Fintech, Finance, Technology, Banking Highlights – 31 July 2018

TransferMate announces a €21m investment by ING

And strategic partnership across the ING corporate client base Investment will help accelerate TransferMate‘s global expansion €51 million Series A funding invested in TransferMate in the past 8 months

TransferMate, a cross-border B2B payments technology solution, is delighted to announce today a €21 million investment from ING, one of Europe’s leading banks, for a small minority equity stake in the Company.

TransferMate and ING have also agreed to a strategic partnership, where TransferMate services will be available to all SME and corporate clients of ING. Using TransferMate’s award-winning cross-border API technology and global payment licences, this partnership will reduce international payments costs and improve cash flow for ING business customers who send or collect funds cross-border.

Terry Clune, co-founder and CEO of TransferMate said:

TransferMate partners with the leading banks, fintech and software providers across the globe. Working together, we make it cheaper, faster and easier for businesses to make or receive cross border payments. TransferMate has built a unique technology platform and we are delighted to welcome ING as an investor and partner to help eliminate costly friction points for business customers.”

Evelien Witlox, Global Head of Payments and Cards of ING commented:

ING is dedicated to offering seamless payment solutions and freedom of choice to its customers. This investment and partnership with fintech TransferMate adds to ING’s capability to help customers by saving time and money for international payments. The solution will become available to all SME and corporate clients of ING. The partnership perfectly fits our innovation strategy and we look forward to offering this service together.”

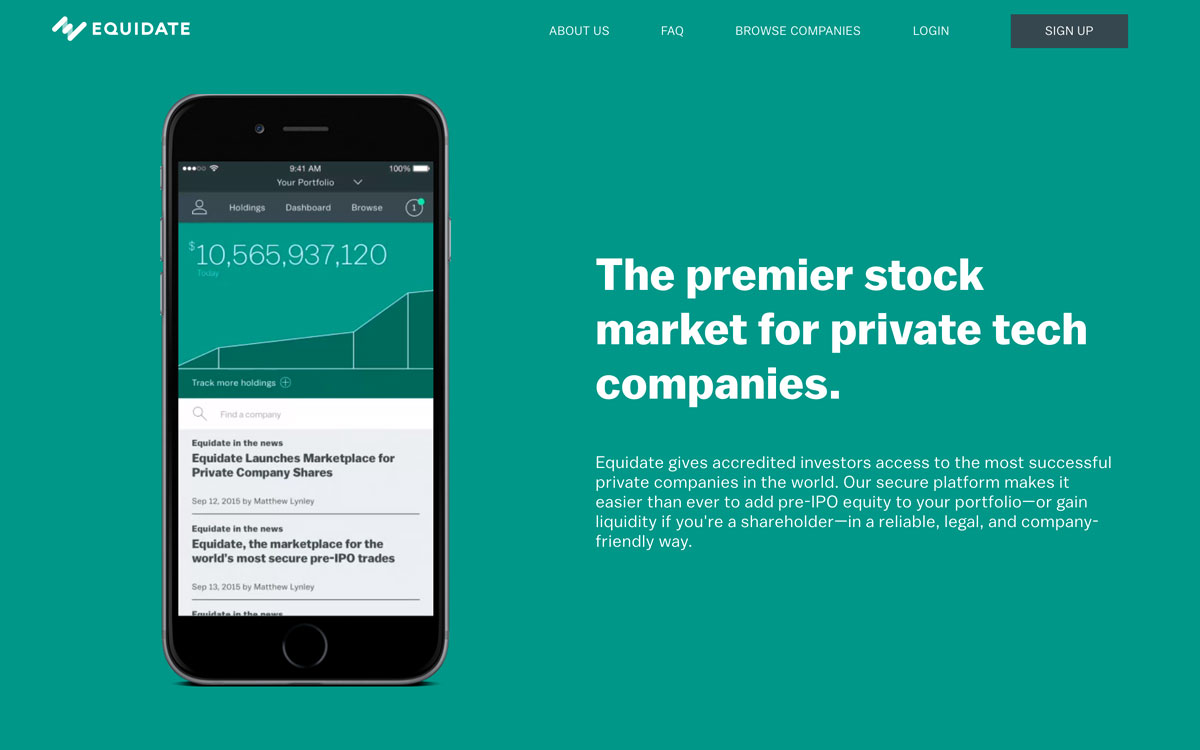

Stock market for private companies raises $50 million

Equidate, the stock market for private technology companies, has announced a $50 million Series B financing round led by Financial Technology Partners, Panorama Point Partners, and Operative Capital.

