Fintech, Finance, Technology, Banking Highlights – 30 January 2018

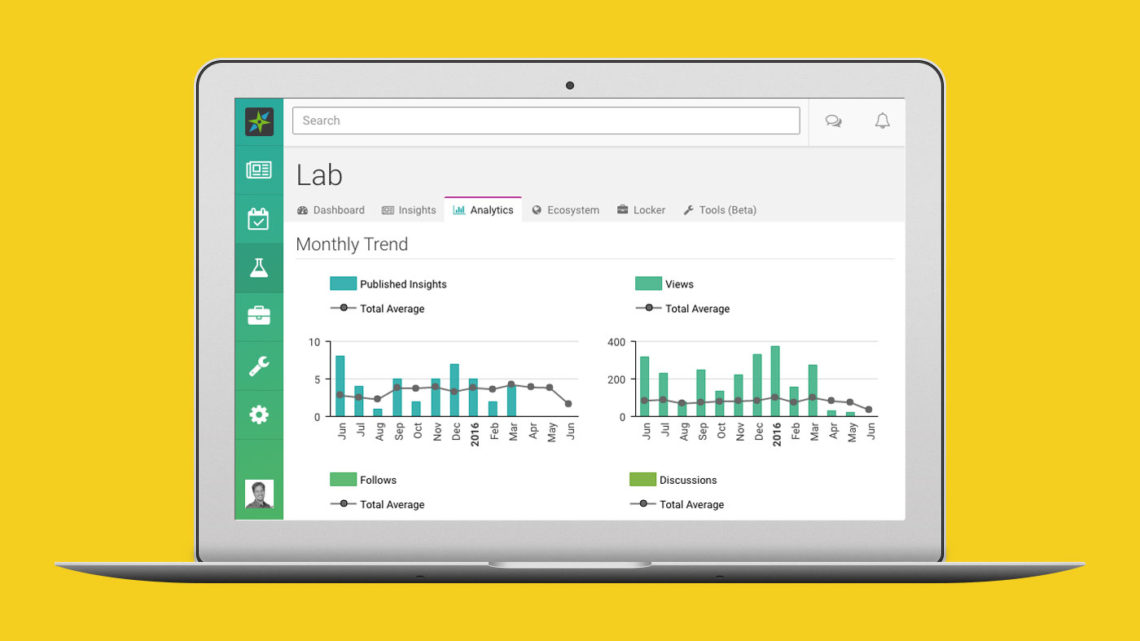

Smartkarma expands to North America with its innovative research platform for unconflicted and independent research in Asian equities

Smartkarma, Asia’s largest provider of independent investment research, announced the opening of its New York City office, headed by 30-year industry veteran Warren Yeh.

Smartkarma is well positioned to expand into American markets after recently completing its Series B funding round, led by Sequoia Capital. With a base in New York, Smartkarma aims to bring unprecedented on-the-ground reach and insight into Asian markets for US-based asset managers. Smartkarma has expanded from its headquarters in Singapore to five locations around the world, servicing a global client base comprising of some of the world’s largest asset managers.

By bringing together the best independent insight providers and asset managers in one collaborative ecosystem, Smartkarma is reinventing the way research is created and consumed, with timely insights delivered in an intuitive and engaging way. Smartkarma has demonstrated rapid growth since its launch in April 2016, with its top ten clients alone accounting for US$13.5 trillion of assets under management.

Raghav Kapoor, Co-founder and CEO of Smartkarma comments, “The demand for differentiated and unconflicted research is rapidly rising and US markets are no exception. Our Insight Providers, based in-country, provide US funds with local insight in areas underrepresented in traditional investment bank research, including IPO/M&A analysis, event-driven special situations as well as small and mid-cap company research.”

Duco Announces $28M Growth Investment for Data Engineering in the Cloud

Duco, the data engineering technology company, announced the completion of a $28m investment round by Insight Venture Partners, NEX Opportunities and Eight Roads Ventures.

The round also includes an investment by lifetime entrepreneur and former CEO of SunGard, Cristóbal Conde.

Duco provides technology that enables banks, brokers, asset managers and exchanges to normalise, validate and reconcile any type of data in Duco’s cloud, providing firms with on-demand data integrity and insight. The company has seen rapid and global growth as the industry re-platforms, adopting advances in leading technology to eliminate operational risk and cost and making actionable data more immediately available across the enterprise. Duco will use the investment to expand its global footprint, with headcount growth in Europe and the US, the launch of an Asia office and an expansion of its award-winning product set.

Christian Nentwich, CEO of Duco, said, “Duco’s approach to solving complex data problems in financial services is to empower experts with self-service solutions. We have gained considerable traction as the industry looks for intelligent answers to evolving new market realities. Our clients have engaged us globally at a strategic level and are relying on our proven ability to deliver at scale. This investment enables us to push further in applying our natural background in Computer Science to solving fundamental industry problems, while strengthening our resources to deepen relationships with our existing client base.”

Volante Technologies and BNY Mellon collaborate on payments technology innovation

Volante Technologies Inc., a global provider of software for the integration, processing and orchestration of payments and financial messages, announced that it has been collaborating with BNY Mellon on creating and deploying technology to enable real-time payments in the US and internationally.

BNY Mellon is a leader in offering faster and improved payments solutions to its corporate and institutional clients, as well as in advocating for payments modernization within the industry. As a part of BNY Mellon’s payments modernization initiative, the bank launched two services leveraging VolPay Hub technology provided by Volante.

BNY Mellon’s first such initiative was to become the first bank to successfully originate a real-time payment over the The Clearing House’s new Real-Time Payments network. It has worked extensively with The Clearing House and other banks to define standards for clearing and settling payments in real-time.

BNY Mellon’s second initiative was to launch a new service, called “BNY Mellon Tokenized Payments – now available with Zelle”, which will further accelerate the transition from paper to electronic payments for their clients.

In support of these initiatives, Volante developed its TCH RTP Processor Module in collaboration with BNY Mellon to process real-time payments and to allow a transaction to reach its recipient within 15 seconds or less.