Led by funds from Vistara Capital Partners, Beedie Capital, and Accenture Ventures, the round will be used to expand sales and marketing growth.

Zafin, has raised $17.2 million in private growth financing led by Vistara Capital Partners, Beedie Capital, and Accenture Ventures.

The round strengthens Zafin’s balance sheet and will fuel growth and innovation for the company, which designs market leading customer centric financial services software that is relied upon by many of the world’s largest financial institutions.

“This round of funding will allow Zafin to fully execute on our business plans and strategy,” said Al Karim Somji, Zafin Founder and Group CEO. “We highly value our long-term partners at Vistara Capital and Beedie Capital and are excited to be working with Accenture as we jointly deliver value to our clients in the fields of open banking, core transformation, AI and machine learning.”

Positioning Zafin to achieve its strategic objectives, the funding will help the company execute on its plan for years to come, while expanding its global market share. Zafin has enjoyed strong relationships with Vistara Capital Partners, Beedie Capital and Accenture, and the firms continue to affirm their support for the organization through this financing round. Vistara Capital Partners will further their partnership with Zafin through Randy Garg, Managing Partner at Vistara Capital Partners, holding a seat on Zafin’s Board of Directors.

Alan McIntyre, a Senior Managing Director and head of Accenture’s global banking practice said: “Technology continues to drive changes in consumer behavior and how they prefer to receive products and services from financial institutions. We are pleased to extend our relationship with Zafin and invest in its software solution, which can help enable financial institutions to improve pricing, personalization and product make-up without having to replace their legacy systems – an essential component for many of those not among the top ten players in the market.”

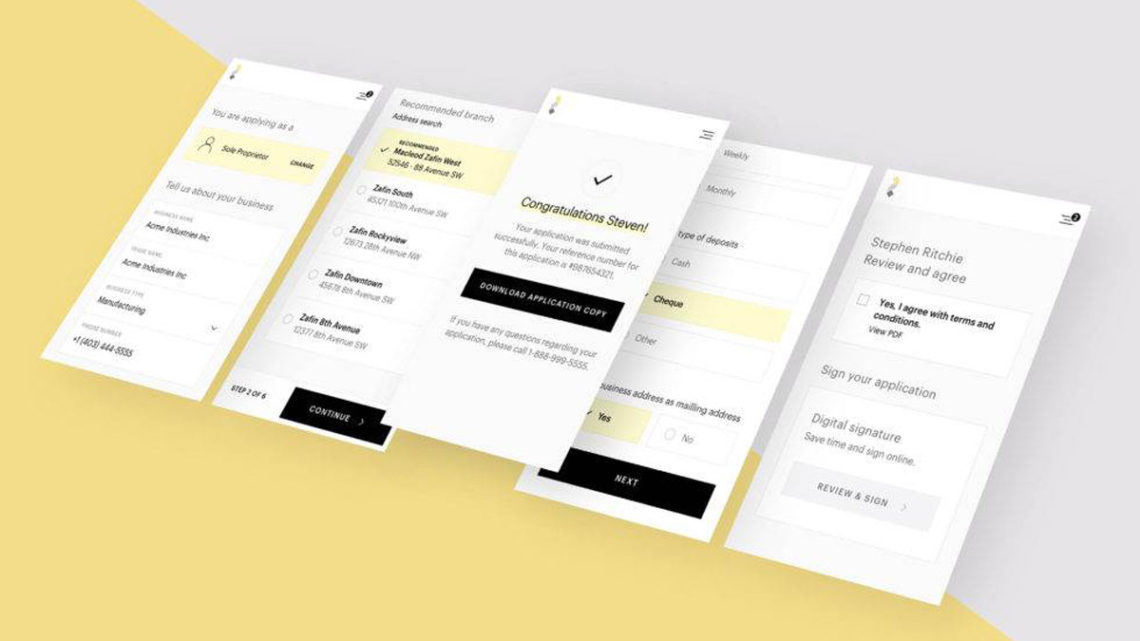

Zafin’s market-leading software and services help power pricing, product and customer strategies for many of the world’s largest financial institutions, providing essential new capabilities along their digital transformation and modernization journeys. The company’s technology platform is designed to modernize and augment legacy IT infrastructures that underpin the financial services industry. Its solutions enable banks to increase revenue generation, drive customer transparency and aid in regulatory compliance, ultimately enhancing their agility and their ability to improve the customer experience and build more personalized and profitable relationships.

“Zafin’s innovative solutions have become increasingly known amongst global banks as the sector continues to go through its technologically driven evolution. Over the past several years of our involvement, it has been very satisfying to see the levels of adoption taking place with many of the world’s most discerning bank customers,” said Randy Garg, Founder and Managing Partner of Vistara Capital Partners. “We are delighted to further expand our long-term partnership with Zafin through this latest growth financing round. With capital and partnerships in place, Zafin is ideally positioned to now accelerate its growth trajectory and become the latest technology success story coming out of Canada.”

“We are excited to continue to expand our partnership with Zafin and look forward to supporting the team through its next phase of growth as a market leader in digital banking solutions,” said David Bell, Director at Beedie Capital.

This funding announcement comes as a follow up to a partial acquisition and strategic alliance between Zafin and Accenture in December 2018. Further terms of the round were not disclosed.