London – Anglo-Turkish fintech pioneer Colendi is launching Turkey’s first digital deposit bank after approval from the Banking Regulation and Supervision Agency (BRSA).

Turkey’s Banking Regulation and Supervision Agency (BRSA) greenlights fintech pioneer Colendi’s digital deposit bank.

London – Anglo-Turkish fintech pioneer Colendi is launching Turkey’s first digital deposit bank after approval from the Banking Regulation and Supervision Agency (BRSA).

“We are thrilled to obtain authorisation for the establishment of a digital deposit bank, ushering in a new era of accessible banking for our platforms and users,” said Bülent Tekmen, Co-Founder and CEO of Colendi. “Colendi’s business model is to work with first class organisations and enable them to reach their retail and SME customers to offer financial products within a regulated environment.”

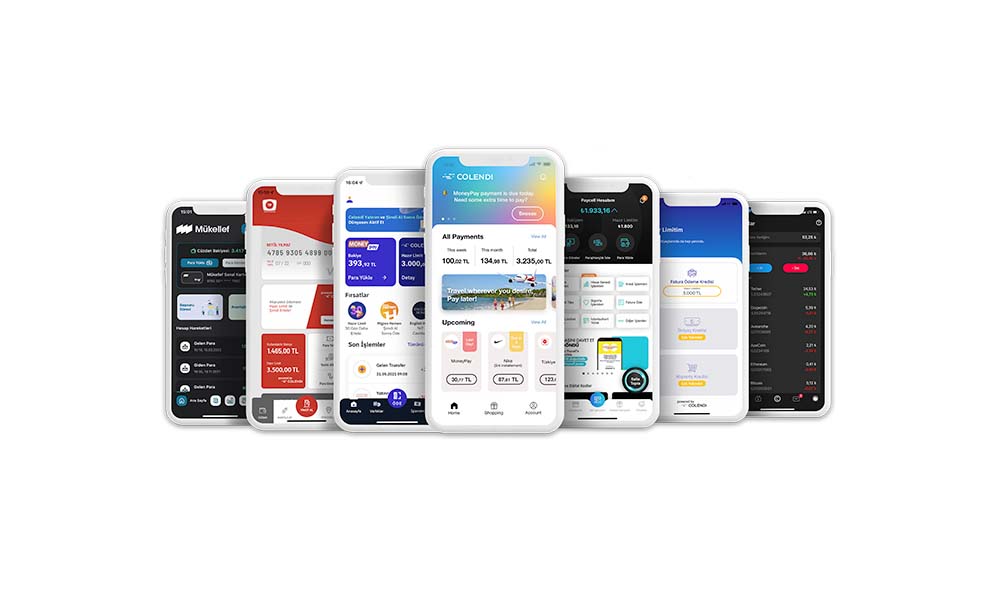

With 18 million customers, Colendi has grown to be Turkey’s leading fintech. It has major partnerships with Migros, the largest multi-format grocery retailer in Turkey, and Turkcell, the country’s largest telecom operator. The latest approval follows Colendi’s acquisitions over the last 24 months of e-money, asset management, capital market and insurance brokerage licences.

Since launching in 2021, Colendi’s payment business has grown more than 40x, while credit business has grown more than 10x, processing more than $300m in financial transactions with more than 1.5m credit users. Colendi is the first brokerage firm to offer trading of international stocks in Turkish Lira, alongside trading in commodities, precious metals and local stocks. The group also launched the first embedded insurtech products into retail channels, expanding into new verticals. Colendi’s banking licence will enable it to receive deposits and lend from its own balance sheet in a secure regulatory environment.

Colendi’s proprietary technology, which controls the whole vertical stack, underpins everything Colendi does. The group will benefit from Turkey’s robust banking infrastructure and regulatory standards. Through technology-driven innovations, the goal is to meet all customers’ financial needs through digital banking, streamlining the user experience with personalised convenience.

As Turkey’s first digital bank, ColendiBank will target growing the platform to reach 50 million customers regionally, making it a leading global player in financial technology innovation.

At the heart of ColendiBank’s transformative potential lies the fusion of financial technology and artificial intelligence. Leveraging its proprietary AI-driven technology, ColendiBank is set to introduce a range of innovative services that are both efficient and individually-tailored. This strategic integration of AI promises to redefine user experiences, ushering in an era of personalised financial services accessible through the digital deposit and service banking model.

Tekmen said that Colendi’s strategic acquisition of London-based SETL, the main technology partner for the Federal Reserve Bank of New York’s digital dollar initiative, had been a driving force behind the new ColendiBank.

SETL serves prominent institutions, including the Central Banks of England, France and Singapore, as well as Swift and the Bank of New York. SETL facilitates a Regulated Liability Network© (RLN) framework, optimising efficiency through a shared Ledger (Accounting and Reconciliation System).

SETL recently launched Ledger Swarm, providing RLN for real-time settlement. SETL’s investor base and its ability to empower banks with technology infrastructure, will enable seamless digital transactions at a rate of 1 million per second, transcending geographical and dynamic barriers.

Colendi has been one of the top innovators in financial technologies, especially on machine-learning driven credit scoring models and blockchain-based settlement systems. The World Bank Group has recognised Colendi’s credit scoring method as one of the innovative use cases in a recent report, while AWS-backed SETL has published a white paper on the impact of blockchain-based settlement systems in Regulated Liability Networks.

In 2021, Colendi successfully raised $30 million in a Series A investment round. The company has enjoyed continued success in an ongoing Series B round, in which Colendi’s valuation has soared from $120 million to $750 million.

“It has been an exciting 2.5 years,” said Ian Hannam, the British Chairman of Colendi. “Turkey has become the right country to establish our base. Our high growth momentum is the result of our hard working, ambitious team and our partners, who always supported us. We look forward to building within the regulated network, developing high quality innovative products, which will operate safely, securely and swiftly for our retail clients. Our next step is to expand into new markets. Turkey’s regulative environment is almost identical to the EU and MENA.”