Splitting the bill with Monzo and Deliveroo

Whether you’re going Dutch on a date night dinner, or ordering takeaway for 10, there are plenty of times when you need to divvy up the cost of a meal.

But as anyone who’s attempted it will know, collecting money can be a hassle, and often leaves you out of pocket.

It’s part of the reason we launched Monzo.me, a handy link that allows Monzo users to request money from anyone. And it’s also an issue that our friends at Deliveroo have been thinking about for a while. “’Split the bill’ is probably one of our most requested features, and it’s been on our roadmap since I joined the company over two years ago,” writes Deliveroo designer James in a Medium post describing the project.

Building a bill-splitting feature from scratch is a big commitment, he explains, requiring a significant amount of technical and design work. There are also a lot of outstanding questions, like whether people would prefer to split the cost evenly or pay per item, or if they’d even use the feature in the first place.

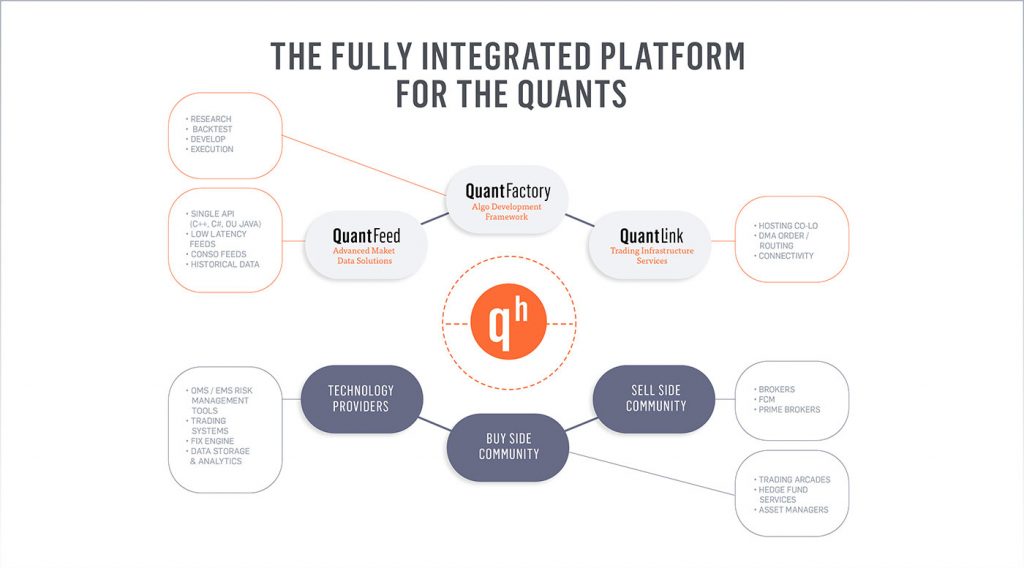

QuantHouse introduces Aqh API Ecosystem

QuantHouse announced the launch of its ‘qh API Ecosystem’. The ecosystem is designed to accelerate the adoption of multi-asset class API based solutions including value added analytics, automated trading tools, AI and machine learning services.

The qh API Ecosystem is a unique global initiative from QuantHouse whose objective is to help all fintech providers turn their software and hardware product portfolios into global, available on-demand solutions through open APIs, removing the burden of the traditional per customer implementation model.

Mitek will demonstrate Mobile Verify for Lending

This new, five step digital lending experience enables lenders to verify identity and bank account information in real time for fast loan decisions with a simple process for borrowers.

When applying for a consumer loan from a desktop computer, the borrower will first log into their online bank account and agree to have their account information shared with the lender. A text message is then sent to the borrower’s smartphone directing them on how to take four photos: front and back of their driver’s license, a selfie and a photo of their pay stub or other trailing document, to complete the loan application process. This new digital experience is quick and easy for the borrower and provides the lender with real-time identity and bank account verification.

Rabobank customers will be able to use the IBAN-Name Check

The check helps to avoid incorrect transfers and fraud. The IBAN-Name Check has been developed by Rabobank and will also be made available to other banks.

Millions of online and mobile transactions take place in the Netherlands on a daily basis. Around 1,300 incorrect transfers per month are reported to Dutch banks. Three quarters of those transfers result from errors made by customers using old account numbers or choosing the wrong account in their address books. Bank customers report more than 200 cases of incorrect transfers per month due to suspected fraud.

‘The IBAN-Name Check allows customers to check the name of the beneficiary before the transfer is executed,’ says Alexander Zwart, Manager Online Access at Rabobank. ‘The check works with all Dutch IBANs. If the entered name differs from the registered account holder, the user can cancel the transfer. Or they receive a warning that the account number doesn’t belong to a company but a private individual. This makes online and mobile banking even easier and safer.’