Fintech, Finance, Technology, Banking Highlights – 30 July 2018

Singapore Airlines rolls out blockchain-based digital loyalty wallet

The SIA Group’s KrisFlyer frequent-flyer programme launched KrisPay, the miles-based digital wallet which enables members to convert KrisFlyer miles into KrisPay miles instantly for everyday spending at partner merchants island-wide. The innovative platform will allow members to choose from using as little as 15 KrisPay miles (equivalent to about S$0.10) to pay for their purchases at partner merchants, either partially or in full.

For a start, KrisPay miles will be accepted at 18 merchants spanning different categories of beauty services, food and beverage, petrol and retail. Selected partners will offer discounts during the launch period. More merchants will be progressively added to the platform, and members can expect frequent in-app promotions and more app features to be delivered in the coming months.

KrisPay is available for download now on the Apple and Google Play Store. Once it has been downloaded, members can easily turn their KrisFlyer miles into KrisPay miles using the app’s instant top-up function. Once transferred, KrisPay miles have a validity of six months. To pay for purchases, members simply need to scan the KrisPay QR code at the merchant, and key in the amount they wish to pay with their KrisPay miles.

ACI equips developers with open API

ACI Worldwide, a global provider of real-time electronic payment and banking solutions, today announced that its UP eCommerce Payments solution provides a fast and flexible way for local card acquirers and alternative payment methods to integrate with ACI’s extensive global network of payment endpoints. New self-integration capabilities, established with developers in mind, give card acquirers and alternative payment providers greater flexibility in how they connect to ACI’s eCommerce payments API.

ACI’s UP eCommerce Payments solution provides best-in-class payments and integrated fraud prevention, with extensive global connectivity to a network of more than 350 card acquirers and alternative payment methods. The RESTful open API now enables third-parties to integrate with the network via certified self-integration, speeding up time-to-market and reducing development costs, ultimately driving faster global eCommerce growth.

PagBrasil, an online payment processing service and gateway focused on the Brazilian market, first piloted the self-integration approach in late 2017. The developer-driven, lower cost alternative to integrate into ACI’s network is proving particularly attractive in addressing the payments complexity of rapid-growth emerging markets, where selected partners retain control over timing and development resources.

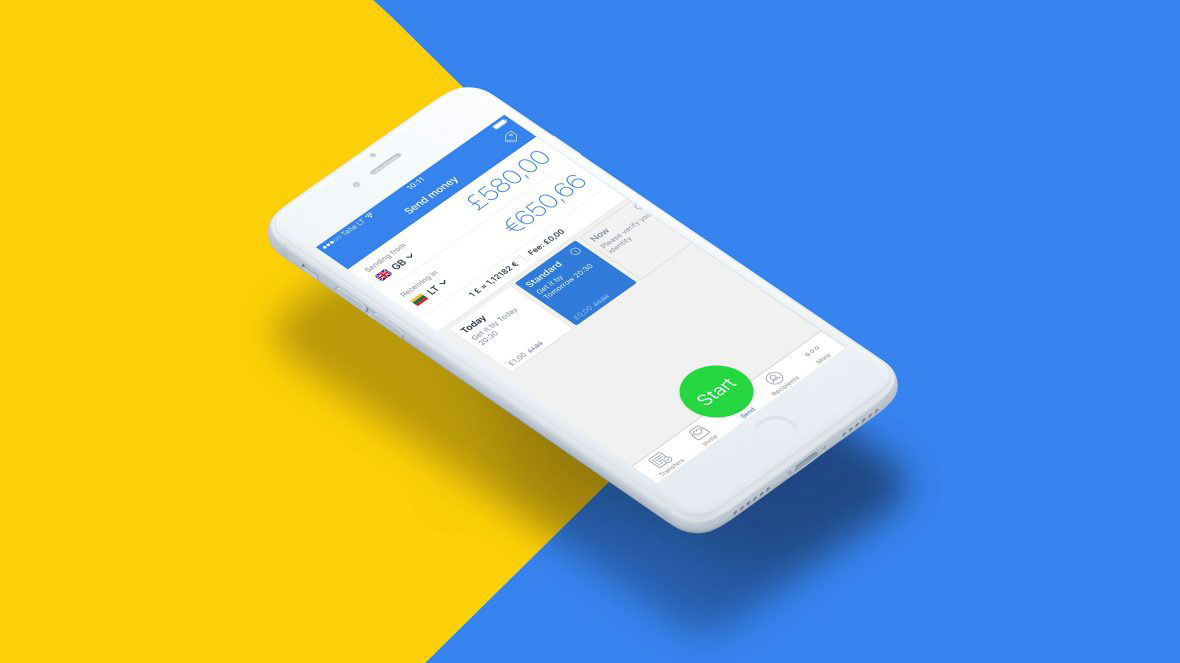

TransferGo adds cryptocurrencies to remittance app

TransferGo became the first remittance company in the world to offer a cryptocurrency trading facility, allowing customers to purchase and sell five major cryptocurrencies. The trading of Bitcoin, Bitcoin Cash, Ethereum, XRP and Litecoin is now available through the TransferGo app.

“We’ve launched this cryptocurrency trading facility in response to demand from our user base” said Daumantas Dvilinskas Founder and CEO of TransferGo “our innovation is driven by empathy for our customers and our focus is wherever there’s a point of friction for them. With over 4,000 users signing up in the first few hours we can see there is a strong demand in the market for a simple and reliable investment and trading solution.”

The new facility focuses on simplicity and enables customers to invest in cryptocurrencies within the familiar environment of the TransferGo user experience. In addition TransferGo, is providing best in class customer service support that operates in 7 languages and is available on phone, email and through facebook, to provide information and guide their clients through the process of buying and selling.

Stripe releases API for programmable payment cards

Stripe Issuing is an end-to-end platform for quickly creating, distributing, and managing physical and virtual cards. It’s infrastructure that enables you to do things like create employee expense cards with dynamic spending limits, generate virtual cards so marketplace couriers can pay with their phones at specific merchants, or run the entire card stack for a new digital bank.

Traditionally, card issuance has involved extensive development time, complex requirements, long-term contracts, and significant upfront fees. But with Stripe Issuing, we help abstract the complexity so you can start creating cards faster and scale more efficiently.