. The platform includes decades of AI research and is trained on thousands of banking intents and millions of banking sentences. It’s fluent in banking — from big picture trends to the minute details — so human-like conversations between a customer and a bank can encompass accounts, transactions, payments, budgets and goals. With permission, customized bots can take action on behalf of the customer.

“At Kasisto, we’re reimagining and reinventing how banking is done,” Kasisto CEO and Co-Founder Zor Gorelov said. “When we met the Varo team, we understood immediately that they share the same vision for the future of banking — one with financial decisions woven into everyday life so people can make smart decisions in the moment. We believe Varo is creating one of the first truly intelligent digital banking experiences and we’re happy to fuel the intelligent conversations between their customers and Val.”

“The common thread here is ’empowerment.’ We are transforming banking to improve the financial lives for a generation of consumers often overlooked by traditional banks,” said Varo CEO and Co-Founder Colin Walsh. “Kasisto had exactly what we were looking for in a partner — a trusted AI portfolio with deep banking know-how combined with the agility of a startup. Together, we’re creating a digital money coach that’s intuitive, personalized and simple to use – just a text away 24/7. We’re excited to be on the forefront empowering people in partnership with Kasisto.”

Roger Van Duinen, Varo Co-Founder, said, “We are excited to see thousands of people signing up for early access to our app. Our early users will continue to be incredibly important in helping us design the best set of features to offer our customers when we launch the product next year.”

Consumers can sign up for early access to the Varo Money app and smart bot, Val, on the Varo website. Earlier this year, Varo partnered with The Bancorp Bank to provide private label banking services to support Varo mobile checking and savings account products. Varo has also partnered with Galileo Processing, Inc. to provide payment and transaction processing services, Socure, Inc. for digital identity verification services, and Cachet Financial Solutions Inc. for mobile check deposit.