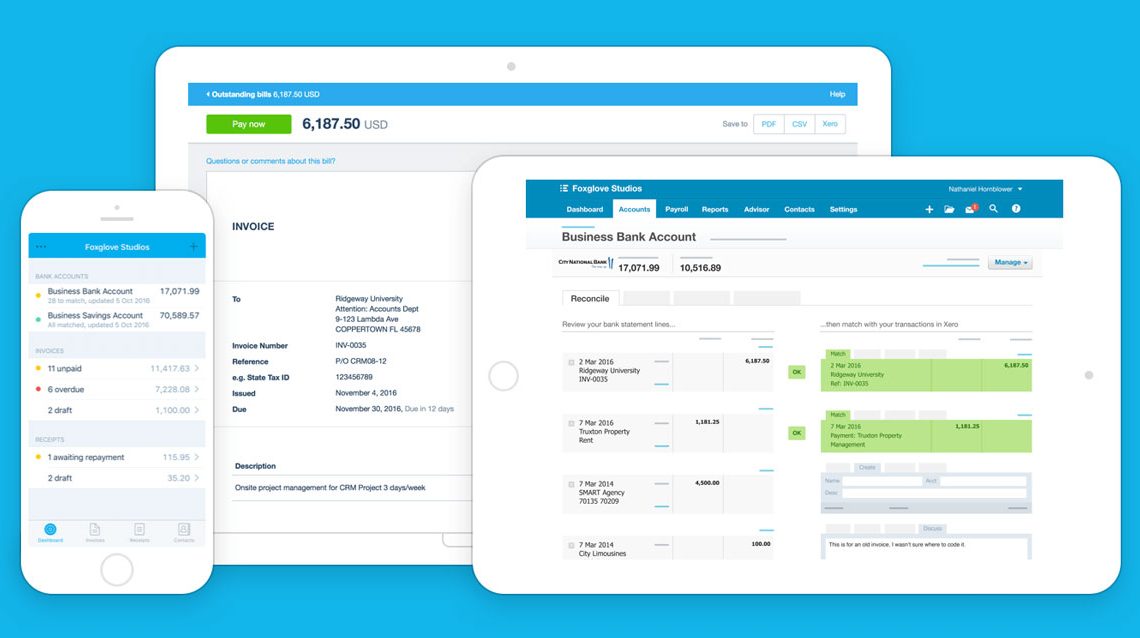

Xero and Santander announce an integrated service for SMEs

The service will provide a secure and simple solution for customers that delivers their financial data directly from their bank account into Xero free of charge.

Launching in the coming weeks, small business owners will receive the benefit of their accounting software and bank accounts communicating with each other through seamless Application Programming Interface (API) synchronisation to enhance business productivity.

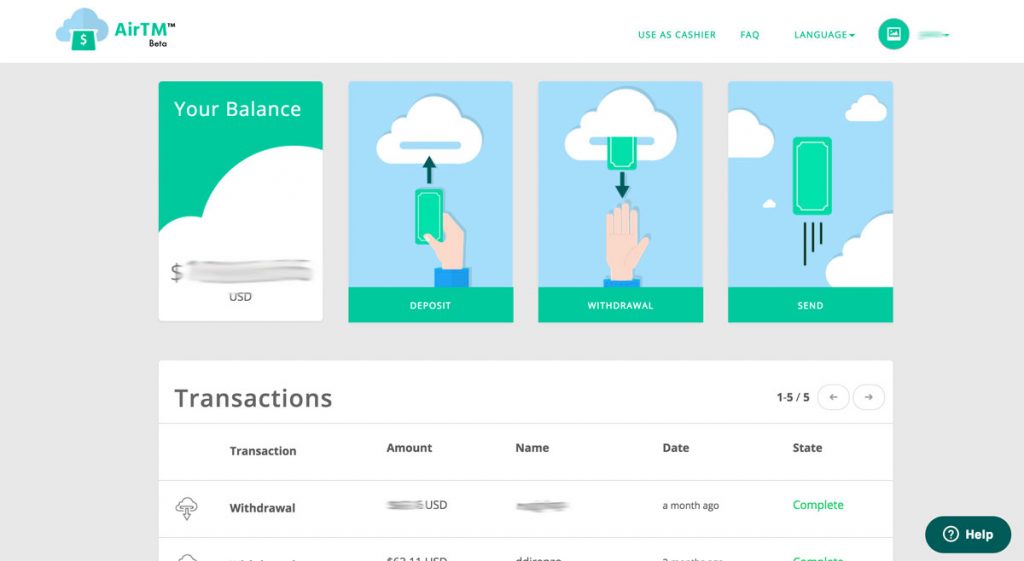

AirTM targets developing world with US dollar-denominated e-wallet

AirTM, the fintech platform that frees trapped money and offers U.S dollar-denominated cloud-based e-wallets to the developing world, has surpassed its funding goal of $1 million with fintech investment site, BnkToTheFuture, enabling it to bring its platform and services to more people who need to preserve their savings in the midst of devaluing currencies.

AirTM Founders Ruben Galindo Steckel and Antonio Garcia Aerenlund, both from Mexico City, started AirTM in 2015 with a clear mission: to help people in the developing world preserve their savings amidst hyper-inflation and free money trapped in oppressive currency regimes. They had both seen first-hand the effects of the devaluation of the Mexican Peso.

Halifax earns AbilityNet seal of approval

Halifax has become the first business to have its website and mobile app simultaneously accredited by accessibility specialists AbilityNet.

This is the first time an organisation in the UK has received the accolade across its digital platforms and is just one component of the bank’s commitment to providing accessible digital services for all its customers.

AbilityNet works with organisations to ensure their digital content is accessible by the 13 million people in the UK with a disability – those who may have sight, literacy or other needs which make it more difficult for them to access online content.

Bloomberg partners Cowen’s for Research Payment Account offering

Bloomberg and Cowen’s Westminster Research Associates announced that their respective research management technology and research payment solutions can be integrated to provide institutional investors with an end-to-end solution to help them seamlessly manage, track, and pay for eligible research under MiFID II.

Due to upcoming MiFID II regulations, some asset managers will be opting to pay for research using a Research Payment Account (RPA), which is charged to the client.

Standard Chartered invests in data management outfit Paxata

Standard Chartered has made a strategic investment and entered into a joint innovation agreement with Paxata, a leading enterprise information management company based in Redwood City, California.

This investment and the introduction of Paxata’s adaptive information platform will further accelerate the Bank’s agenda of being a digital bank with a human touch by making data more accessible and improving the way its employees use information to make better decisions.

Earthport strengthens US network with Cross River partnership

Earthport, the payment network for cross-border transactions, is pleased to announce its partnership with Cross River, a US-based bank, to provide inbound cross-border payment services across the US market, adding to its existing capabilities to process payments in the US.

Founded in 2008, Cross River is a New Jersey State Chartered FDIC-insured bank. The bank combines technology and innovation with a commitment to industry best practices in regulatory compliance and service to build fully compliant and integrated solutions for the marketplace lending and payment processing arenas.