Fintech, Finance, Technology, Banking Highlights – 10 August 2018

Valar Ventures leads $13M Series A round in Taxfix

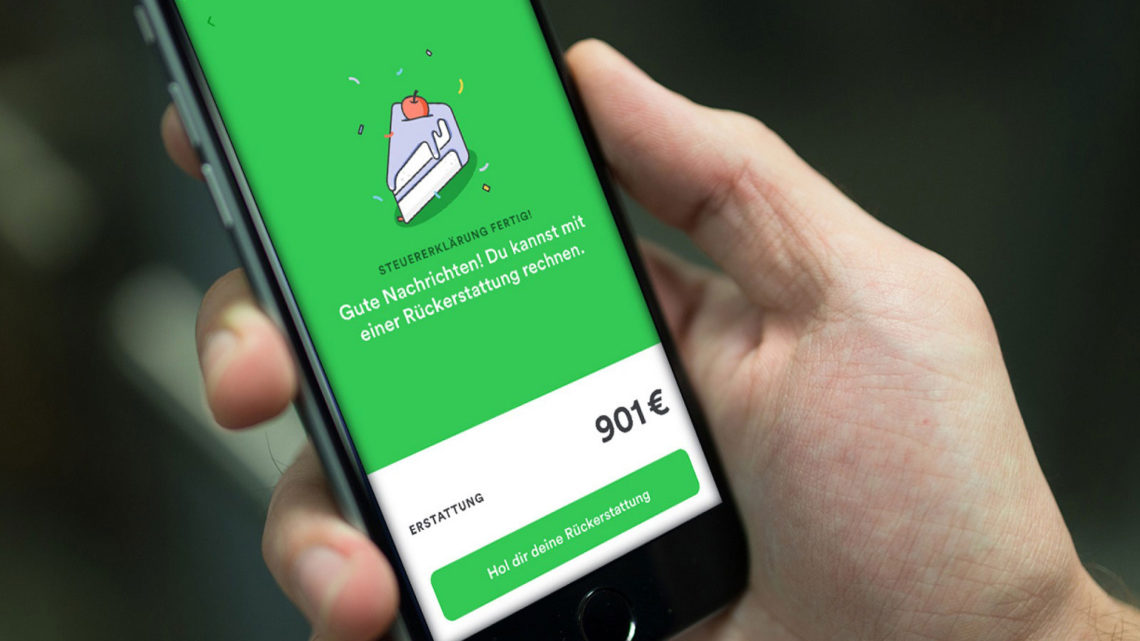

Taxfix, the first mobile assistant for tax declarations, has completed a Series A round, raising $13 Million to fuel its expansion to international markets.

Led by N26 and TransferWise investor Valar Ventures and supported by existing investors Creandum and Redalpine, this funding will not only allow Taxfix to bring its unique 20-minute tax return app to other countries, but also to invest heavily in machine learning to bring its tax engine technology to the next level.

Since entering the market in 2017, the Berlin tech startup has seen double-digit growth week over week. In less than one year, Taxfix submitted up to 800 tax returns per day to the financial authorities, claiming back tens of millions of Euros for its users.

With over 700 million tax returns filed every year, the global tax filing market is enormous. The US market accounts for over 152 million tax returns, the European market, while much larger, has only very limited tax software offerings, and practically all returns are filed with government-provided paper or digital forms. Taxfix’s mobile-first approach, paired with its adaptable tax engine technology, not only redefines the user experience but also opens a new market for younger people, who are increasingly turning away from desktop solutions to do everything on their mobile devices, from online shopping to banking and now to taxes.

Capital One inks data sharing deal with Finicity

Capital One Financial Corporation and Finicity, a provider of real-time financial data aggregation and insights, have signed a data sharing agreement that enhances access and security through Capital One’s Customer Transactions application programming interface (API).

As a result, Capital One customers can more securely share financial data with the third-party apps and services that Finicity supports in a way that is safe, secure and within the customer’s control.

“Finicity is hyper-focused on delivering the data insights our partners need to drive their services and enable their customers to make better financial decisions. This starts with superior data access, quality and intelligence,” said Finicity CEO Steve Smith. “Capital One has proven to be an excellent partner in pursuing these common goals of empowering consumers to have more access to their financial data and better manage their financial health.”

Establishing a formalized API integration with the bank allows the broader FinTech and financial services community to more securely automate needed financial account data while delivering a variety of apps and services for financial management. The result is significant time savings, added stability and greater accuracy. Capital One customers will also have increased control over how and when their data is used. This secure access to data provides the ability to have an on-demand and accurate view of their finances.

Paytm acquires smart savings startup Balance.Tech

We are excited to announce that we have acquired Bengaluru-based Smart-savings Management Startup named ‘Balance.Tech’.

We have been building some amazing user experiences, and the ‘Balance.Tech’ team has great insights and track record in building such intelligent and elegantly designed products.

Madhur Deora, Chief Financial Officer & SVP, Paytm said, “We are excited to welcome Ankit, Abhishek and the Balance.Tech team to Paytm. They have created a fantastic product with real user engagement. As we constantly look to create customised and intuitive user experiences, the Balance.Tech team will be an invaluable part of this journey.”

Ankit Kumar, CEO & Co-Founder, Balance.Tech said, “Our team has been building automated products that make the saving experience relatable and delightful by helping users reach their goals in clever little ways. Our conversational personal savings assistant nudges users to build a saving habit, and give purpose to their money as they go about their busy lives. We look forward to bring in computational intelligence, unique design and proprietary algorithms with Balance to help Paytm users accomplish more with their money.”