Chinese Tech Giant Baidu and China Life Insurance Launching a $1 Billion Fund

China Life Insurance Group Co and Baidu Inc will form a 7 billion yuan ($1 billion) private equity fund, targeting internet and other technology investments, China Life’s listed arm said on Thursday.

The Baidu Fund Partnership will be capitalized by China Life through a special partnership, which will contribute up to 5.6 billion yuan, China Life Insurance Co Ltd said in a Hong Kong Stock Exchange statement.

Baidu, the Chinese language internet search provider, will contribute as much as 1.4 billion yuan.

Source: Reuters – https://www.reuters.com/article/us-china-fund-internet-idUSKCN1B41EX

RBC pilots AI financial insight tools

Walk the dog, make lunch, dash out the door to work, pay bills, buy groceries on the way home, binge-watch your favourite series, reset and start all over again tomorrow.

Living in the moment doesn’t leave a lot of time for planning your future, or for trying to grow any savings to finance that future. Imagine if money management and saving could be effortless, something that happened in the background while you were busy living your life?

In another first for a Canadian bank, RBC is announcing the pilot launch of two digital services based on artificial intelligence (AI) that offer actual insights about our client’s financials and a fully-automated savings solution that uses predictive technology to identify money in a client’s cash flow that can be automatically saved.

NYDFS brings in cybersecurity regulations

Financial Services Superintendent Maria T. Vullo reminds all entities covered by the DFS cybersecurity regulation, that today, August 28, 2017, is the first compliance date of New York’s first-in-the-nation cybersecurity regulation.

Beginning today, banks, insurance companies, and other financial services institutions regulated by DFS are required to have a cybersecurity program designed to protect consumers’ private data; a written policy or policies that are approved by the board or a senior officer; a Chief Information Security Officer to help protect data and systems; and controls and plans in place to help ensure the safety and soundness of New York’s financial services industry. Covered entities must also begin reporting cybersecurity events to DFS through the Department’s online cybersecurity portal. In addition, DFS recently announced that covered entities can virtually file notices of exemption, which are due within 30 days of the determination that the covered entity is exempt.

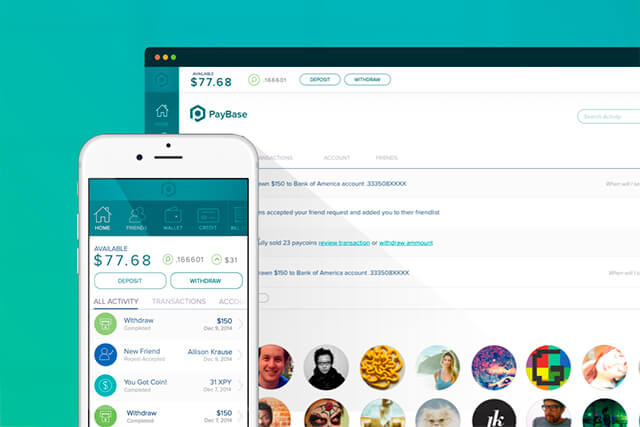

Paybase recieves £700k grant from Innovate UK

London-based FinTech startup Paybase has received a grant of almost £700,000 from Innovate UK to democratise eMoney infrastructure for SMEs and startups.

Innovate UK is the nation’s innovation agency, which aims to drive growth by working with UK companies to de-risk, enable and support innovation. In the last 10 years, Innovate UK has helped more than 7,600 organisations, with projects estimated to have added more than £11.5 billion to the UK economy and created 55,000 jobs.

Anna Tsyupko, CEO of Paybase, said: “We would like to thank Innovate UK for the grant which will go towards developing the business and perfecting our technology.”

“The electronic money (eMoney) space is competitive but we’re offering something different that will have a real impact on the SME sector. Electronic money infrastructure allows for the easy opening of eMoney accounts – lightweight financial instruments – in-app or directly on your website. This makes it perfect for escrow-like accounts, peer-to-peer-transactions and attached physical prepaid cards to name but a few applications. Essentially, it meets payment requirements that cannot simply be accommodated by a payment gateway and is the cornerstone of a lot of today’s FinTech innovation. Due to the complexity, legacy of systems and multiple partners required to create such infrastructure, however, the eMoney space is expensive, inaccessible and inflexible.”