Equidate’s existing investors include Peter Thiel, Tim Draper, and Scott Banister. “As a global leader in FinTech investment banking, we have executed many hundreds of private deals and have evaluated thousands more. I have rarely seen a business with Equidate’s potential to define the future of private company investment services,” said Steve McLaughlin, founder and CEO of FT Partners. “Equidate’s global technology platform has accelerated the behavioral shifts fueling the growth of the private markets, and we are excited to partner with them through this period of strong growth to create a truly foundational component of this new economy.”

Equidate, founded in 2014, is the leading stock market for private companies. The company’s global electronic trading platform connects individual and institutional investors with sellers like venture capitalists and shareholder employees, as well as some of the largest and most prominent private companies themselves. Equidate believes its run-rate of $1 billion of trade volume this year squarely places the company as both the market leader and the fastest growing player.

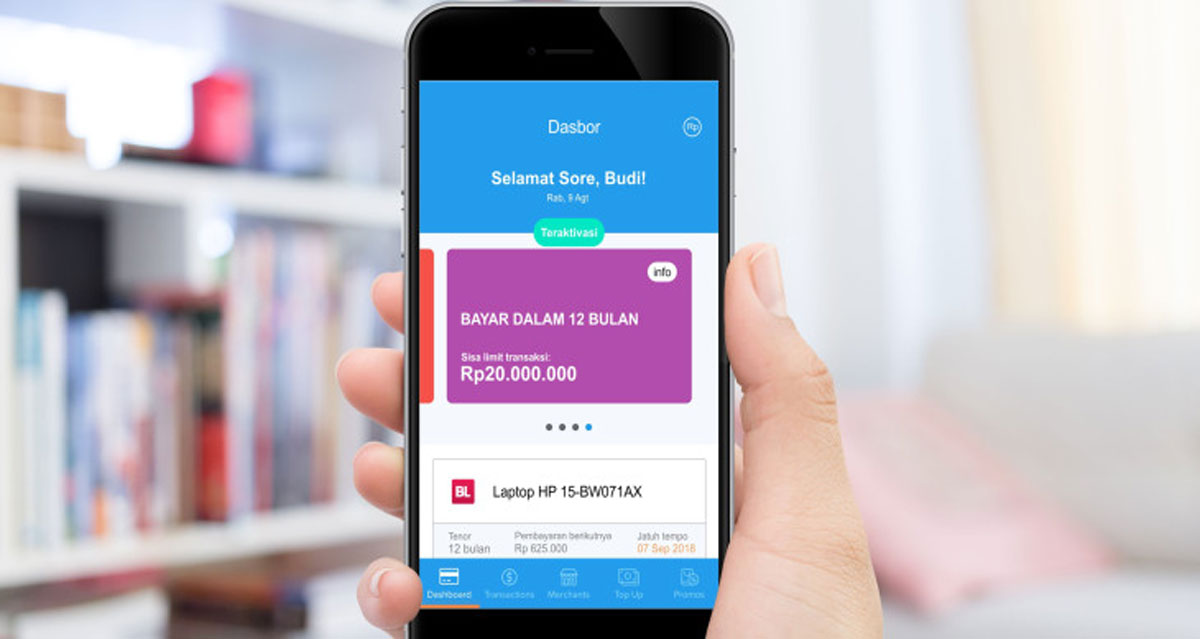

FinAccel raises $30 million to extend ‘buy now, pay later’ app across SE Asia

Jakarta based FinAccel has raised a USD30 million Series B equity investment round led by Square Peg Capital, with participation from new investors MDI Ventures and Atami Capital, and from existing investors Jungle Ventures, Openspace Ventures, GMO Venture Partners, Alpha JWC Ventures and 500 Startups.

FinAccel’s core product, Kredivo, is a digital credit card and point-of-sale transaction engine that enables consumers to quickly and easily “buy now and pay later” on Indonesia’s leading e-commerce sites. Kredivo solves major problems for both consumers and e-commerce merchants. For merchants, it increases order value and eases the friction in online transactions that can lead up to 80% cart abandonment rates. For consumers, it enables a fast and safe online checkout while offering flexible payment terms, such as interest-free 30 days or low-cost installment plans. Kredivo credit scores and approves consumers in real-time using its proprietary credit decisioning platform.

In just over two years since launch, Kredivo has become the most widely adopted alternative checkout and digital credit payment method across Indonesian e-commerce merchants. No other company is live on nearly all of the top ten merchants, including Tokopedia, Shopee, Bukalapak and Lazada, and more than 200 overall. Kredivo has credit scored nearly two million Indonesian consumers and helped e- commerce merchants increase sales and customer retention significantly. Kredivo’s consumers are incredibly valuable and loyal, with 80% of its transactions in any month coming from repeat customers.