Fintech, Finance, Technology, Banking Highlights – 18 July 2018

Wirecard and Mastercard Expand Strategic Cooperation to Promote Contactless Payments Via Wearables

Wirecard and Mastercard have announced that they are to expand their existing strategic cooperation with the aim of making digital, contactless payments via wearables accessible to ever more consumers.

As a result, boon from Wirecard will be available in Germany via Garmin Pay as of today. Further future cooperation projects are planned, which will make mobile payment with the own smartwatch available for more and more users.

Garmin Pay customers can now benefit from smartwatch-based payments with boon in Germany and six further European countries independent of their bank, as they are owners of a digital boon Mastercard. boon is the quickest growing mobile payment solution in Europe and since 2015 the industry’s first fully digitized mobile payment solution to operate independently of banks. Currently, Garmin Pay functions with the GPS multisport smartwatches vívoactive 3 and vívoactive 3 Music, the GPS fitness watches Forerunner 645 and Forerunner 645 Music in addition to the fēnix 5 Plus series.

Payroc, Ethos Announce U.S. Cryptocurrency Payments Partnership

Payroc, a merchant services and payment processing organization, and Ethos.io PTE, a leading cryptocurrency services platform, formally announced their partnership to create a best-in-class cryptocurrency merchant payment processing service.

The Ethos Bedrock platform will be integrated with Payroc’s payment gateway platform, enabling a simple “Pay with Crypto” button to be placed on merchant websites, giving consumers the option of paying with cryptocurrency in addition to traditional payment forms. The companies made their partnership intentions known late last week during Digital Currency Con in Park City.

“We’re excited about partnering with Ethos as it brings together the traditional payments world Payroc operates in with new digital currencies,” said Jared Poulson, chief integrations officer for Payroc. “Our merchants will be able to accept payments via traditional credit cards, ACH, PayPal and now popular cryptocurrencies,” added Poulson. “We have been tracking Ethos for quite some time. Their commitment and vision of bringing the benefits of blockchain technology to the mass market aligns with Payroc’s culture of innovation, trust and stability.”

New York State Department of Financial Services Grants Virtual Currency License to BitPay

BitPay, a global blockchain payments provider, announced the company has received its Virtual Currency License from the New York Department of Financial Services which governs rules for virtual currency business activity in New York.

The virtual currency License enables BitPay to transact business with companies and consumers based in New York. Businesses based in New York can leverage BitPay to accept Bitcoin and Bitcoin Cash for purchases from users globally. Further, residents with Bitcoin and Bitcoin Cash are able to make purchases.

The Department of Financial Services conducted a comprehensive review of BitPay’s application, including the company’s anti-money laundering, know your customer, anti-fraud, capitalization, and cybersecurity policies.

“New York state has one of the strictest policies around businesses involved in cryptocurrency and working through the approval processes to obtain a License was important to BitPay,” said Stephen Pair, CEO of BitPay. “We believe this hard work will pay off as New York presents significant business opportunities for BitPay.”

DPOrganizer grabs funding in Paladin Capital-led round

DPOrganizer raises a €3 million Series A extension investment round led by US-based venture capital firm Paladin Capital Group.

The Stockholm-based data protection company, which helps organisations across the world grow, and live, with GDPR, will use the financing for continued product development.

Nordic venture capital firm Industrifonden, Creades, Inbox Capital, and Soläng Invest, which had all invested in DPOrganizer’s initial round, all participated in this extension round, which takes DPOrganizer’s total Series A funding to €6 million. Over the past year the company has grown tenfold with GDPR coming into force on 25th May, 2018

“Joining forces with Paladin Capital Group at this stage of our growth is very timely. With Paladin’s deep industry expertise and international experience, bringing on an global investor of their calibre will be an important step in our mission of reaching more privacy professionals around the world,” says Egil Bergenlind, CEO and founder of DPOrganizer.

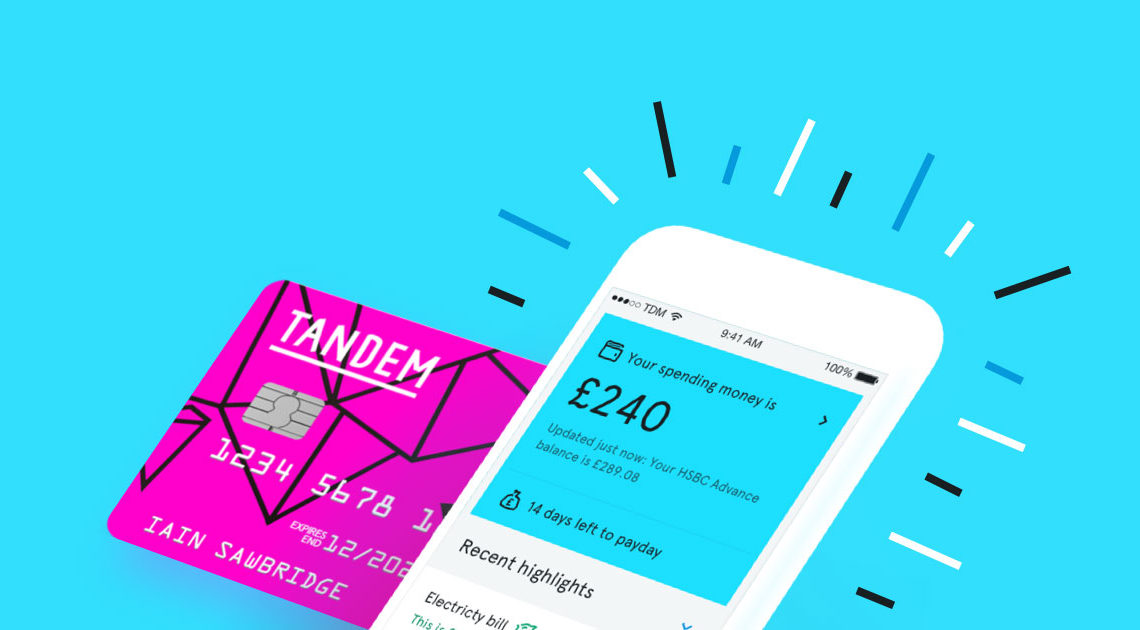

Tandem reaches 250,000 customers

Tandem Bank announces that it has reached 250,000 customers across its cashback credit card, fixed term savers and account aggregating banking app.

This news comes just two months after the bank hit the 100,000 customer mark, accelerating their growth ahead of internal targets and that of their competitors. Millennial holidaymakers are capitalising on the fee free spending overseas offered by Tandem’s cashback credit card on holiday this summer and have spent across a total of 158 countries on their travels, from Britain to Botswana. They are also are making use of the fixed savers’ competitive interest rates to set money aside for the future.

With these market leading financial products and an advanced banking app that offers customers a 360° view of their finances Tandem are now looking to grow their suite of services with a new card and mortgage products. The Tandem App aggregates all of customers’ accounts, which not only allows them to view everything in one place, but also lets Tandem use this financial data to tailor product offerings to their specific financial situation. This way their products fit customers like a glove.