Fintech, Finance, Technology, Banking Highlights – 18 January 2018

Visa makes signature optional for EMV merchants in North America

To continue the ongoing migration to EMV chip, and to bring increased security and convenience to the point of sale, Visa is making the signature requirement optional for all EMV contact or contactless chip-enabled merchants in North America, beginning April 2018.

Simultaneously, Visa continues to invest in emerging capabilities that leverage advanced analytics and biometrics to define the future of payments security.

“Visa is committed to delivering secure, fast and convenient payments at the point of sale,” said Dan Sanford, vice president, consumer products, Visa. “Our focus is on continually evolving the market towards dynamic authentication methods such as EMV chip, as well as investing in emerging capabilities that leverage advanced analytics and biometrics. We believe making the signature requirement optional for EMV chip-enabled merchants is the responsible next step to enhance security and convenience at the point of sale.”

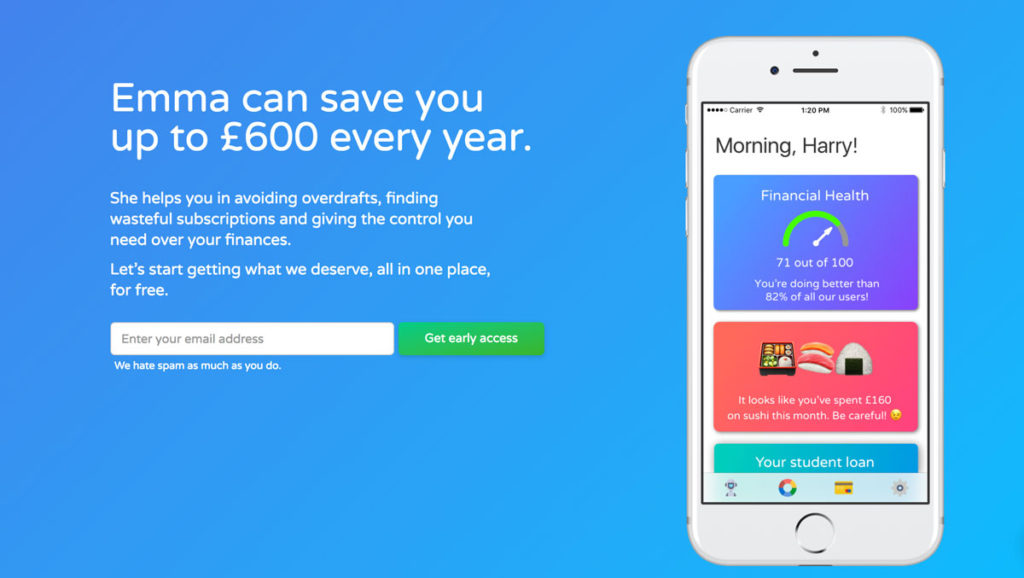

Emma receives FCA approval under the Payment Services Regulations 2017

London-based Emma Technologies LTD has been approved and registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

The company reference number is 794952. After successfully launching a closed beta in early December, the company can now fully operate under the new PSD2 scheme enacted in the UK on the 13th of January.

Emma is currently building the banking app for millennials (iOS and Android), a mobile only solution that helps consumers avoid overdrafts, find and cancel subscriptions, track debt and save money. The product aims at providing a consumer focused banking experience, with the only aim to improve the financial situation of its users. The company believes anyone should have an advocate that is able to help in the daily life, no matter who they are and where they come from.

“We started developing Emma on a mission to improve people’s financial well being,” said Antonio Marino, CTO and Co-founder of Emma Technologies LTD. “We are thrilled to announce the FCA has given us full permission to achieve our goal. Further, we are happy to share we are currently working to integrate a series of challenger banks and savings solutions to further extend our offering.”

Alipay partners Blackhawk Network to expand US footprint

Blackhawk Network, a global financial technology company, and Alipay, a leading digital payment platform operated by Ant Financial Services Group, have partnered to expand Alipay’s mobile payment acceptance and engagement offerings to participating U.S. retailers.

Leveraging Blackhawk’s technology, the partnership will present an opportunity for Blackhawk’s network of retail partners to elect to engage with visiting Chinese travelers. Blackhawk intends to roll out the service in select participating retailers beginning January 2018.

“Until now, Chinese tourists lacked convenient access to information on what payment methods were accepted at U.S. retailers they wished to visit,” said Talbott Roche, CEO and president of Blackhawk. “Alipay is ubiquitous in China, and represents an effective way for retailers to engage with Chinese travelers. We are excited to offer our retail partners a way to better connect with Chinese consumers by alleviating the major pain points of shopping, researching and paying while visiting and ultimately, providing Alipay users with an excellent shopping experience while they travel here in the U.S..”