Bill.com announced it is eliminating wire transfer fees for businesses paying electronically in local currencies using its International Payments solution.

Businesses can now save time and even more money on the payments process while managing all their domestic and international payments in one simple workflow platform.

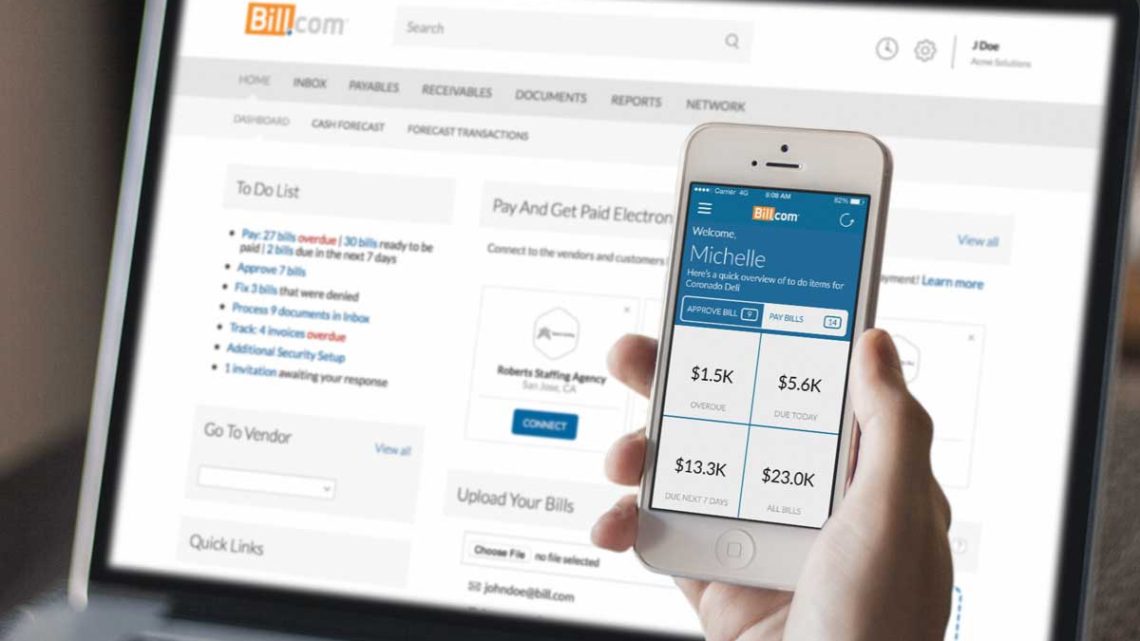

For small and medium businesses and mid-market companies who need an easy and cost-effective way to pay international vendors, Bill.com International Payments streamlines the business payments process making cross-border payments as easy as domestic. Unlike banks or other international payment providers, Bill.com offers control with automated approval workflows and time savings by syncing with leading accounting software.

According to Accounting Today, which recently named the Bill.com International Payments solution as a Top Product of 2019, “In an era of globalized business and communication, it feels anachronistic that international payments can still pose significant obstacles. But they continue to be a thorn in international business’ sides. For that reason, international bill pay being offered by one of the most popular billing and invoicing apps in the accounting world, Bill.com, deserved recognition.”

“If your business is global, your payment process should be as well,” said Yael Zheng, Chief Marketing Officer at Bill.com. “With Bill.com International Payments, we provide small and mid-size companies a simple, seamless, and cost-effective way to pay electronically all over the world, with just a few clicks. Now, payments can be made and tracked in U.S. dollars, for a better wire transfer rate than most banks, and in more than 24 local currencies with no wire transfer fee and at a competitive exchange rate. We’re delighted to see the customer response to this new offering and how it is helping companies expand their global footprint.”

Since launching International Payments in July 2018, Bill.com has seen rapid adoption of its digital business payments platform by customers wanting to make payments outside the U.S. small and mid-size companies in the United States now can pay vendors in 40+ countries, including the Eurozone, UK, India, and China. Paying international vendors in local currencies has several cost-saving benefits. In addition to saving on the wire transfer fees by paying via Bill.com, businesses can also save by removing the need for overseas vendors to convert payments resulting in fluctuating exchange rates and potential errors.

“Bill.com has eliminated payments torture from our business life. We’re growing approximately 25-30% outside the U.S. and the Bill.com International Payments solution enables us to pay our contractors, who are located all over the world, in a timely manner,” said Judy Williams, Cofounder and Operations Manager, The New Stack. “Importantly, all the cumbersome and antiquated processes we previously had to manage with international banks are eliminated. I can make all the payments myself in one app, even while I’m traveling internationally.”

Bill.com International Payments users can process and pay invoices in local currencies or U.S. dollars and then automatically sync with accounting software including Sage Intacct, NetSuite, QuickBooks, and Xero, providing end-to-end cash flow visibility and eliminating the need for double data entry. Additionally, Bill.com International Payments is supported on iOS and Android, making it that much simpler to complete payments on multiple devices while on the go.