Fintech, Finance, Technology, Banking Highlights – 21 October 2017

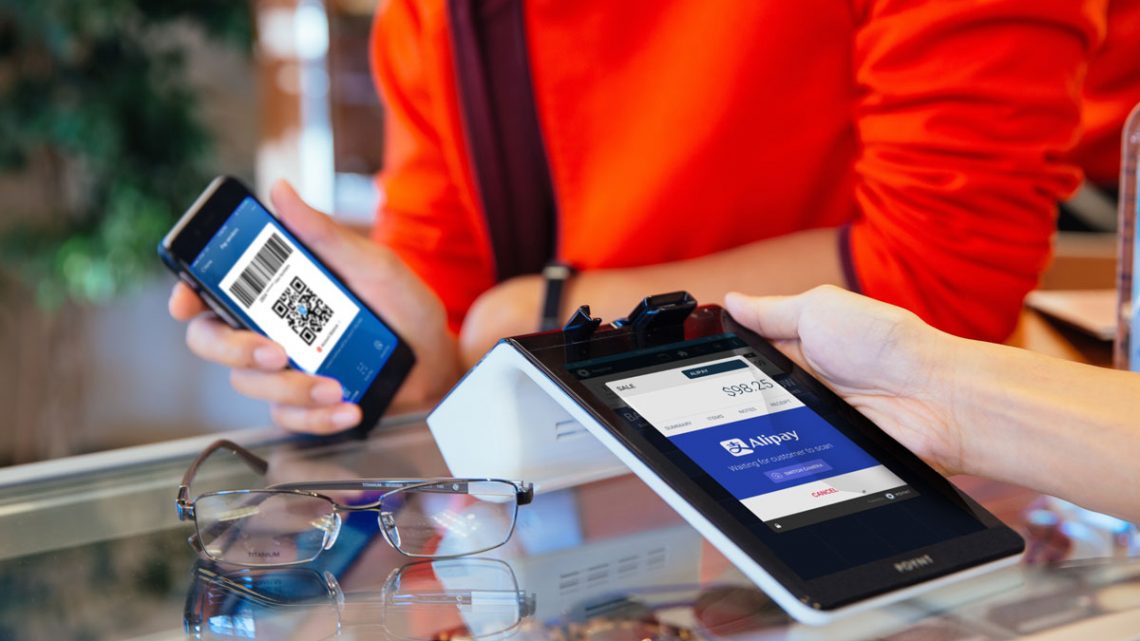

Alipay Partners with Poynt to Provide Millions of Chinese Travelers with Seamless Payment Acceptance on Smart Terminals Across North America

Alipay, one of the world’s leading digital payment platforms, has partnered with Poynt, the maker of the world’s first smart terminal, to enable Alipay’s more than 520 million registered users in China and beyond to pay with Alipay across all Poynt devices in North America.

Through the agreement, Alipay users visiting North America will enjoy a seamless, familiar checkout experience using the payment method that is most comfortable for them. Alipay is China’s leading online payment provider and the primary means of online and mobile payments for Chinese consumers.

“Given all the capabilities built into Poynt’s hardware and software, and its agnostic approach to acquirers, we will be able to deliver a truly integrated payment solution for retailers, as well as the simple payment experience our users are accustomed to,” said Mr. Souheil Badran, President, Alipay North America. “We partnered with Poynt because we both share a commitment to enabling a modern commerce experience for merchants and customers alike.”

Standard Bank joins CCRM digital trade network

Standard Bank has signed an agreement with CCRManager Pte Ltd, a global trade FinTech company, joining their global innovative electronic platform as a member bank.

“We are delighted to have joined CCRManager’s distribution platform, which offers an automated, fast and transparent platform for trade risk distribution and participation”, says Vinod Madhavan, Group Head of Trade for Standard Bank. “As the first African bank to have joined this network, this presents us with many opportunities, including being able to show African trade risk to international banks that are members of CCRM, and is aligned with our desire to connect Africa to the world.”

CCRManager is a web-based platform that enables banks to manage the entire process of distributing trade finance internationally to other banks, credit insurers, and fund managers.

Swift and VPS build closer links

SWIFT will reinforce its connectivity to Verdipapirsentralen ASA (VPS), Norway’s central securities depository (CSD), which could make a shift in transaction volume to SwiftNet from other networks.

Banks connected to VPS currently use different networks to connect to VPS, SwiftNet being one of them. The banks have the freedom to choose among the network connectivity offered by VPS. By signing the Swift CSD Community Agreement, VPS’s members benefit from SWIFT’s CSD Community Offering, which significantly reduces current level of SwiftNet costs for connectivity to VPS.

Nadine Limbourg, Senior Market Manager at SWIFT, comments: “Approximately two-thirds of transactions to the Norwegian market are foreign transactions derived from international centres, such as London. It is therefore critical for Norway to have standardised and efficient connectivity with market participants globally.”

Nakamo.to gets behind Brickblock digital asset exchange

The team behind Brickblock, a trading platform to connect real-world assets and cryptocurrencies, has partnered with the nakamo.to team in a bid to explore new levels of scalability, which will be needed to support Brickblock’s ambitious plans.

The Brickblock team has been hard at work for many months, striving to make the independant trading of real-world assets on the blockchain a possibility. Its focus has been building a foundation for the efficient, transparent trading of real-world assets such as real estate, Exchange Traded Funds (ETFs), and coin funds on the blockchain. Brickblock is on the verge of becoming the first team to conduct a real-world asset transaction on the blockchain by tokenizing a 27-unit, 1528m2 multi-storey building in Berlin.

Those in and around the crypto world are becoming aware of the challenges presented by the blockchain’s mainstream adoption. Ethereum has been the go-to platform for blockchain tokenization for a while, and its blockchain is taking on increasingly heavy traffic. The Ethereum blockchain is likely to encounter scalability issues in the near future, with 3.2 billion assets expected to be tokenized by 2020.