Fintech, Finance, Technology, Banking Highlights – 28 October 2017

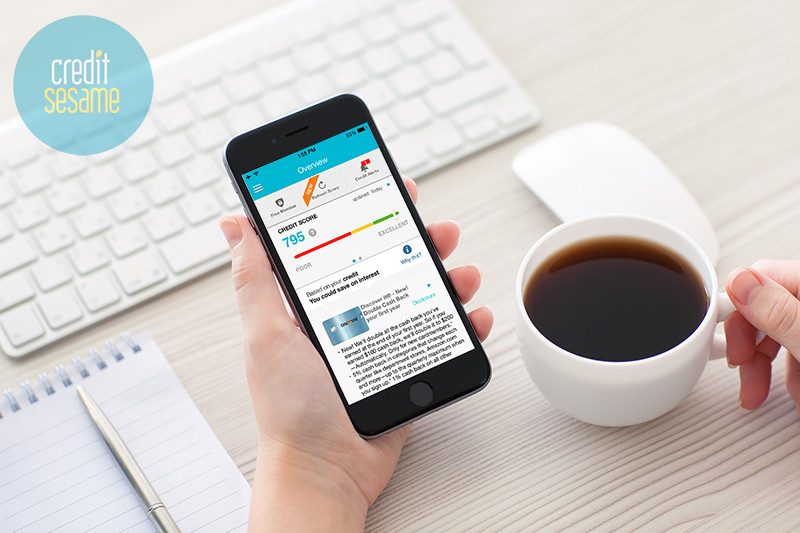

Credit Sesame scores $42 million in funding

Credit Sesame, a fast-growing, personalized credit service and financial wellness company, announced today it has raised over $42 million in equity and venture debt.

The funding comes from existing and new investors including Menlo Ventures, Inventus Capital, Globespan Capital, IA Capital, SF Capital, among others, along with a strategic investor. The funds will be used to accelerate the company’s growth, hiring, and member acquisition, and to advance its analytics, robo-advisor and machine learning technologies.

Credit Sesame’s robo-advisor technology leverages its significant consumer data and analytics along with thousands of rules and insights that have been developed and proven over the past several years. As the first of its kind in the industry, this technology aims to simplify and automate the management of consumer credit and loans, addressing the liability side of the balance sheet and helping consumers achieve improved financial wellness.

SBI leads $2 million round in Jirnexu

Southeast Asian fintech startup Jirnexu – Southeast Asia’s only full stack fintech solutions provider – has raised US$2 million in a pre-Series B round.

Japan-based SBI Group—a financial services company and a pioneer in internet-based financial services—led the latest round, joined by existing investors Celebes and Cento Ventures. This brings Jirnexu’s total funding to US$8 million. Bringing over 18 years of experience in developing an internet-based financial ecosystem in Japan, SBI Group will work with Jirnexu to consolidate its leadership in Malaysia and expand their regional footprint by accelerating the development of new products and services.

Jirnexu provides financial service institutions (“FSIs”)—banks and insurance companies—with a full stack solution to effectively increase sales by attracting, retaining and monetising connected consumers. Jirnexu’s fintech solution is driven by XpressApply, a proprietary data-driven platform that enables FSIs to reach online and mobile-first consumers. With over half of all consumer banks in Malaysia already signed onto XpressApply, the technology has enabled Jirnexu’s clients to achieve 300% ROI, while tripling productivity per headcount and doubling conversions when compared with traditional methods.

Personetics AI tackles student loan debt

Personetics Cognitive Banking applications, already used by leading banks to deliver AI-powered automated savings, can now be leveraged by financial institutions to help customers repay their student loans ahead of schedule, ultimately reducing the length of debt repayment plans and saving thousands of dollars in interest payments. The student loan burden

Student loan debt is a heavy burden for large portions of the US population – Americans owe over $1.4 trillion in student loan debt, spread out among an estimated 44 million borrowers. The average class of 2016 graduate has more than $37,000 in student loan debt, a number that is steadily inching up year after year. For many millennials, the ability to repay these loans has redefined financial success: 46 percent say financial success means being debt free, compared to 21 percent who say owning a home and 13 percent who say the ability to retire is the number one indicator of financial success.

Cinnober launches post-trade engine Minium

Minium’s solution, based on Cinnober’s award winning technology for exchanges and clearinghouses, will enable banks and brokers to offer modern and efficient real-time post-trade services to their customers.

This includes a complete overview of their risk exposure to different markets in real-time. Minium’s multi-asset technology is able to handle all asset classes traded on exchange as well as over-the-counter to provide operational and capital efficiencies.

“Minium offers a unique high availability real-time core engine that powers advanced cross-asset risk and post-trade modules: this combination will support our customers in their transformation away from the constraints of today’s legacy solutions”, says Patrick Tessier, COO of Minium. “This new subsidiary will take risk management and post-trade services to the next level, by providing true exception based real-time services supported by today’s scalable technology”.