Baxter Credit Union takes Temenos’ Lifecycle Management Suite to the cloud

Temenos, the software specialist for banking and finance, announces that Baxter Credit Union (BCU) has successfully implemented the Lifecycle Management Suite in Microsoft Azure.

The implementation, which included the Collection, Service, and Loan Origination modules, incorporated an upgrade spanning four major releases, as well as the inaugural launch of the Lifecycle Management Suite in the Cloud.

Jeff Johnson, CIO, BCU, commented: “We have a strategic initiative in place to move all of our technology into the Cloud. Since BCU uses the Lifecycle Management Suite frequently as part of our day-to-day activities, we felt it was necessary to explore hosting our technology on Microsoft Azure. We are already well embedded with Azure, so they were a natural choice. We are looking forward to benefitting from the ability to scale more efficiently, reduce system response time, enhance disaster recovery abilities and run on optimally-sized hardware.”

WEX Virtual Payments Secures E-Money License

WEX, a provider of corporate payment solutions, announced its European office has secured an Electronic Money Institute (EMI) license by the Financial Conduct Authority (FCA) and, as a result, is now a principal member of Mastercard.

The EMI license enables WEX to offer credit and therefore the full product suite, in all 31 countries in the European Economic Area, which according to the latest figures from PhocusWright, is a travel market worth an estimated €273 billion. This new license accelerates WEX’s European expansion plans, which have been a core part of the global strategy of the virtual payments line of business.

“Having our own e-money license and becoming a principal member of Mastercard are key elements of our European strategy,” said Ian Johnson, Commercial Director Europe, at WEX. “Almost all businesses are looking for effective ways to manage supplier payments, and we are pleased to provide our full range of products and credit services across EEA.”

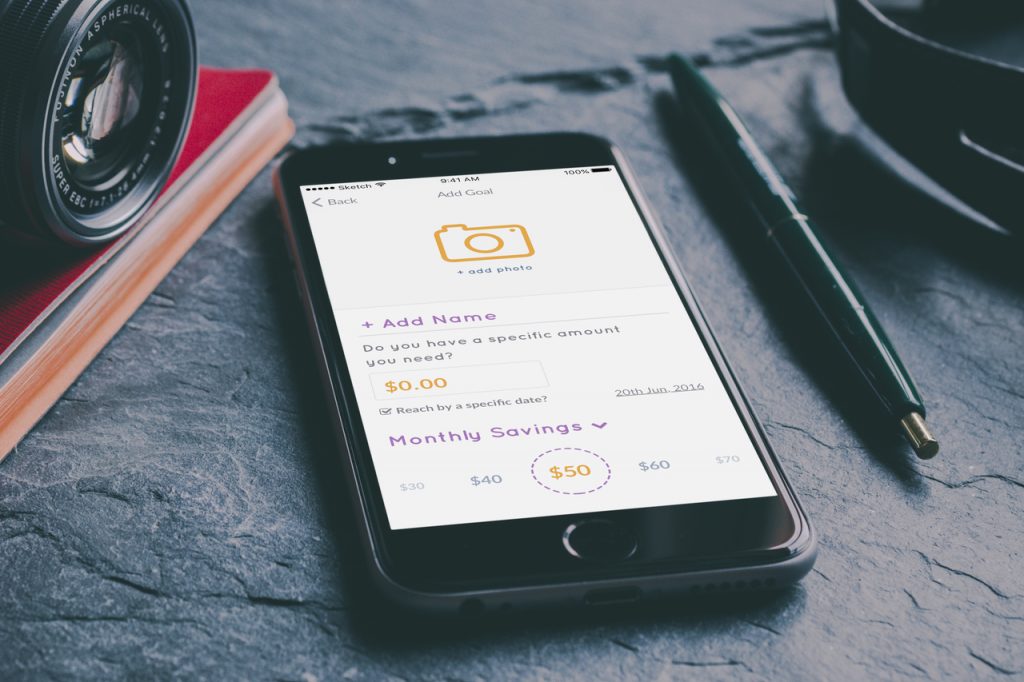

Robo-Advisor Platform Bambu Completes Funding Round Led by Franklin Templeton, Others

Bambu, a B2B robo-advisor platform provider, announces it has completed a funding round led by three new investors.

Franklin Templeton Investments becomes the first strategic investor in Bambu. Wavemaker Partners, one of Singapore’s leading venture capitalists and part of the Draper Venture Network, brings the first venture capital funding for Bambu. They are joined in the round by renowned FinTech investor Robby Hilkowitz, an early advocate of, and investor in robo-advisors globally.

Ned Phillips, Founder and CEO of Bambu, said; “We are delighted to have both strategic and venture capitalist investors in our latest round of funding, as further validation of our B2B business model. Bambu is now a growth stage company in the rapidly changing world of digital wealth, and to gain support from leading industry players brings great momentum towards our goal of becoming the market leader in this space.”

Payworks extends First Data partnership with EMV and contactless accreditation via First Data Merchant Solutions UK

Payworks, a provider of Point of Sale payment infrastructure, announced their new certification with First Data Merchant Solutions UK.

Payworks will bring their next generation payment gateway technology to nearly one-hundred thousand merchants across the UK via their new accreditation with First Data Merchant Solutions. Certification for both EMV Chip + PIN and contactless transactions has been completed, ensuring FDMS access to the latest payment technologies. With over 108 million contactless cards issued, consumers in the UK have been one of the fastest demographics to adopt tap & go payment. Payworks enables acquirers to support modern payment acceptance including contactless, EMV, mobile wallet and alternative payment transactions through a powerful payment infrastructure.