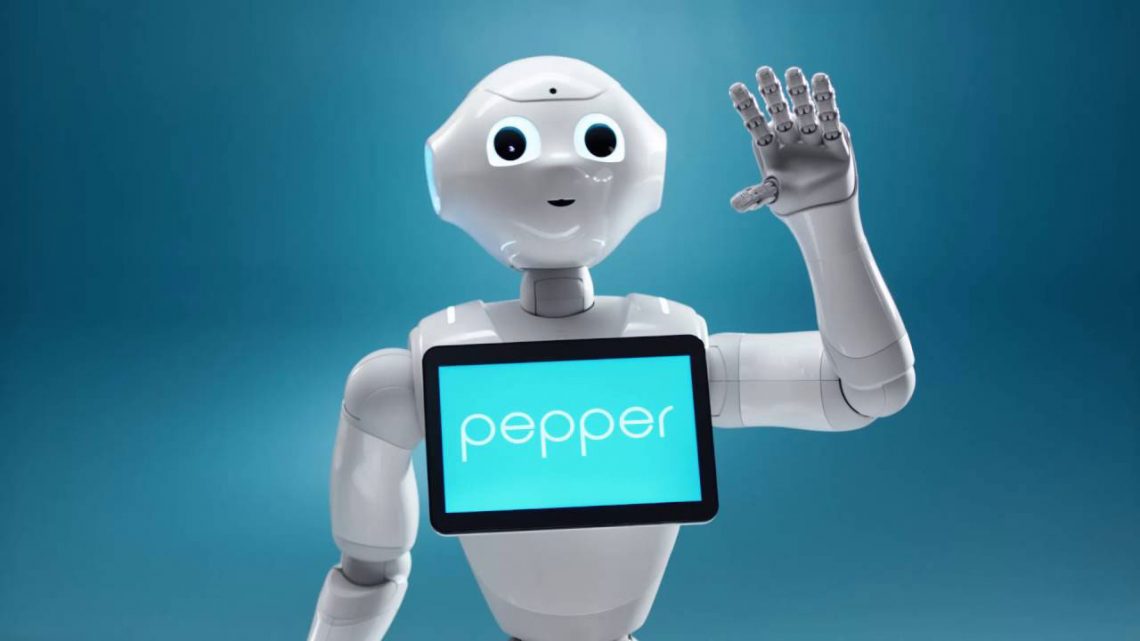

Emirates NBD’s Pepper learns Arabic

Emirates NBD’s Pepper has now learnt to speak Arabic! The artificial intelligence (AI) powered humanoid robot, brought to the UAE by Emirates NBD last year, has been widely popular due to his novel proposition and charming personality, and will now also cater to the bank’s Arabic-speaking customers.

Adding a fun element to the banking experience, the bilingual Pepper will continue to interact with customers at the bank’s Jumeirah Emirates Towers and Dubai Mall branches and provide assistance with issuing branch queueing tokens, presenting information about products and services in an engaging manner and obtaining customer feedback through a happiness meter.

“Pepper has been extremely popular with customers and well received at our branches and promotional events,” said Suvo Sarkar, Senior Executive Vice President & Group Head – Retail Banking & Wealth Management, Emirates NBD. “As a bank that has been at the forefront of digitisation and in bringing innovations to the region, we are pleased to offer our customers the opportunity to interact with Pepper in the language of their choice. Pepper brings in a modern and contemporary aspect to banking, complementing our multi-channel yet personalised banking proposition.”

Plynk partners with Jumio to power ID verification

Jumio, the creator of Netverify Trusted Identity as a Service (TIaaS), today announced a partnership with Plynk, Europe’s first money messaging app, to accurately verify users who are loading money onto their Plynk accounts for instant person-to-person payments.

Plynk removes the complexity and awkwardness from money transfers between friends by integrating a payments account and a messaging platform so people can instantly send funds to other Plynk account-holders in the familiar setting of a messenger. Money can be sent either to a single individual or easily distributed through group chat applications, without the fees and delays that are associated with high street banks. Users simply register and receive a payment account, an IBAN and virtual Mastercard for online payments.

Jumio’s trusted Netverify solution will help Plynk deliver a hassle-free user experience by verifying frequent customers who are instantly loading money from their debit and credit cards to their Plynk payment account. The verification takes less than a minute and does not require users to leave the app. This convenient process is perfectly suited to Plynk’s target market of on-the-go, digital-first consumers.

Jibrel Network signs MoU with blockchain platform

Jibrel Network, the first protocol with built-in regulatory compliance that allows anyone to put traditional assets like currencies, bonds and other financial instruments on the blockchain, has today announced that it has signed a Memorandum of Understanding with Dubai-based company, ArabianChain.

The partnership will allow Jibrel to provide technical advisory services and support to ArabianChain, the leading blockchain-enabled platform that serves both public and private enterprises in the Middle East – a region increasingly embracing the emerging technology.

With over thirty years’ experience working in financial securities for leading management consultancies Oliver Wyman, PWC and Deloitte, Jibrel’s team are particularly well placed to support ArabianChain’s engagement in the financial services sector, including many of the region’s leading banks.

“Financial services in the MENA region have very specific compliance requirements that must be accommodated,” commented Yazan Barghuthi, Project Lead at Jibrel Network.

Enterpay and Collector Bank have kicked off their collaboration

Collector Bank will add a B2B invoice powered by Enterpay to its payment method selection in Finland and later in the Nordics.

The collaboration lays the groundwork for Enterpay’s expansion to the Nordics and after Finland, the collaboration will continue in the Swedish market. Partnering with Collector helps Enterpay to grow the number of its service’s users and reach potential customers in new channels.

“Here at Enterpay we are very excited and proud about the collaboration. Having Collector as our partner introduces the service to a significant number of new merchants and gives our customers more selection and more possibilities to make buying online even easier”, says Jarkko Anttiroiko, Enterpay’s Managing Director.

Collector widens its payment method selection by introducing a B2B invoice specifically designed for B2B ecommerce to its customers. Both Collector’s new and existing customers have access to the new service easily with available integrations.