Fintech, Finance, Technology, Banking Highlights – 18 April 2018

RBC adds Samsung Pay support

Samsung Electronics Canada announced that Royal Bank of Canada (RBC) personal payment cards are now supported by Samsung Pay, the widely accepted mobile payment system that works almost anywhere you can swipe or tap a card.

This latest announcement follows the expanded Canadian availability of Samsung Pay, with RBC joining existing Samsung Pay partners including CIBC, American Express Canada, ATB Financial, Interac Debit, Mastercard, Scotiabank and Visa Canada.

This latest expansion comes as Canadians are increasingly looking to their banking and smartphone providers for fast, seamless experiences at check out. In 2016, 29% of Canadians actively used their smartphone to make mobile payments, while 74% of mobile payers state they would like to see rewards programs and mobile wallets integrated to ensure they can redeem rewards points immediately.

“We’re excited to work with RBC, a valued and longstanding partner, in delivering an exclusive, industry-leading mobile payment experience through Samsung Pay,” said Paul Brannen, COO and Executive Vice President of Samsung Electronics Canada. “Samsung Pay provides real-life benefits to Canadians, ensuring the cards they need are easily available on their smartphone.”

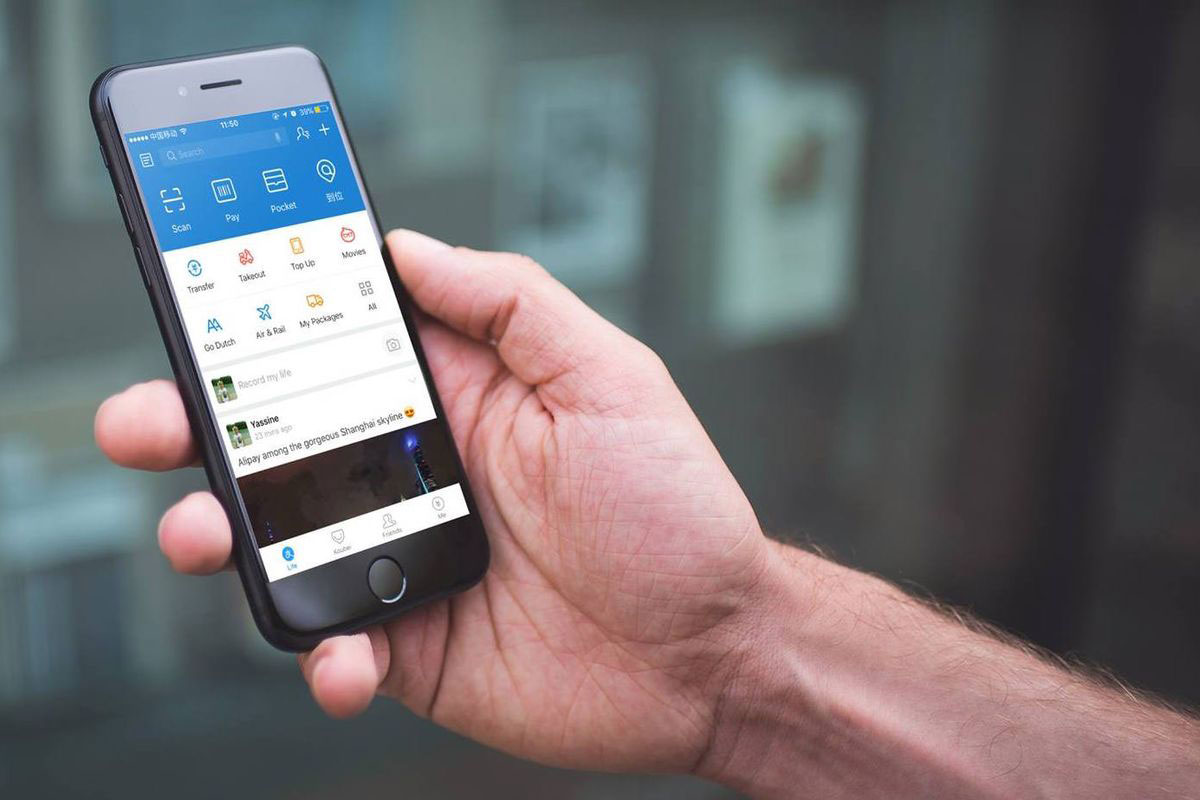

Alipay makes Italian move through Sella tie-up

Shopping with their smartphones will be increasingly possible, for more than 3 million Chinese tourists arriving each year in our country, thanks to the agreement signed between Gestpay, the Italian solution for online payment of Sella Group, and Alipay, the payment platform of Ant Financial, an affiliate company of Alibaba Group.

Made in Italy and Italy as a destination are increasingly attractive to the Chinese market, as demonstrated by recent studies realized by Nielsen for Alipay, that highlight how the budget allocated by Chinese tourists for a holiday in Europe is more than 3700 dollars, an amount often spent in luxury shops, restaurants and on Italian craftsmanship. What better way to pay than the Alipay app, installed on 99% of tourists’ smartphones and used by 63% of Chinese tourists in stores accepting this payment instrument.

Thanks to the agreement between Gestpay and Alipay, this will be easier. Users of the Alipay wallet, in fact, will be able to buy in physical and online enabled stores throughout Italy; they will also be able to make online purchases from China and around the world on e-commerce sites that use Gestpay, one of the most popular acceptance and management payment platforms in Italy by number of customers and transactions, and already used in more than 20 countries.

Lending app Tala targets India, fuelled by $65m in new financing

Tala, the leading global technology company committed to financial inclusion, will bring its popular consumer lending app to India.

The expansion was announced along with a new $50 million Series C investment led by Revolution Growth to scale up the success already in progress. Tala has also recently raised an additional $15 million to power its loan book. The round brings Tala’s total financing to more than $105 million.

Tala, which launched Kenya’s first smartphone-based lending app in 2014, has grown significantly in the last year, expanding to Tanzania, the Philippines, and Mexico. Through its mobile platform, Tala has delivered more than 6 million loans to nearly 1.3 million customers and originated more than $300 million. The popular app is currently number 3 in the Google Play Store in Kenya.

Openbank extends Temenos partnership with WealthSuite

Temenos, the banking software company, announced that Openbank, the digital bank of Santander Group, has selected Temenos’ WealthSuite for enhanced digital customer experience.

This will be integrated with Temenos T24 Core Banking, which Openbank chose last October as its new core banking solution for retail and SME banking across its global operations.

Openbank, which already has over one million customers today, will use Temenos technology to drive domestic and international expansion and support the group digital strategy. Openbank is one of the first fully fledged digital banks in the world, with its software, APIs and client transactions running in the cloud, offering a complete range of banking and investment products through its digital platform.