Klarna launches “Wavy” Peer-to-Peer Payment Service

Klarna Bank AB (publ) is delighted to announce the release of our new free of charge peer-to-peer (P2P) payment service ‘Wavy’, which enables people to send and request money in a secure, fast and easy way.

Wavy enables consumers across 31 European markets to smoothly transfer money (Euros) and split bills amongst friends, colleagues and family members. Consumers can connect their bank accounts or credit cards to Wavy and simply generate a payment link when they want to initiate a transfer. This link can be shared via existing social media channels or directly to a Wavy user. The recipient of the payment does not have to sign up to Wavy to redeem a payment, they can receive it through a bank account. Payment requests can be paid using EU issued credit cards or SOFORT Überweisung and are settled in real-time. Wavy uses 3D animated stickers to illustrate the payment purpose e.g. for last night’s pizza or for shared household expenses.

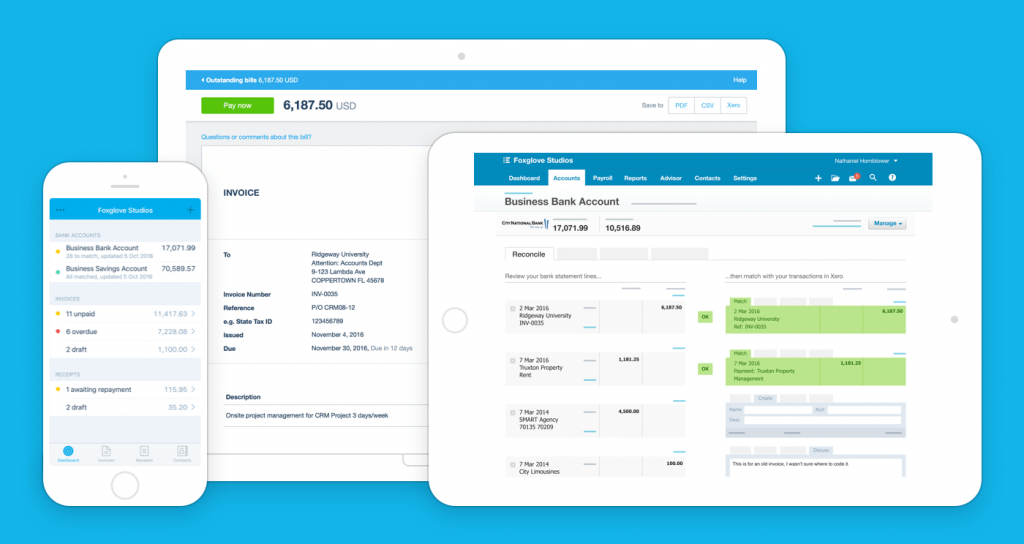

Xero partners with Stripe to help small businesses get paid faster

Xero and Stripe have partnered to help small business owners get paid faster, today announcing an expanded online payment solution with automated reconciliation.

The seamless integration gives Xero’s more than one million subscribers greater choice of payment services, more cash flow control and enhanced efficiency through automation.

The Stripe reconciliation functionality means when a Stripe payout comes in through your bank feed, Xero will do the matching work for you. All the transactions in Xero are tied to the Stripe statement line and will be automatically matched against it so you can reconcile them with just one click.

Telindus joins Ripple network

Telindus is proud to announce its integration into the Ripple network consisting of many distributed servers, called Trusted Validator Nodes, which accept and process transactions.

This way, a worldwide shared ledger – called XRP Ledger – is implemented, facilitating cross-border settlement for Financial Institutions with XRP as the native digital asset.

Client applications sign and send transactions to the Ripple network for processing. Examples of client applications include mobile and web wallets, gateways to financial institutions, and electronic trading platforms.

xPressTap Launches Tap2App, Turns Smart Phones into Payment Terminals to Eliminate Payment Hardware and Card Readers

xPressTap Inc., today announced the launch of its “Tap2App” merchant payment solution and pilot program. With Tap2App, micro-retailers and small business owners can use their smartphones to accept card payments from consumers without the hassle of attaching a dongle or a portable card reader. xPressTap’s patented technology turns any NFC-enabled smartphone or pad into a virtual card reader and can reduce merchant fees by as much as 25 percent.

The revolutionary Tap2App technology has proprietary payment terminal functionality and chip card (EMV) reading capability that resides in the app, which eliminates the need for separate card readers or mobile Point-of-Sale (mPOS) devices. The company is on a mission to eliminate the cost and burden of hardware and dongles from the payments process for sellers of all shapes and sizes including micro-merchants such as contractors, food trucks, pop-up shops, charities, outdoor event hosts, self-employed service providers and a variety of on-the-go sellers.

FINSYNC and Worldpay US Team up to Help Businesses Improve Their Operations

FINSYNC, a fully-integrated accounting and payroll platform, and Worldpay US, a global leader in payments processing technology and solutions, are teaming up to speed up the approved cash flow of businesses.

Through the new collaboration, FINSYNC customers can now connect their account to Worldpay to receive fast funding on online invoice payments. Worldpay customers will also have the option to integrate their accounts to FINSYNC, allowing them to experience centralized, automated accounting, invoicing and payroll functions through FINSYNC’s cash flow management software.