Fintech, Finance, Technology, Banking Highlights – 3 April 2018

Thomson Reuters Boosts Investment Portfolio Risk Analytics Capabilities on Eikon with Addition of MSCI RiskMetrics

Thomson Reuters has enhanced its investment portfolio risk management solutions on its financial flagship desktop product, Eikon, through an agreement with MSCI.

MSCI RiskMetrics is now integrated within the Eikon platform, giving investment professionals access to market-leading, multi-asset class risk analytics alongside Eikon’s capabilities for portfolio analytics, market monitoring and idea generation, powered by Thomson Reuters data and news.

These capabilities are designed to assist investment professionals using Eikon to track market movements and monitor its effect on portfolios, while aligning portfolios with investment objectives and policy statements. Portfolio managers can stress test portfolios and perform scenario analysis on-the-fly to help ensure they understand the risk to their portfolios as a result of market moves and are in compliance with their investment guidelines.

Eikon users can now construct portfolios and monitor portfolio risk, all on the Eikon platform. These capabilities are available for the most popular asset classes. A Monte Carlo simulation feature is also available as an add-on.

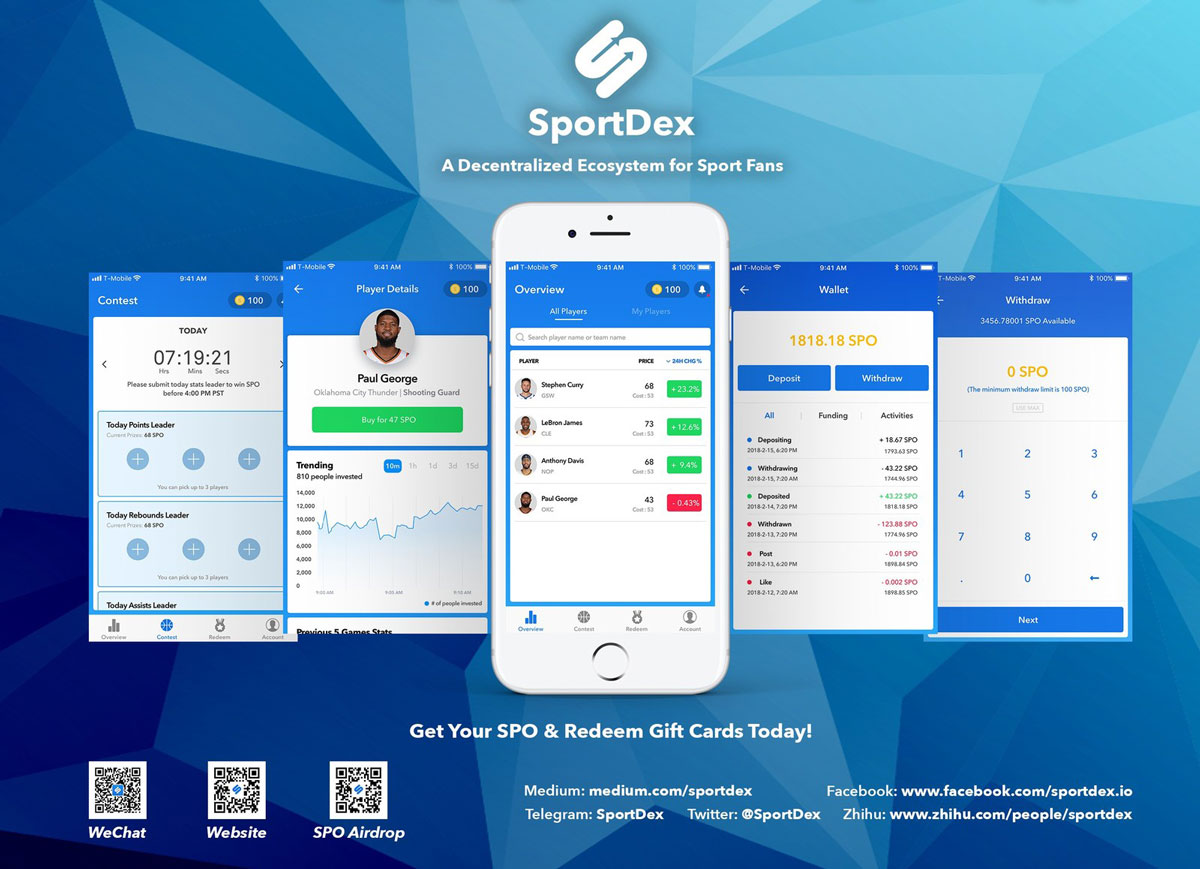

SportDex Launches Its Crypto-Based Sports App on iOS and Android

SportDex (sportdex.io), a decentralized sports ecosystem for sports fans, launched its app. SportDex is designed with four new features in this version: cryptocurrency SPO, Player Exchange, Wallet, and Contest. Remarkably, SportDex has created a unique version of its cryptocurrency-powered app, offering 20 SPO tokens for users who sign up in the next 30 days. The app is accessible through two platforms: iOS and Android.

“We are truly excited to be able to offer our newly crypto-powered products,” announced SportDex founder, Charles Chen. “SportDex always keeps the community in heart striving to build the most engaging product. We are verbally committed, and we finally landed on the market. I am very proud of our team who exerted great effort in bringing about our new product line.”

This unique edition app will specially introduce a player exchange for the first time. It delivers a player data profile exchange for fans. Users can validate their predictions of a player’s performance by buying and selling the data profile of the player. Accurate predictions will be rewarded SPO tokens.

SportDex is also embracing the new era of blockchain to incentivize the whole community. SPO, the cryptocurrency of SportDex, is designed to be used solely within the network. Users would own a crypto wallet after signing up on the platform, and they will be able to deposit or withdraw the SPO into their wallet.

Baidu Announces Pricing of Initial Public Offering of iQIYI

Baidu, Chinese language Internet search provider, announced the pricing of the initial public offering by its subsidiary iQIYI, Inc. (“iQIYI”) of 125,000,000 American Depositary Shares (“ADSs”), each representing seven Class A Ordinary Shares of iQIYI, at a price of US$18.00 per ADS for a total offering size of US$2.25 billion, assuming the underwriters do not exercise their option to purchase additional ADSs. The ADSs have been approved for listing on the NASDAQ Global Market and are expected to begin trading today under the ticker symbol “IQ.” We have subscribed for, and have been allocated by the underwriters, 8,333,333 ADSs in this offering at the initial public offering price.

The underwriters have been granted an option, exercisable within 30 days from the date of the final prospectus, to purchase up to an additional 18,750,000 ADSs.

Goldman Sachs (Asia) L.L.C., Credit Suisse (USA) LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated are acting as joint bookrunners for the offering. The co-managers of the offering are China Renaissance Securities (Hong Kong) Limited, Citigroup Global Markets Inc., and UBS Securities LLC.

iQIYI’s registration statement relating to the offering has been filed with, and declared effective by, the United States Securities and Exchange Commission. This press release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.