Fintech, Finance, Technology, Banking Highlights – 18 December 2017

Israel and Singapore fintech hubs sign MoU

The Singapore FinTech Association (SFA) and the Israeli City TLV association have inked a Memorandum of Understanding (MOU) to foster greater FinTech co-operation between the two communities.

The MOU signed between the non-profit associations aims to bridge the two FinTech ecosystems, through cross border collaboration and initiatives. Concretely, last month the leaders of the two associations took part in a joint televised conference on SMEs and an Israeli delegation attended the Singapore Fintech Festival. Further exchanges are planned to link these two hubs, which share similar profiles as leaders in technology with impeccable reputations for business services. The partnership will continue to nurture global business opportunities and allow exchange of technology and expertise between members, with the aim of developing innovation in both markets.

Mr Shmuel Ben-Tovim, President of City TLV said: “Singapore is an important partner in our global FinTech network. They set a fine example of the potential for FinTech, with natural synergies between Israel and Singapore, enforced by our shared ambition for excellence in innovation and technology and the friendly relations between the two governments.

Standard Chartered to partner Ant Financial

Standard Chartered Bank (“SCB”), a leading international banking group with a strong presence in Asia, Africa and Middle East, and Ant Financial Services Group (“Ant Financial”), one of the world’s leading digital financial services providers, today announced the signing of a Memorandum of Understanding (MOU).

Under the terms of the MOU, Standard Chartered Bank will combine its banking expertise and insights in emerging markets with Ant Financial’s industry leading TechFin capabilities, to increase access to financial services for clients based in countries along the “Belt & Road Initiative” route.

Standard Chartered Bank has been operating for more than 150 years in some of the world’s fastest growing economies, including many along the “Belt & Road Initiative” route. With around 1,000 branches and outlets in 65 countries and regions, 69% of its global footprint overlaps with the “Belt & Road” countries. The bank is an industry leader in RMB, SME and Retail financial services, and has been supporting Chinese companies to expand their operations globally with innovative financial products and services.

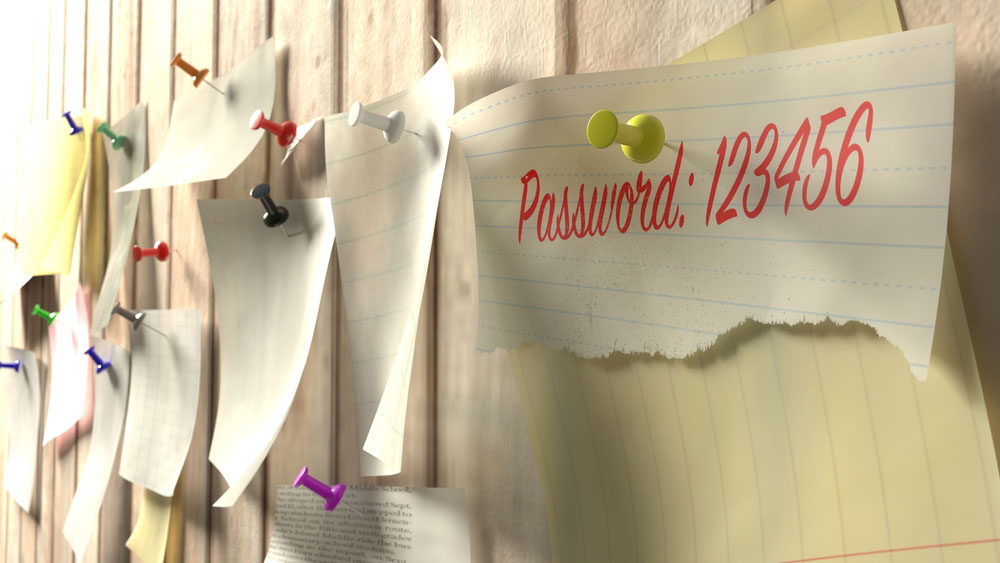

Consumers ready to say goodbye to passwords – Visa survey

A new Visa survey of 1,000 Americans exploring awareness and perceptions of biometric authentication confirms that consumers continue to have a strong interest in new biometric technologies that make their lives easier.

New forms of authentication, such as fingerprint, facial, and voice recognition, can make unlocking accounts and payments much easier and more convenient than traditional passwords or PINs – which are difficult to type onto tiny keyboards, easy to forget, and can be stolen.

“For financial institutions, the time has never been better to integrate biometric technology into banking apps and payments experiences for customers,” said Mark Nelsen, senior vice president of risk and authentication products, Visa. “Visa is investing in the best ways to add these emerging technologies to our portfolio of products and services. Advances in mobile device features are increasing the accuracy and speed of biometrics, such that they can be used for financial transactions. At the same time, consumers are widely familiar and comfortable with using biometrics for more than just unlocking their phones.”

Citi and CME Group roll out Baton Systems distributed ledger platform

Citi and CME Clearing have implemented a real-time distributed ledger platform developed by Baton Systems, a payments technology provider.

The solution allows a bank to view the collateral in its ledgers in real time, send cash or securities with one click to a clearing house, and receive an immediate acknowledgment, regardless of the current technologies they are deploying.

The blockchain-inspired software could materially reduce the cost of back-office operations and speed up margin funding times. Currently, banks have to set aside capital as they wait for collateral to be settled; this platform could potentially free up billions of dollars in capital if trade times can be reduced from days to seconds.

“This technology allows us to eliminate manual touch points, reduce email traffic, and avoid logging into multiple portals,” said Stephen Marx, Head of Futures, Clearing, and Collateral Operations at Citi. “The capabilities in the funding and collateral space create efficiency and improve productivity for our clients.”