Fintech, Finance, Technology, Banking Highlights – 29 May 2018

Tandem hits 100,000 customers

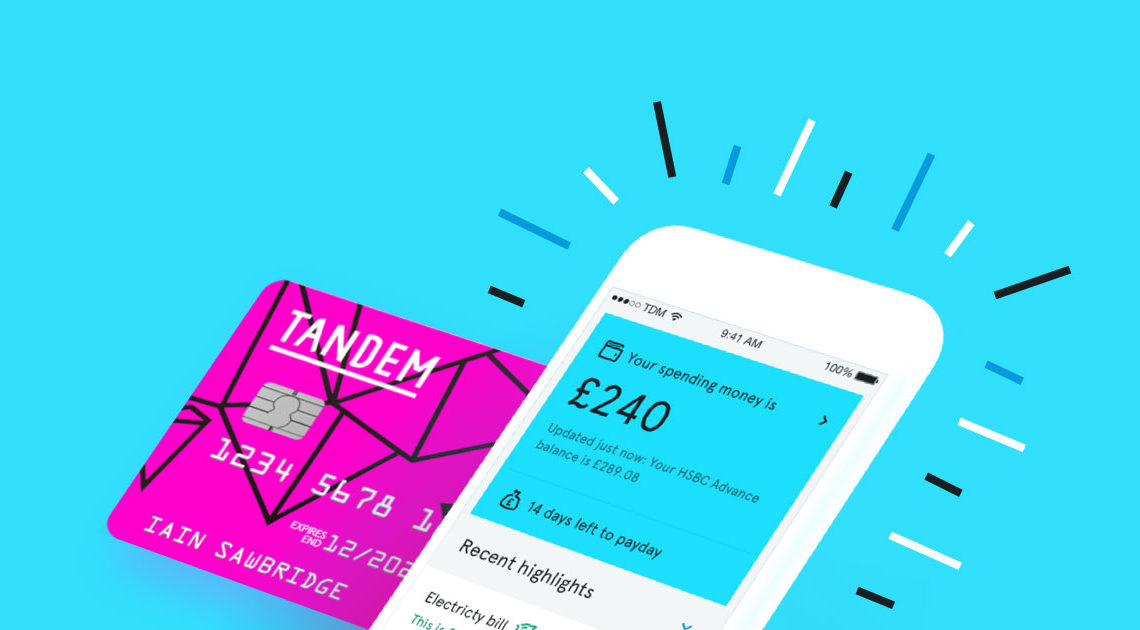

Tandem is pleased to announce that 100,000 Brits are now using the bank to spend, save, and manage their money.

It offers a competitive cashback card to the UK public. Tandem have seen tens of thousands of app downloads, product applications, and eager savers signing up. CEO Ricky Knox’s ambition is to match Lloyds Bank in terms of customer numbers in ten years time.

Tandem have moved from strength to strength after their acquisition of Harrods Bank in January this year. CEO Ricky Knox welcomed the Harrods Bank’s 7,000 global customers with open arms, inviting each individual into his office for a face to face meeting to discuss how they manage their money. Plenty took Ricky up on his offer and remain satisfied customers to this day. The purchase also brought with it a Banking license and £80 million of capital, as well as sizeable loan and mortgage books. Tandem became the UK’s leading challenger bank overnight and began helping people UK wide save, spend, and earn right away.

Before Tandem launched its first product it managed the huge groundswell of interest by placing people on a waitlist. The waitlist allowed thousands of interested customers to get early access to products and services. In February the waitlist was lifted and Tandem launched their first product, a cashback credit card, to the UK public. The card boasts a winning combination of 0.5% cashback on all purchases, no overseas transaction fees, market leading exchange rates, and real time in-app updates every time you use the card. In April savers were rewarded with a choice of three fixed saver accounts, boasting competive fixed rates for one, two, or three years. Now 100,000 happy customers are spending freely abroad, nurturing nest eggs, and managing money across all of their bank accounts. Plus, due to popular demand, another card is on the way – it’ll be worth the wait!

Ricky Knox, Tandem CEO, says, “The response to our products has been incredible. People are using the Tandem App to track their spending, taking our cashback credit card abroad, and putting their nest egg away in one of our fixed savers. With new products on the way we’re targeting major growth. There is a lot of noise surrounding the legacy banks moving into the digital only challenger market, which is great. However, we are moving at twice the pace and as a small agile organisation we are accelerating as we speak.

Plutus launches NFC-enabled app for cryptocurrency at the POS

Cryptocurrencies are steadily gaining popularity, but the real challenge remains how to convince merchants to accept them.

It’s estimated that fewer than 0.1% of the world’s stores accept Bitcoin because of the difficulties in exchanging it for legacy currencies.

Plutus is offering a revolutionary new idea which avoids the need to wait for merchant adoption altogether. Customers can top up their Plutus app with Bitcoin, Ether or even Pluton and then spend it anywhere. The unique PlutusDEX platform exchanges the crypto to sterling or euros as soon as the payment is made, and the merchant gets paid immediately without additional fees.

Danial Daychopan, Plutus CEO and founder, says, “Our system is the first that is safe for customers, easy for merchants and acceptable to banks. It’s a push-only system and purchases are verified using the Bitcoin and Ethereum blockchains, secured by the most powerful distributed computing networks in the world”.

Emirates NBD Introduces Integrated Digital Onboarding Service Enabled By Diebold Nixdorf

Emirates NBD, has partnered with Diebold Nixdorf, to soon launch Emirates NBD EasyHub, the region’s first integrated digital kiosk that will allow customers to sign up for new products and access a variety of teller services, functioning like a mini-branch that is open beyond normal banking hours and all days of the week.

Emirates NBD EasyHub offers customers a self-service banking experience aided by a video banker who will guide customers via onscreen instructions and step by step assistance. EasyHub will enable individual retail and affluent customers to open Current or Savings Accounts of their choice and instantly obtain a personalized Debit Card. Customers will also be able to conduct all routine teller services such as cash deposit and withdrawal, cheque encashment including coins, cheque deposits and internal fund transfers. Additionally, customers will also be able to carry out a variety of banking services such as updating their personal details, requesting for a cheque book or for authenticated statements and even apply for a personal loan, without having to wait at a bank counter.