Fintech, Finance, Technology, Banking Highlights – 12 February 2018

Tsys scores virtual payments deal with Chase

TSYS announced that J.P. Morgan will offer TSYS’ Virtual Payment PreceptSM (VPP), a strategic commercial card payables solution to corporations.

TSYS’ VPP enables the generation of secure, virtual, single-use account information in real-time with more control over account and transaction parameters. It will allow J.P. Morgan to broaden their virtual card solution through issuance on both the Visa and Mastercard networks.

TSYS’ VPP reduces risk, improves operational efficiency and makes it easier for both accounts payable and accounts receivable to reconcile transactions. Virtual cards replace primary account numbers on physical purchasing cards, making them the most secure, fraud-proof method of paying suppliers by placing strict limits around what each virtual account number can be used for when making a purchase.

“TSYS takes pride in being a trusted partner in commercial payments, helping our clients implement a best-in-class payables platform,” said Scot Yarbrough, Group Executive of Commercial Services, TSYS. “We are thrilled that J.P. Morgan’s Commercial Card business is utilizing our solution to continue to grow their business by leveraging the latest technologies.”

Certify and Western Union collaborate for international business mass payments

Leading automated travel and entertainment expense management software provider, Certify, announced the formation of a new integration collaboration with Western Union.

The aim of the relationship is to provide mass international business payment capabilities for Certify’s expense and invoice customers with operations outside the United States.

Leveraging Western Union’s unique global payments network and unparalleled success managing distributed financial transactions, Certify can now offer mutual customers the ability to directly remit employee expense reimbursements and vendor payments directly to employees’ bank accounts in a range of currencies for both domestic and international transactions.

The new service, called Certify Payments, is powered by the Western Union® Mass Payments API (Application Programming Interface), capable of processing electronic direct to bank payments in 45 currencies. Currently available for all mutual Certify-Western Union customers, the integration with Western Union allows for seamless processing of each currency in accordance with the specifications of each country’s unique clearing system, including settlement times and other factors.

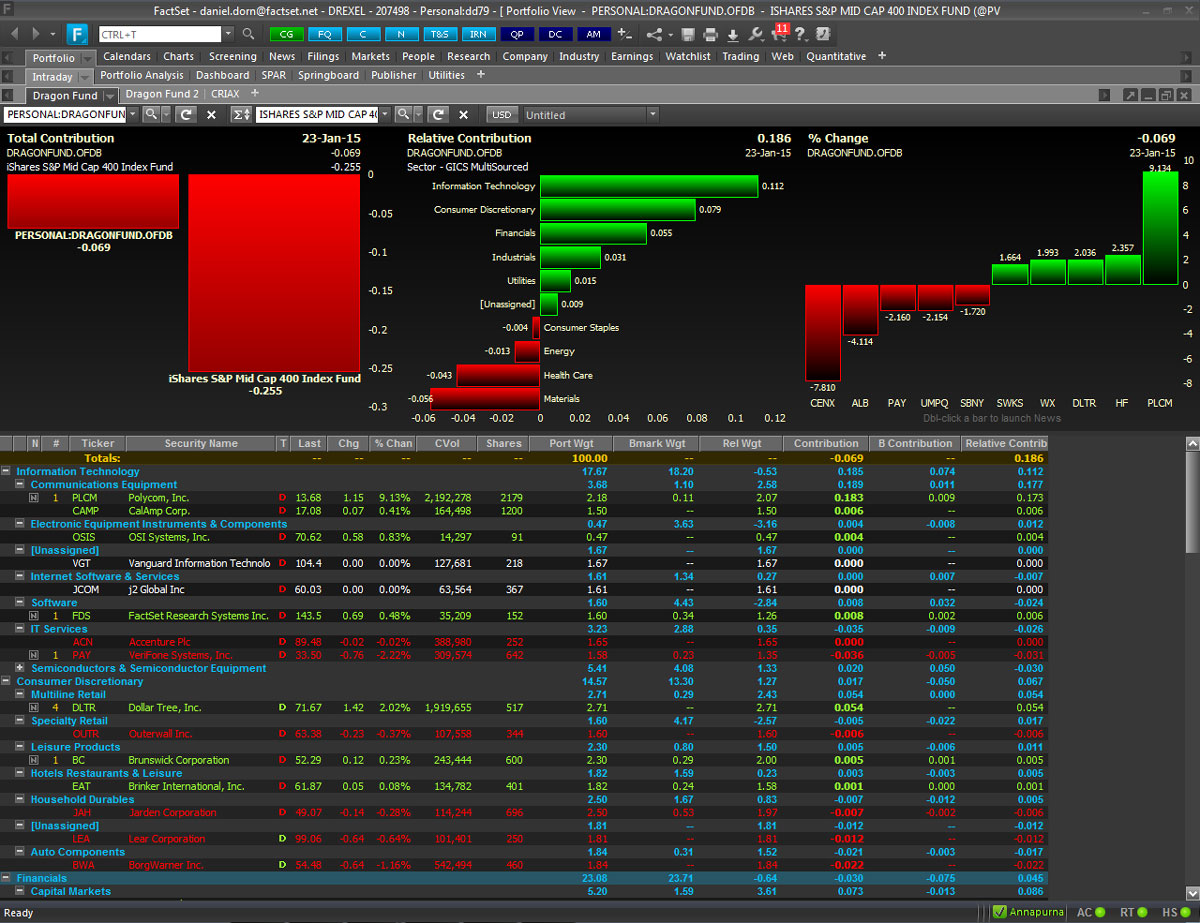

FactSet partners CG Blockchain

FactSet, a global provider of integrated financial information, analytical applications, and industry-leading services, announced a strategic relationship with CG Blockchain, a developer of blockchain technology for the investment industry.

Through this relationship, FactSet clients will have access to CG Blockchain products through its BCT Fundstore. CG Blockchain’s current and future clients will also use FactSet’s industry-leading Portware execution and order management capabilities, delivered as FactSet OEMS, for trade execution, analysis, order generation, and compliance efforts.

FactSet OEMS is a configurable, “thinking” order and execution management system designed to act as the central platform for the creation and execution of trading strategies across asset classes.

As an extension of CG’s current product, ComplianceGuard, BCT Fundstore offers a suite of blockchain apps built upon a robust compliance framework.

The powerful combination of FactSet’s OEMS solutions and CG Blockchain’s Fundstore brings to market one of the first times blockchain technology is directly integrated with an OEMS for real-time, persisted, immutable recording of transactions to a distributed ledger—helping investors achieve new levels of transparency and security.